Loan Estimate And Closing Disclosure Your Guides As You Choose The

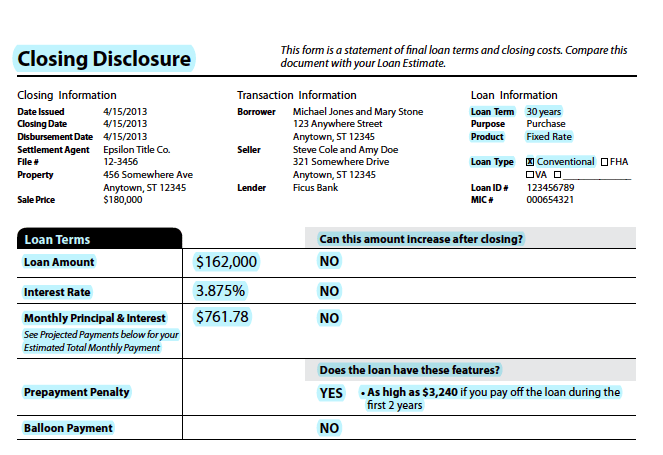

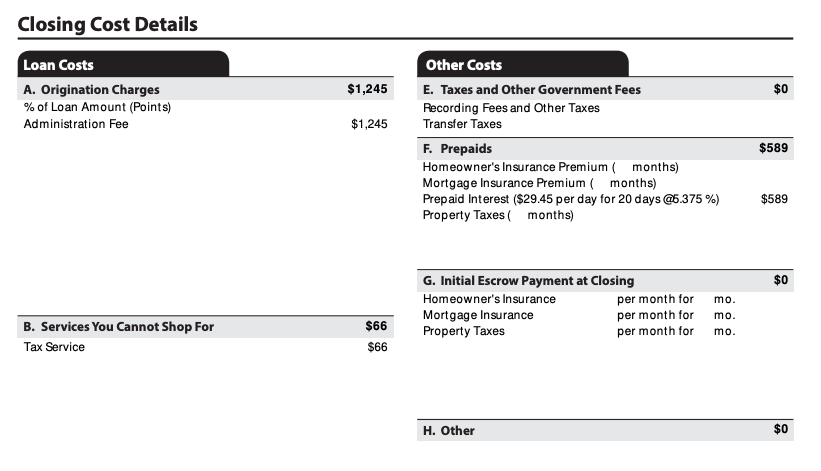

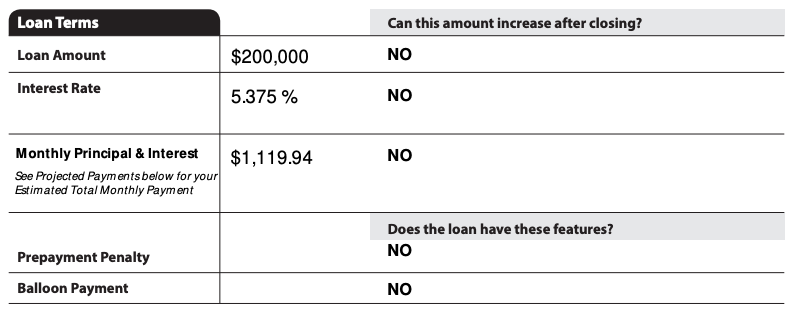

Understanding The Loan Estimate Le And Closing Disclosure Cd What A loan estimate isn’t an indication that your loan application has been approved or denied. you don’t need to have a signed contract for the property that you’re receiving a loan estimate for. you’re not obligated to pay an application fee other than a reasonable fee for the lender to run a credit report. Here’s what you’ll find on each page of your closing disclosure: page 1. contains the same information as your loan estimate, in the same format. it’s easy to compare these pages to look for changes. page 2. breaks down who pays each closing cost (borrower, seller, or other) and when (before closing or at closing).

Fillable Online Loan Estimate And Closing Disclosure Your Guides As Getty. the closing disclosure is one of the most important documents you’ll get during the mortgage lending process because it spells out all of the details of your home loan, including how much. Integrated disclosure guide to the loan estimate and closing disclosure forms this guide is current as of the date set forth on the cover page. it has been updated to reflect the final rule issued on july 7, 2017 and published on august 11, 2017. november 2017 consumer financial protection bureau tila respa integrated disclosure guide to the. The closing disclosure is a five page form that describes the critical aspects of your mortgage loan, including purchase price, loan fees, interest rate, estimated real estate taxes, insurance, closing costs and other expenses. it’s important that you review it thoroughly – in fact, it’s one of the most important steps you can take while. The closing disclosures are a statement that breaks down the final loan terms and closing costs. this is like a finalized, more detailed version of your loan estimate. think of your loan estimate as a third or fourth draft of a novel, whereas the closing disclosures are like the final manuscript that gets sent off to publication.

The Loan Estimate And Closing Disclosure Your Guide The closing disclosure is a five page form that describes the critical aspects of your mortgage loan, including purchase price, loan fees, interest rate, estimated real estate taxes, insurance, closing costs and other expenses. it’s important that you review it thoroughly – in fact, it’s one of the most important steps you can take while. The closing disclosures are a statement that breaks down the final loan terms and closing costs. this is like a finalized, more detailed version of your loan estimate. think of your loan estimate as a third or fourth draft of a novel, whereas the closing disclosures are like the final manuscript that gets sent off to publication. Closing disclosure explainer. use this tool to double check that all the details about your loan are correct on your closing disclosure. lenders are required to provide your closing disclosure three business days before your scheduled closing. use these days wisely—now is the time to resolve problems. This document is the final bill of sale on your home loan and closing costs. it shows you the full cost of the home loan you’ve chosen—including the terms, projected monthly payments, fees, and cash to close. a simple way to think about your closing disclosure is that your loan estimate tells you what you might pay, while a closing.

The Loan Estimate And Closing Disclosure Your Guide Closing disclosure explainer. use this tool to double check that all the details about your loan are correct on your closing disclosure. lenders are required to provide your closing disclosure three business days before your scheduled closing. use these days wisely—now is the time to resolve problems. This document is the final bill of sale on your home loan and closing costs. it shows you the full cost of the home loan you’ve chosen—including the terms, projected monthly payments, fees, and cash to close. a simple way to think about your closing disclosure is that your loan estimate tells you what you might pay, while a closing.

Comments are closed.