Markets Are Misunderstanding The Fed S Inflation Response Says Former

Markets Are Misunderstanding The Fed S Inflation Response Says Former William dudley, former president of the new york federal reserve, joins cnbc's 'squawk box' to discuss the fed's response to inflation, his outlook for interest rates, and more. The federal reserve's credibility in the eyes of financial markets helped in its battle against inflation over the past two years, but it had to be earned afresh with interest rate hikes that.

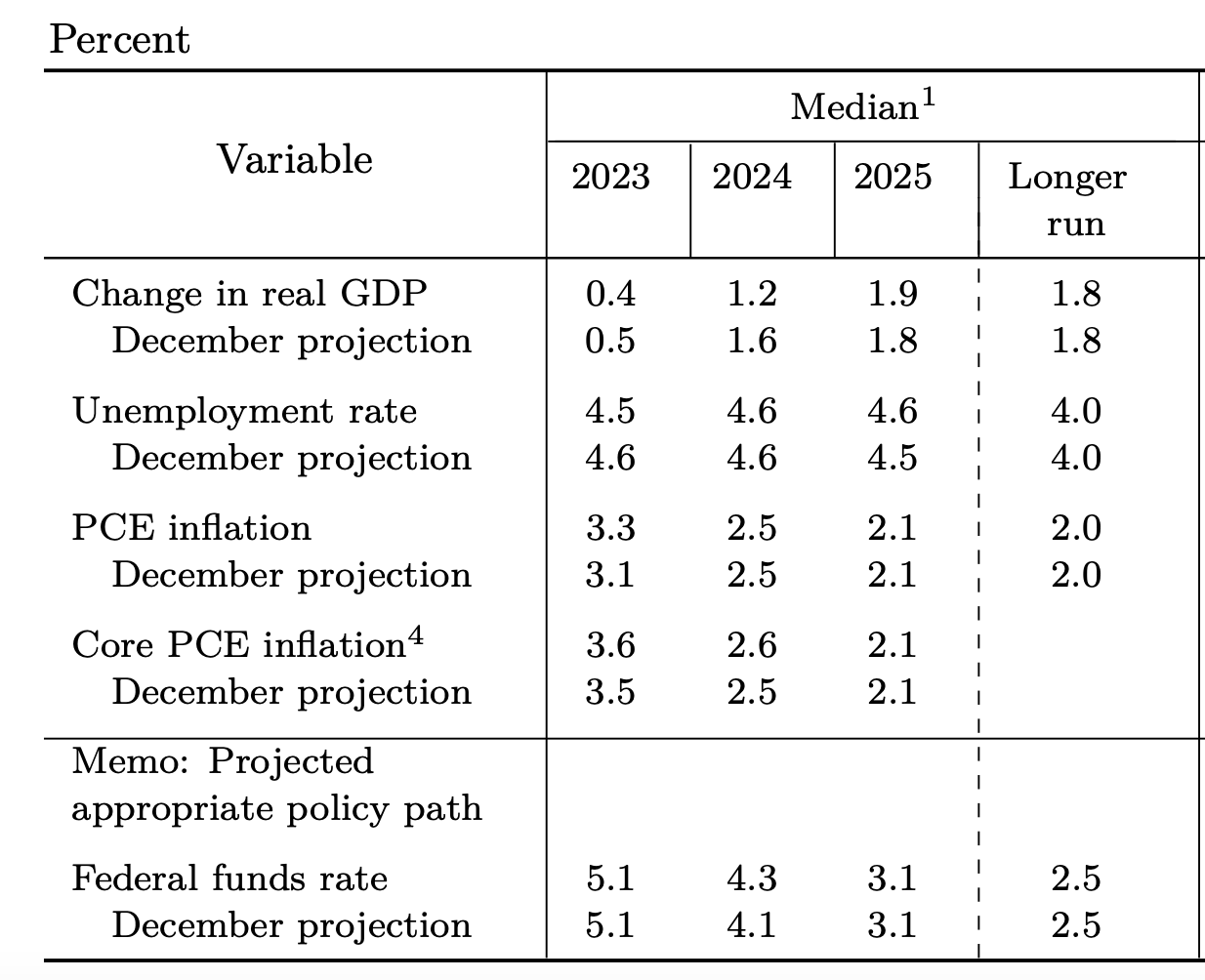

U S Paying A Powell Tax For Fed S Misunderstanding Of Inflation Larry summers considers the federal reserve vindicated after its initial misstep on inflation. the former treasury secretary told bloomberg tv that the central bank's interest rate strategy has. 2:36. former treasury secretary lawrence summers said that, while the federal reserve hit a “low point” in its monetary policy history by failing to act quickly against the 2021 inflation. Although dudley says the fed deserves “credit” for its “powerful and very fast” response to the pandemic in early 2020, he suggests it also deserves blame for its inflation response. The federal reserve’s response. in light of these inflation dynamics, the federal reserve responded more forcefully than both markets and policymakers themselves had anticipated. the policy adjustment process began from a very accommodative starting point. the federal reserve’s targeted interest rate—the federal funds rate—had been.

Fed Won T Wait For Inflation At Target Before Easing Refinitiv Although dudley says the fed deserves “credit” for its “powerful and very fast” response to the pandemic in early 2020, he suggests it also deserves blame for its inflation response. The federal reserve’s response. in light of these inflation dynamics, the federal reserve responded more forcefully than both markets and policymakers themselves had anticipated. the policy adjustment process began from a very accommodative starting point. the federal reserve’s targeted interest rate—the federal funds rate—had been. Translate. former treasury secretary lawrence summers warned against the exuberance taking hold in financial markets that the federal reserve has effectively won the war on inflation. “people. An unspoken edict amongst former fed chairs has been to not speak ill of their successors to preserve the apolitical nature of and trust in the institution. but former fed chair ben bernanke broke.

Inflation Expert Says Markets Are In Sweet Spot As End Of Fed Rate Translate. former treasury secretary lawrence summers warned against the exuberance taking hold in financial markets that the federal reserve has effectively won the war on inflation. “people. An unspoken edict amongst former fed chairs has been to not speak ill of their successors to preserve the apolitical nature of and trust in the institution. but former fed chair ben bernanke broke.

The Fed S Struggle With Inflation Has The Markets On Edge The New

Markets Mixed Ahead Of Inflation Fed Decision

Comments are closed.