Leigh Goehring Golds Massive Bull Market Just Starting Uranium And Copper Outlook

Why Leigh Goehring Is Betting On Copper And Uranium Leigh goehring of goehring & rozencwajg discusses his outlook for gold, outlining calculations that show the yellow metal potentially rising to the us$15,000. Leigh goehring: gold's "massive bull market" just starting; uranium and copper outlook, full video: watch?v=hbxkontelxi.

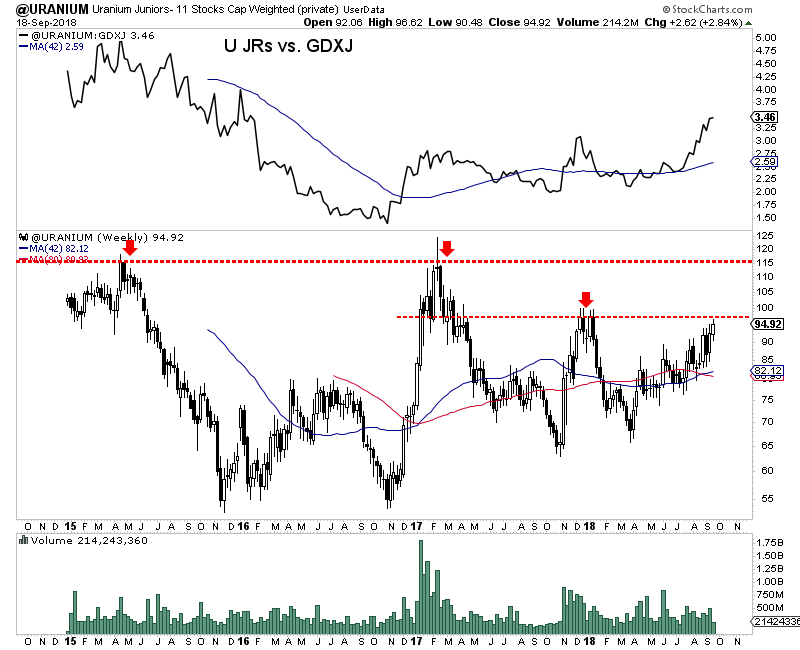

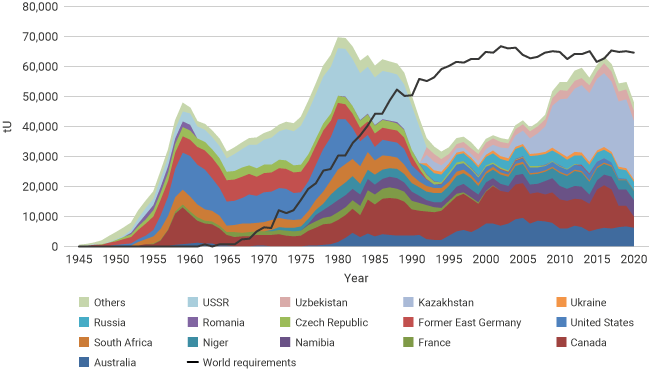

Gold Stocks Remain In Downtrend But Uranium Stocks On The Cusp Of New Commodity prices are on the rise. leigh goehring and adam rozencwajg say why they expect prices to continue to climb and how investors can best gain exposure to resources such as energy, metals and agricultural commodities in today’s inflationary environment. christoph gisiger 06.06.2022, 04.26 uhr. merken. More and more, we believe the answer is an allocation to gold. precious metals have done very well during each of the prior commodity bull markets of the past 150 years. we believe this time will be no different. our newest commentary, golden foresight, looks at how gold might protect investors’ wealth as we progress through the coming years. Uranium has started 2024 the same way it ended 2023 – like a bull in a china shop. spot prices are now agonisingly close to us$100 lb for the first time since 2008, with term pricing not far behind. “this year alone, demand is around 200 million pounds and supply is about 160 million pounds,” s ays justin huhn, founder of uranium insider. Mines and money daily issue 31. highly regarded by the new york natural resource community, leigh’s big bets are now copper and uranium. mines and money caught up with leigh to ask him why, as.

Uranium How To Know When The Bull Market Really Starts Uranium has started 2024 the same way it ended 2023 – like a bull in a china shop. spot prices are now agonisingly close to us$100 lb for the first time since 2008, with term pricing not far behind. “this year alone, demand is around 200 million pounds and supply is about 160 million pounds,” s ays justin huhn, founder of uranium insider. Mines and money daily issue 31. highly regarded by the new york natural resource community, leigh’s big bets are now copper and uranium. mines and money caught up with leigh to ask him why, as. Unfortunately, a new uranium mine can take as long as 15 years to come on line from discovery to first production, so meeting the demand will be difficult. therefore, the “underlying market fundamentals are still ratcheting tighter,” according to leigh goehring, managing partner with natural resource investors goehring & rozencwajg associates. Investors continue to be bullish on uranium, according to a number of recent news reports. stockhead recently trumpeted, “uranium has started 2024 the same way it ended 2023—like a bull in a china shop. spot prices are now agonizingly close to us$100 lb for the first time since 2008, with term pricing not far behind.”.

Uranium The Bull Market Everybody S Talking About Patrick Poke Unfortunately, a new uranium mine can take as long as 15 years to come on line from discovery to first production, so meeting the demand will be difficult. therefore, the “underlying market fundamentals are still ratcheting tighter,” according to leigh goehring, managing partner with natural resource investors goehring & rozencwajg associates. Investors continue to be bullish on uranium, according to a number of recent news reports. stockhead recently trumpeted, “uranium has started 2024 the same way it ended 2023—like a bull in a china shop. spot prices are now agonizingly close to us$100 lb for the first time since 2008, with term pricing not far behind.”.

Uranium Stock Market Forecast 2021 Analysis Of Upcoming Uranium Bull

Comments are closed.