Larger Retirement Catch Up Contribution For 60 63 Year Olds In 2025

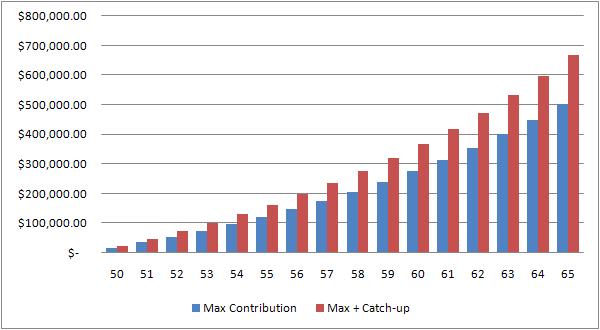

New Catch Up Contribution Amounts At Age 60 Youtube Under a change made in secure 2.0, a higher catch up contribution limit applies for employees aged 60, 61, 62 and 63 who participate in simple plans. for 2025, this higher catch up contribution limit is $5,250. details on these and other retirement related cost of living adjustments for 2025 are in notice 2024 80 pdf, available on irs.gov. Secure 2.0 catch up contributions 60 63 under secure 2.0, beginning in 2025, individuals ages 60 to 63 will be eligible for increased catch up contributions in their retirement plans.

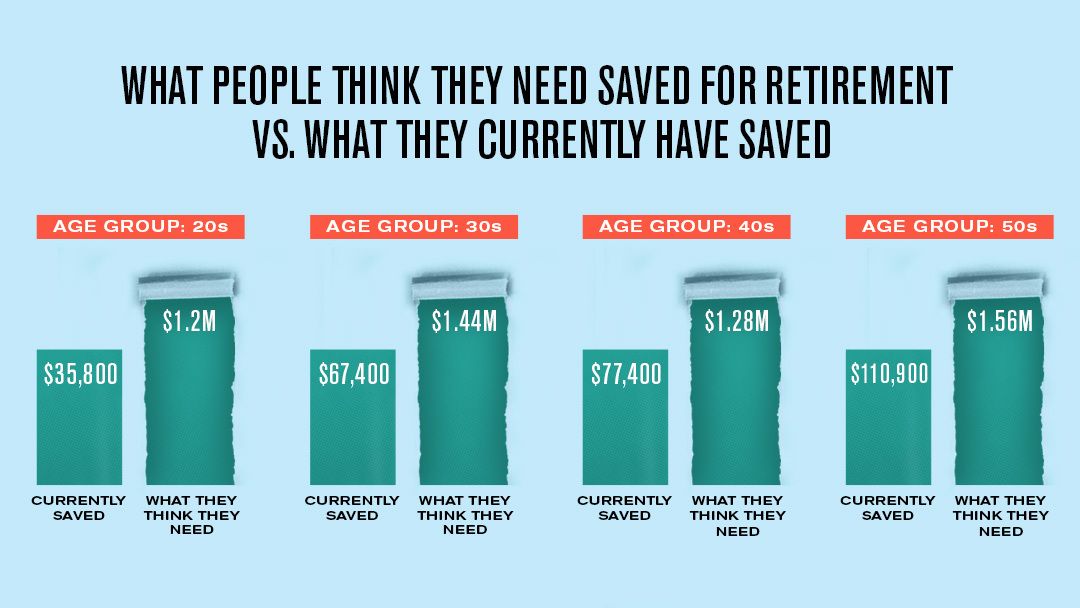

Americans Average Retirement Savings By Age And What They Think They Irs raises 401 (k) contribution limits, adds super catch up for 60 63 year olds in 2025. americans will be able to sock away more in their workplace retirement plans, before taxes, in 2025. the. The 2025 401(k) contribution limit increased to $23,500, up from $23,000 in 2024. employees age 50 and older can contribute an additional $7,500 for a total of $31,000. workers ages 60 to 63 have. Starting in 2025, people aged 60, 61, 62, or 63 who participate in workplace retirement plans can make even greater catch up contributions of up to $11,250 instead of $7,500. retirement savers can. 2025 is $11,250. the roth catch up wage threshold for 2024, which under section 414(v)(7)(a) is used to determine whether an individual’s catch up contributions to an applicable employer plan (other than a plan described in section 408(k) or (p)) for 2025 must be designated roth contributions, remains $145,000.

401k Calculator With Catch Up Contributions Starting in 2025, people aged 60, 61, 62, or 63 who participate in workplace retirement plans can make even greater catch up contributions of up to $11,250 instead of $7,500. retirement savers can. 2025 is $11,250. the roth catch up wage threshold for 2024, which under section 414(v)(7)(a) is used to determine whether an individual’s catch up contributions to an applicable employer plan (other than a plan described in section 408(k) or (p)) for 2025 must be designated roth contributions, remains $145,000. A new super catch up rule, where older workers between 60 and 63 will be allowed to make a larger contribution of up to $11,250, is part of the inflation adjustments to retirement account limits. Effective january 1, 2025, section 109 of secure act 2.0 (higher catch up limit to apply at age 60, 61, 62, and 63) increases the catch up contribution limit for active participants turning ages 60, 61, 62, or 63 in the calendar year to either $10,000 or 50 percent more than the regular catch up contribution limit, whichever is greater.

2025 401 K Contribution Limits Maximizing Your Retirement Savings A new super catch up rule, where older workers between 60 and 63 will be allowed to make a larger contribution of up to $11,250, is part of the inflation adjustments to retirement account limits. Effective january 1, 2025, section 109 of secure act 2.0 (higher catch up limit to apply at age 60, 61, 62, and 63) increases the catch up contribution limit for active participants turning ages 60, 61, 62, or 63 in the calendar year to either $10,000 or 50 percent more than the regular catch up contribution limit, whichever is greater.

Comments are closed.