Let My Credit Card Debt Go To Collections Creditcarddebt

Let My Credit Card Debt Go To Collections Youtube The most common types of debt that go to collections are credit card balances and medical bills, but there are many other reasons why people go into debt. rent, student loans and tax debts are. 3. ask the debt collector to stop contacting you. under federal law, a debt collector in most cases must stop contacting you when you request so in writing. after it receives your written request, a debt collector can contact you to verify that it won't contact you anymore or that it's filing a lawsuit against you.

Dealing With Credit Card Debt Collections When you let your bill go unpaid for 180 days, your debt will be turned over to a collection agency, and your credit score will suffer. To stop the contact, you would go through the same steps as if the debt was yours: ask the collector to verify the debt, and then dispute it in writing. if the collector continues, you have the. The collection agency buys these bad debts in bulk. if it buys 100 debts worth $1,000 each at a cost of $50 each, it will have paid $5,000, but is now owed $100,000 by its new debtors. if the. Credit card debt collection is the process by which credit card companies try to collect on the debt that they are owed. the credit card companies may try to collect the debt themselves, or they may hire a third party credit card debt collection firm to collect. in some cases, the debt owed may be sold to another company, who might then try to.

How To Get Out Of Credit Card Debt Fast Credit Card Solution Tips And The collection agency buys these bad debts in bulk. if it buys 100 debts worth $1,000 each at a cost of $50 each, it will have paid $5,000, but is now owed $100,000 by its new debtors. if the. Credit card debt collection is the process by which credit card companies try to collect on the debt that they are owed. the credit card companies may try to collect the debt themselves, or they may hire a third party credit card debt collection firm to collect. in some cases, the debt owed may be sold to another company, who might then try to. Wallethub senior researcher. credit card debt settlement is when a consumer submits a lump sum payment for the majority of what they owe in return for the company that owns the debt forgiving part of the outstanding balance as well as certain fees and finance charges. a debt settlement agreement is one way to escape serious credit card debt. If you don’t recognize the creditor, submit a written request to the third party collector within 30 days, asking them to provide the name and contact information of the original and current creditor. the third party debt collection agency must then cease efforts to collect the unpaid bill in your name until they’ve given you this information.

Know Everything About Credit Card Debt In 2023 The Enterprise World Wallethub senior researcher. credit card debt settlement is when a consumer submits a lump sum payment for the majority of what they owe in return for the company that owns the debt forgiving part of the outstanding balance as well as certain fees and finance charges. a debt settlement agreement is one way to escape serious credit card debt. If you don’t recognize the creditor, submit a written request to the third party collector within 30 days, asking them to provide the name and contact information of the original and current creditor. the third party debt collection agency must then cease efforts to collect the unpaid bill in your name until they’ve given you this information.

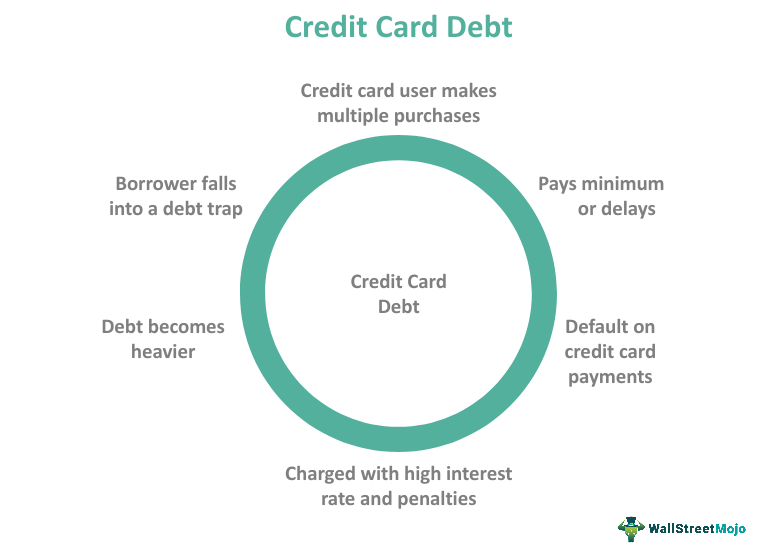

Credit Card Debt What Is It Consolidation How To Pay It Off

How To Settle Your Credit Card Debt Fast In 2023

Comments are closed.