Line Of Credit Loc Definition Types And Examples 54 Off

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples A line of credit is a preset borrowing limit that a borrower can draw on at any time that the line of credit is open. types of credit lines include personal, business, and home equity, among. In the simplest terms, a line of credit (loc) is a financial tool that provides individuals or businesses with a pre approved borrowing limit from which they can withdraw funds whenever needed, up to a certain maximum amount. think of it as a flexible and revolving credit facility that you can tap into whenever the need arises.

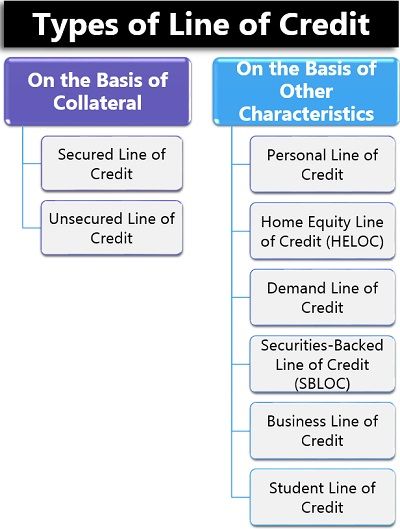

What Is A Line Of Credit Loc Definition Example Essentials Types Line of credit is a flexible loan facility, wherein lending institutions offer a defined limit of credit that one can access as per his her requirements. borrowers can either repay the used amount immediately or over a predetermined tenure. for the latter, the interest accrues on the used credit on a day to day basis. A revolving line of credit is an open ended, flexible loan with a fixed credit limit. the term “revolving” refers to the borrower’s ability to continue drawing from the line of credit as funds are repaid. examples of revolving lines of credit include: personal lines of credit. business lines of credit. home equity lines of credit. Secured line of credit examples. a line of credit is usually unsecured, which is why you need a good credit rating to access one. however, there are a few examples of secured credit lines as well. in some countries, borrowers can secure their account with a certificate of deposit (cd) as collateral. a more common example is a home equity line. A line of credit is a predetermined amount of funds that a financial institution, such as a bank, makes available to an individual or a business which the borrower pays interest on. depending on the type of loc, the borrower either receives a lump sum or is allowed to withdraw from the line of credit at any time, up to the maximum amount or the.

Line Of Credit Meaning Examples Investinganswers Secured line of credit examples. a line of credit is usually unsecured, which is why you need a good credit rating to access one. however, there are a few examples of secured credit lines as well. in some countries, borrowers can secure their account with a certificate of deposit (cd) as collateral. a more common example is a home equity line. A line of credit is a predetermined amount of funds that a financial institution, such as a bank, makes available to an individual or a business which the borrower pays interest on. depending on the type of loc, the borrower either receives a lump sum or is allowed to withdraw from the line of credit at any time, up to the maximum amount or the. Line of credit examples. let us consider the following examples to understand how the concept of line of credit works: example 1. suppose customer a is provided with a $10,000 loc to purchase a home secured against the house by baseline bank. the bank sets a loan term of 5 years and allows customer a to use the funds within the overall limit. A line of credit (loc) is a flexible loan that lenders extend to borrowers, functioning much like a credit card but often with a higher borrowing limit. there are certain key concepts you’ll need to grasp to fully understand how a loc operates. credit limit: this is the maximum amount you can borrow at any given time.

Line Of Credit Loc Definition How It Works How To Get One Line of credit examples. let us consider the following examples to understand how the concept of line of credit works: example 1. suppose customer a is provided with a $10,000 loc to purchase a home secured against the house by baseline bank. the bank sets a loan term of 5 years and allows customer a to use the funds within the overall limit. A line of credit (loc) is a flexible loan that lenders extend to borrowers, functioning much like a credit card but often with a higher borrowing limit. there are certain key concepts you’ll need to grasp to fully understand how a loc operates. credit limit: this is the maximum amount you can borrow at any given time.

Comments are closed.