Loan Estimates 101 How To Review Them And Compare Mortgage Lenders

Loan Estimates 101 How To Review Them And Compare Mortgage Lenders First, to get a loan estimate, you’ll need six pieces of information: your name, income, social security number, desired loan amount, desired property address, and its listing price. after you provide these six pieces of information, a lender is legally required to share a loan estimate within 3 days. some aspects of the loan estimate, such. How to compare mortgage loan estimates. when comparing offers between mortgage lenders, follow these tips: pay attention to where the estimates differ on interest rate, origination charges and.

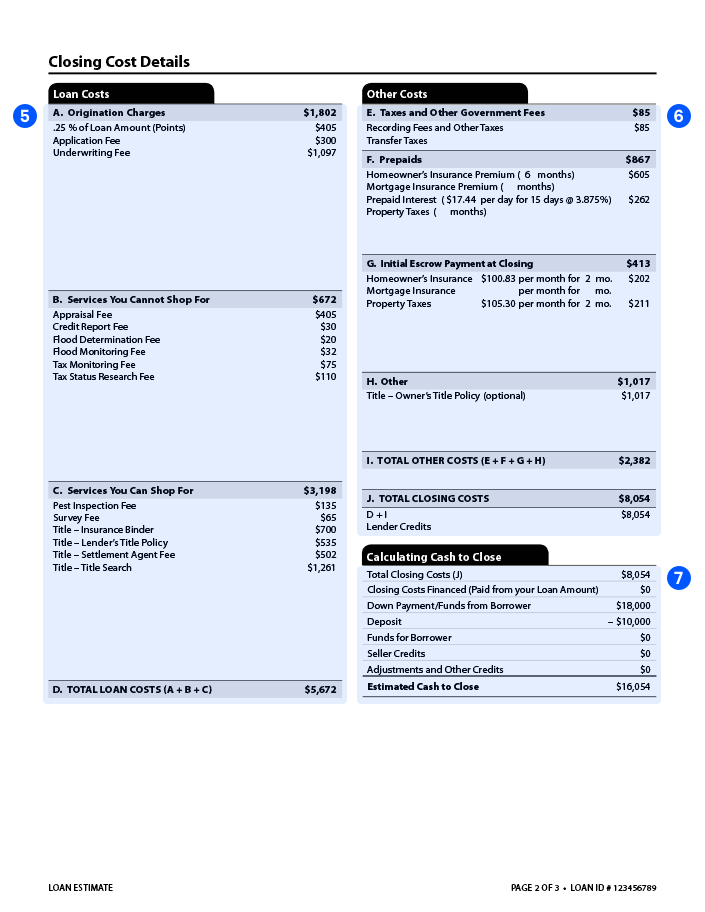

How To Compare Mortgage Lenders Using Loan Estimate Youtube The loan estimate is three pages long, split into sections that outline the terms, closing costs, and fees associated with your loan. how to read a loan estimate and compare it across lenders. all lenders must use a standard three page document to provide a loan estimate, so the borrower can compare loan specifics to find the best deal. To get a loan estimate you must provide a lender your name, income amount and social security number as well as the address of the property you want to buy, an estimated value of the property and. A loan estimate tells you important details about a mortgage loan you have requested. use this tool to review your loan estimate to make sure it reflects what you discussed with the lender. if something looks different from what you expected, ask why. request multiple loan estimates from different lenders so you can compare and choose the loan. A loan estimate (formerly called a good faith estimate) shows you all the details of a mortgage before you agree to it; including interest rate, apr, terms, fees, and more. learn how to read a.

Loan Estimates 101 How To Review Them And Compare Mortgage Lenders A loan estimate tells you important details about a mortgage loan you have requested. use this tool to review your loan estimate to make sure it reflects what you discussed with the lender. if something looks different from what you expected, ask why. request multiple loan estimates from different lenders so you can compare and choose the loan. A loan estimate (formerly called a good faith estimate) shows you all the details of a mortgage before you agree to it; including interest rate, apr, terms, fees, and more. learn how to read a. Below is a loan estimate example highlighting the 11 most important details to review. page 1 of the loan estimate. 1. “save this loan estimate to compare to your closing disclosure.” this is an important reminder that lenders are legally required to honor the interest rate offer that’s been given in a binding loan estimate (more on that. 2. know your credit scores. credit scores are important when you shop for a mortgage for two reasons. first, they help you determine which loan program to choose. conventional loans are usually a good fit if your score is higher than 620, while fha loans may be your only option if your score is between 500 and 619.

How To Compare Mortgage Loan Estimates Bankrate Below is a loan estimate example highlighting the 11 most important details to review. page 1 of the loan estimate. 1. “save this loan estimate to compare to your closing disclosure.” this is an important reminder that lenders are legally required to honor the interest rate offer that’s been given in a binding loan estimate (more on that. 2. know your credit scores. credit scores are important when you shop for a mortgage for two reasons. first, they help you determine which loan program to choose. conventional loans are usually a good fit if your score is higher than 620, while fha loans may be your only option if your score is between 500 and 619.

Comments are closed.