M A Process 8 Step Process Types Regulations

M A Process 8 Step Process Types Regulations The process of m & m&a transactions can be lengthy or short, depending on the transaction's complexity and size. the period may also depend on the regulatory approvals required. table of contents. process of m&a (mergers and acquisition) m&a explained; types; 8 step process; regulations; recommended articles; m&a explained. Consider all aspects like market segment, geographic region, size or demographics of customer base, and profit margins to narrow in on the ideal target. assemble the team: m&a transactions are complex — and the right team can make all the difference. identify internal team members that can help facilitate a smooth merger and acquisition outcome.

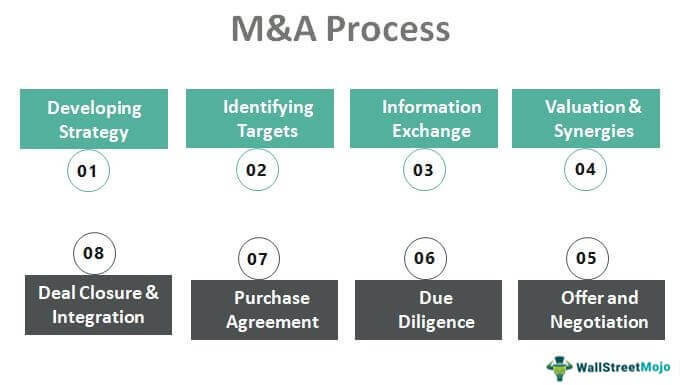

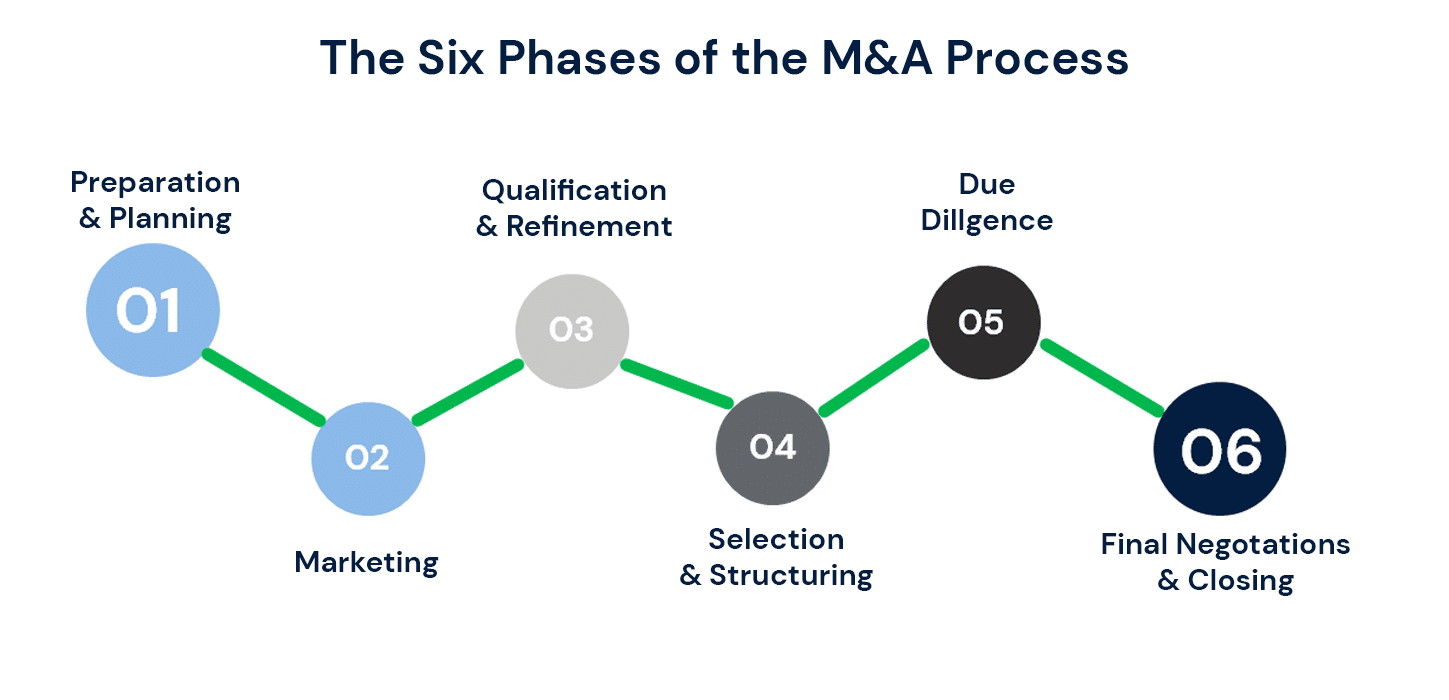

M A Process A Step By Step Guide Capstone Partners The m&a process, which stands for "mergers and acquisitions," is a complex and multi step procedure businesses undergo to merge with or acquire other companies. this includes formulating the strategy, due diligence, and integration, which we will discuss thoroughly in this article. m&a process overview. an m&a transaction touches almost every. The phrase mergers and acquisitions (m&a) refers to the consolidation of multiple business entities and assets through a series of financial transactions. the merger and acquisition process includes all the steps involved in merging or acquiring a company, from start to finish. this includes all planning, research, due diligence, closing, and. Step 2 – pre analysis. step 3 – letter of intent (loi) step 4 – due diligence. step 5 – securing financing. step 6 – closing the deal. step 7 – handover period. step 8 – handover completion. simplify your deal using m&a financial models. in the late 1990s, the energy industry was on the brink of a seismic shift. One of the biggest steps in the m&a process is analyzing and valuing acquisition targets. this usually involves two steps: valuing the target on a standalone basis and valuing the potential synergies of the deal. to learn more about valuing the m&a target see our free guide on dcf models. when it comes to valuing synergies, there are two types.

M A Process 10 Fundamental Elements To Know About M A Step 2 – pre analysis. step 3 – letter of intent (loi) step 4 – due diligence. step 5 – securing financing. step 6 – closing the deal. step 7 – handover period. step 8 – handover completion. simplify your deal using m&a financial models. in the late 1990s, the energy industry was on the brink of a seismic shift. One of the biggest steps in the m&a process is analyzing and valuing acquisition targets. this usually involves two steps: valuing the target on a standalone basis and valuing the potential synergies of the deal. to learn more about valuing the m&a target see our free guide on dcf models. when it comes to valuing synergies, there are two types. M&a process steps from the buy and sell side’s perspective merger and acquisition steps and planning are an important part of corporate development strategy. it’s fair to say that the m&a process stages might differ depending on the deal—some adopt a 7 step acquisition process, while others apply a few extra steps to finish the transaction. A detailed m&a plan becomes a solid foundation for further steps on the m&a timeline. #1 revise strategic growth plans. #3 pick a corresponding m&a strategy. it’s reasonable for company a to acquire a company in the same industry to reduce competition, scale products and services, and acquire customers and talent.

Overview Of M A Process Genesis Law Firm M&a process steps from the buy and sell side’s perspective merger and acquisition steps and planning are an important part of corporate development strategy. it’s fair to say that the m&a process stages might differ depending on the deal—some adopt a 7 step acquisition process, while others apply a few extra steps to finish the transaction. A detailed m&a plan becomes a solid foundation for further steps on the m&a timeline. #1 revise strategic growth plans. #3 pick a corresponding m&a strategy. it’s reasonable for company a to acquire a company in the same industry to reduce competition, scale products and services, and acquire customers and talent.

M A Process

Comments are closed.