Long Term Capital Gains Tax Exemption Under Section 54f Of The Income

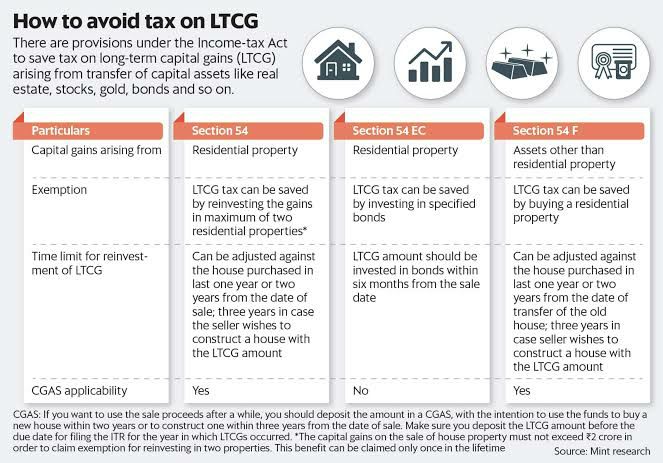

Under Section 54f Of The Income Tax Act Ltcg Income tax allows an exemption on long term capital gains if reinvested in a new residential property. budget 2024 updates include amendments in classification of assets for long and short terms, changes in taxation rates and benefits, and exemption limit increase. section 54f provides exemptions subject to specific conditions. Section 54f of the income tax act, 1961, permits tax exemption on long term capital gains generated from the sale of a capital asset excluding a residential property. thus, if you sell assets such as shares, bonds, jewelry, or gold, this provision applies.

Long Term Capital Gains Tax Exemption Under Section 54f Of The Income 1. an exemption under section 54f is available only to an individual or a hindu undivided family (huf). 2. an exemption is available towards the capital gain arisen on the transfer of any long term capital asset other than a residential house. 3. Summary: the income tax act provides capital gain exemptions under sections 54, 54f, and 54ec for individuals or hufs. section 54 offers relief for long term capital gains (ltcg) from the sale of residential property, allowing reinvestment into a new house within specific timeframes. if the cost of the new asset exceeds the ltcg, the entire. Two such very crucial exemptions one can claim are under sections 54 and 54f. as discussed above the exemption under section 54 is available on long term capital gain on sale of a house property. exemption under section 54f is available on long term capital gain on sale of any asset other than a house property. Step 5: long term capital gains chargeable to tax. the long term capital gains chargeable to tax formula is: ltcg chargeable to tax = net sale consideration (indexed cost of acquisition indexed cost of improvement) exemptions under section 54 54b 54d 54ec 54f.

Exemption Of Capital Gain Section 54 To 54f Ifccl Two such very crucial exemptions one can claim are under sections 54 and 54f. as discussed above the exemption under section 54 is available on long term capital gain on sale of a house property. exemption under section 54f is available on long term capital gain on sale of any asset other than a house property. Step 5: long term capital gains chargeable to tax. the long term capital gains chargeable to tax formula is: ltcg chargeable to tax = net sale consideration (indexed cost of acquisition indexed cost of improvement) exemptions under section 54 54b 54d 54ec 54f. Here’s how you can save capital gains tax under section 54f in india . 1. eligibility: to be eligible for the benefits of section 54f, you must be an individual or a hindu undivided family (huf) taxpayer. 2. nature of asset: section 54f applies to the sale of any capital asset, except for a residential house property. Section 54f of the income tax act, 1961, is a section that allows tax exemption on the long term capital gains earned from selling a capital asset other than a house property. so, if you sell a capital asset like shares, bonds, jewelers, gold, etc. and reinvest the sale proceeds towards the purchase or construction of a house property, the.

Understanding Section 54f Of The Income Tax Act Exemption On Capital Here’s how you can save capital gains tax under section 54f in india . 1. eligibility: to be eligible for the benefits of section 54f, you must be an individual or a hindu undivided family (huf) taxpayer. 2. nature of asset: section 54f applies to the sale of any capital asset, except for a residential house property. Section 54f of the income tax act, 1961, is a section that allows tax exemption on the long term capital gains earned from selling a capital asset other than a house property. so, if you sell a capital asset like shares, bonds, jewelers, gold, etc. and reinvest the sale proceeds towards the purchase or construction of a house property, the.

Section 54f Of Income Tax Act For Ay 2021 22 Understanding Exemption

Comments are closed.