Kyc And Aml Compliance Key Differences And Best Practices Idenfy

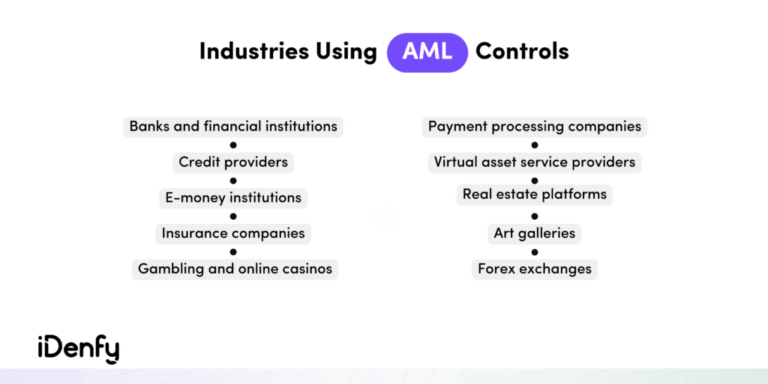

Kyc And Aml Compliance Key Differences And Best Practices Idenfy Idenfy offers both kyc and aml compliance tools under one platform, helping businesses lower kyc operating costs while improving overall customer experience. best practices for kyc and aml compliance with idenfy. with idenfy, you can customize your identity verification flow, add aml checks, and verify plus screen your customers in seconds. Aml in fintech is the process of identifying people involved in money laundering, aiming to safeguard the fintech industry and other financial institutions from financial crimes. the primary goal of aml compliance is to ensure the overall security of financial institutions for all customers. since the fintech industry is a well known target for.

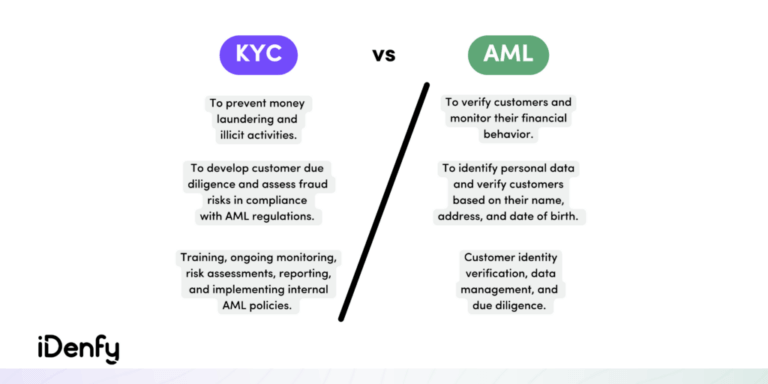

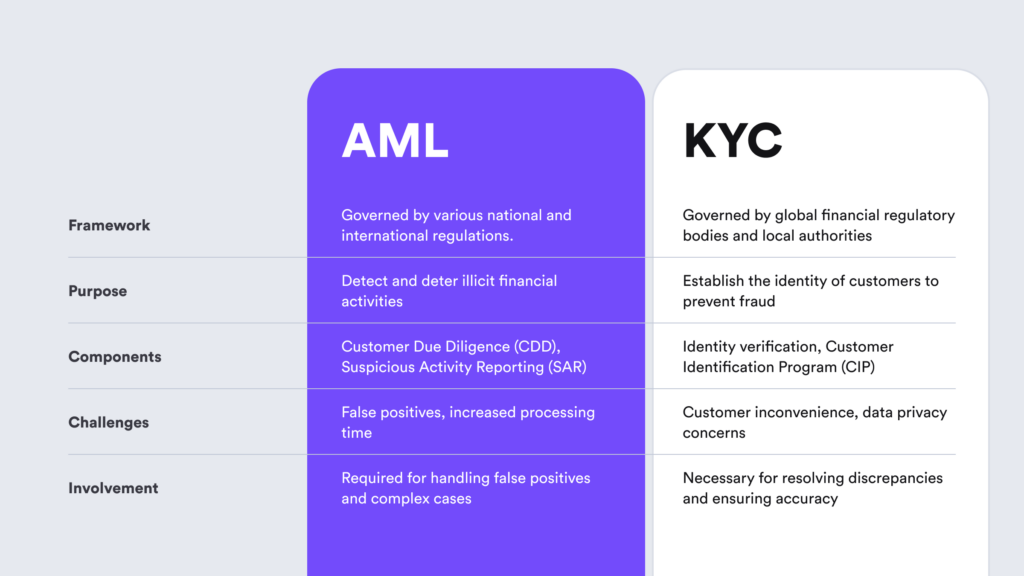

Kyc And Aml Compliance Key Differences And Best Practices Idenfy Related: kyc and aml compliance — key differences and best practices. are neobanks subject to the same aml regulations? neobanks, as licensed financial institutions, are obligated to adhere to aml and kyc regulations. these are the same regulations that require traditional banks to verify customer identities and prevent transactions with. Aml vs kyc: differences, compliance and best practices. 08 08 2023. ensuring the integrity and security of financial transactions in the dynamic global financial landscape is paramount. two processes that play a critical role in maintaining this integrity are anti money laundering (aml) and know your customer (kyc). Kyc compliance: definition and best practices. kyc compliance refers to the process of verifying the identity of customers and assessing their potential risk for money laundering or other financial crimes. financial institutions must establish robust kyc procedures that include customer identification, due diligence checks, and ongoing monitoring. Transparency: regular kyc processes increase transparency, fostering trust between the customer and the institution. 4. operational efficiency. risk management: aml and kyc protocols allow for better assessment and management of risks associated with new and existing customers. streamlined processes: advanced kyc aml verification processes can.

Kyc And Aml Compliance Key Differences And Best Practices Idenfy Kyc compliance: definition and best practices. kyc compliance refers to the process of verifying the identity of customers and assessing their potential risk for money laundering or other financial crimes. financial institutions must establish robust kyc procedures that include customer identification, due diligence checks, and ongoing monitoring. Transparency: regular kyc processes increase transparency, fostering trust between the customer and the institution. 4. operational efficiency. risk management: aml and kyc protocols allow for better assessment and management of risks associated with new and existing customers. streamlined processes: advanced kyc aml verification processes can. From kyc to kyb: the key differences and best practices sep 16, 2022 crypto exchange, coinbase, started the new year with a $100 million bill to pay, because of “ significant failings ” in its anti money laundering (aml) and know your customer (kyc) compliance programs. The aml kyc compliance process is a series of steps, some of which are continuous processes, that financial institutions undertake to verify and understand their customers’ identities. it’s a.

Kyc And Aml Compliance Key Differences And Best Practices Idenfy From kyc to kyb: the key differences and best practices sep 16, 2022 crypto exchange, coinbase, started the new year with a $100 million bill to pay, because of “ significant failings ” in its anti money laundering (aml) and know your customer (kyc) compliance programs. The aml kyc compliance process is a series of steps, some of which are continuous processes, that financial institutions undertake to verify and understand their customers’ identities. it’s a.

Kyc Vs Aml Meaning Differences And Best Practices

Aml Kyc Guidelines For Fintech Companies Idenfy

Comments are closed.