Long Term Care Annuity Rider How It Works Pros And Cons Etc

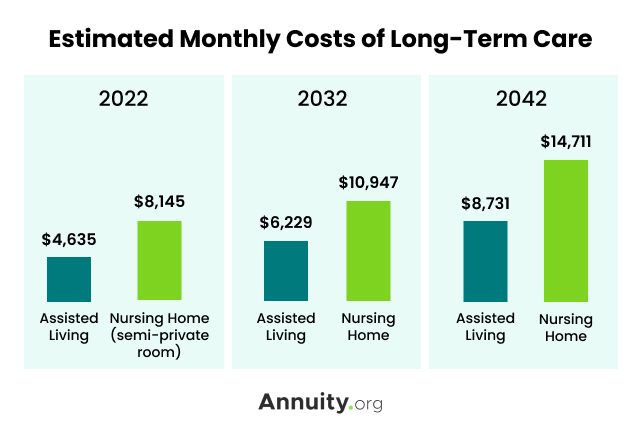

Long Term Care Annuity Rider How It Works Pros And Cons Etc Long term care riders serve to help insulate annuity customers from the potential expenses of things like nursing homes or extended medical care. the average cost of long term care in the united states ranges from $5,148 per month to as high as $9,034 or more per month in 2024, according to the senior list. Long term care riders cover long term care for disabilities from illness, accidents and injuries. premium stability. unlike typical long term care insurance policies, premiums for long term care annuity riders don't change. potential tax advantages. payouts from a long term care rider are usually tax free.

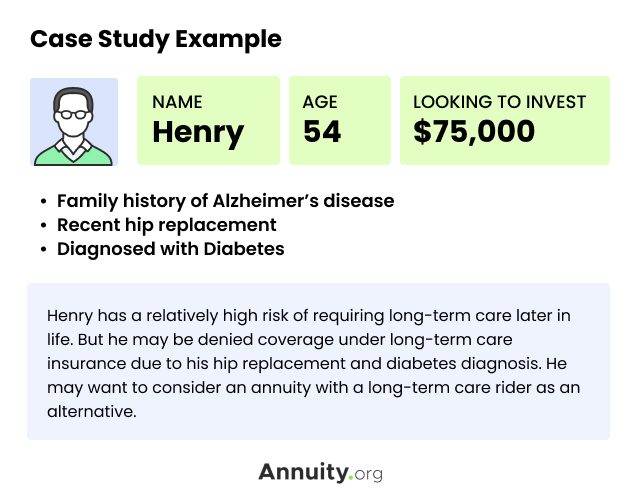

Long Term Care Annuity Rider How It Works Pros And Cons Etc The long term care rider will have a maximum monthly benefit. you might, for example, be able to receive 1%, 2%, 3%, or 4% of your policy's death benefit per month, the rider will also have a. Long term care annuities: pros and cons. with the price of long term care insurance rising, many are choosing an alternative: long term care annuities. There are several benefits of ltc (long term care) riders. financial protection: one of the main benefits of ltc riders is that they provide financial protection in the event that you need long term care later in life. the cost of long term care can be very expensive. having an ltc rider can help cover those costs and prevent you from depleting. The average costs of a long term care facility is around $75,000 to $140,000 per year depending on the the type you choose. you may also want to know that approximately over 52% of individuals turning age 65 will need some long term care in their life. today we’re going to help you understand the different types of long term coverage that’s.

Long Term Care Annuity Riders Benefits Drawbacks There are several benefits of ltc (long term care) riders. financial protection: one of the main benefits of ltc riders is that they provide financial protection in the event that you need long term care later in life. the cost of long term care can be very expensive. having an ltc rider can help cover those costs and prevent you from depleting. The average costs of a long term care facility is around $75,000 to $140,000 per year depending on the the type you choose. you may also want to know that approximately over 52% of individuals turning age 65 will need some long term care in their life. today we’re going to help you understand the different types of long term coverage that’s. A long term care annuity, also known as an annuity with a long term care rider, is a hybrid insurance product designed to serve two purposes: take a deposited sum of money and have it grow on a tax deferred basis. How does a long term care annuity products work? adding a long term care rider to your annuity contract establishes the terms for receiving long term care benefits and the coverage amount. this rider transforms your annuity with long term care into a valuable resource for funding, either in addition to or instead of its original purpose as a.

Annuity With Long Term Care Rider How Do They Work A long term care annuity, also known as an annuity with a long term care rider, is a hybrid insurance product designed to serve two purposes: take a deposited sum of money and have it grow on a tax deferred basis. How does a long term care annuity products work? adding a long term care rider to your annuity contract establishes the terms for receiving long term care benefits and the coverage amount. this rider transforms your annuity with long term care into a valuable resource for funding, either in addition to or instead of its original purpose as a.

Annuities With Long Term Care Riders 2023

Long Term Care Annuity Rider How It Works Pros And Cons

Comments are closed.