Loan Estimate Explainer Consumer Financial Protection Bureau Home

Printable Loan Estimate Explainer Consumer Financial Protection Bureau A loan estimate tells you important details about a mortgage loan you have requested. use this tool to review your loan estimate to make sure it reflects what you discussed with the lender. if something looks different from what you expected, ask why. request multiple loan estimates from different lenders so you can compare and choose the loan. A loan estimate is a three page form that you receive after applying for a mortgage. the loan estimate tells you important details about the loan you have requested. the lender must provide you a loan estimate within three business days of receiving your application. the form provides you with important information, including the estimated.

Loan Estimate Explainer Compare Mortgage Closing Costs 3. check to see if your interest rate is locked. some lenders may lock your rate as part of issuing the loan estimate, but some may not. check at the top of page 1 on your loan estimate to see whether your rate is locked, and until when. if your rate is not locked, it can change at any time. Source: the consumer financial protection bureau. how to read a loan estimate: page 3. page three of the loan estimate has a few more key numbers to help you compare offers from different mortgage. The consumer financial protection bureau (cfpb) designed the loan estimate to help you understand any mortgage you apply for, whether you’re buying a home or refinancing one. because any lender. First, estimate your total monthly home payment. second, look at the percentage of your income that will go toward your monthly home payment. third, look at how much money you will have available to spend on the rest of your monthly expenses. step 1. estimate your total monthly home payment by adding up the items below.

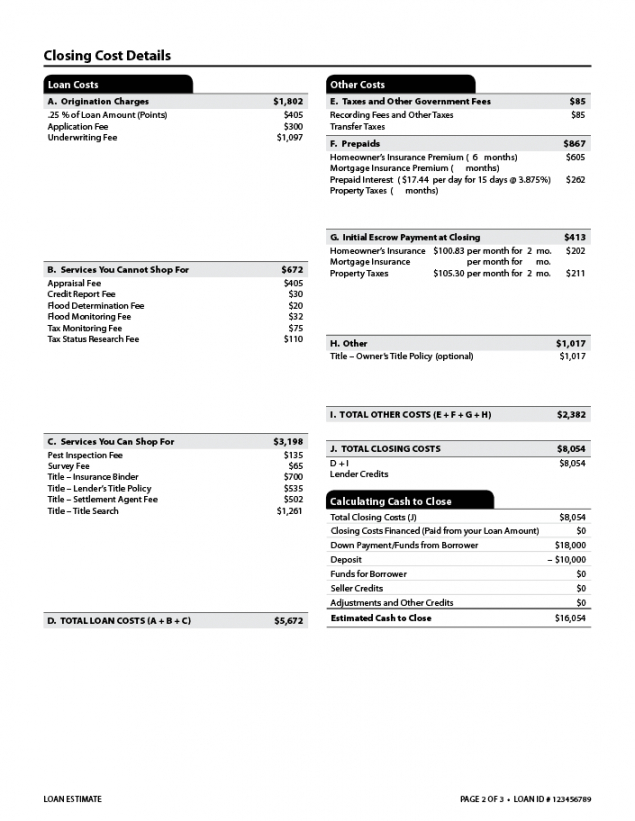

Sukesh Shekar On Linkedin Loan Estimate Explainer Consumer Financial The consumer financial protection bureau (cfpb) designed the loan estimate to help you understand any mortgage you apply for, whether you’re buying a home or refinancing one. because any lender. First, estimate your total monthly home payment. second, look at the percentage of your income that will go toward your monthly home payment. third, look at how much money you will have available to spend on the rest of your monthly expenses. step 1. estimate your total monthly home payment by adding up the items below. A loan estimate explains important features of a mortgage you’ve applied for, like your interest rate and estimated closing costs. the consumer financial protection bureau (cfpb) requires all lenders to use a standardized form to present the information, making it easier for consumers to compare the details of each loan offer they’re received. Page 2 of a sample loan estimate on the consumer financial protection bureau's website it's a good idea to apply with a few lenders and compare loan estimates line by line to see which is the best.

Loan Estimate Explained Mortgage Fee Disclosure Youtube A loan estimate explains important features of a mortgage you’ve applied for, like your interest rate and estimated closing costs. the consumer financial protection bureau (cfpb) requires all lenders to use a standardized form to present the information, making it easier for consumers to compare the details of each loan offer they’re received. Page 2 of a sample loan estimate on the consumer financial protection bureau's website it's a good idea to apply with a few lenders and compare loan estimates line by line to see which is the best.

Comments are closed.