Know Your Customer Kyc Checklist How To Create A Kyc Checklist For

Kyc Checklist How To Build A Know Your Customer Program Common kyc checklists for business to business (b2b) relationships include: registered company name. registered company address. nature of business. type and status of the business. name of bank. company reference or registration number vat number. company branch. account number iban swift code. Secure your operations and stay compliant with five necessary elements for kyc. know your customer (kyc) procedures are essential for verifying clients' identities, assessing potential risks, and preventing illegal activities like money laundering, terrorist financing, and identity theft. building a kyc checklist makes mitigating risks and.

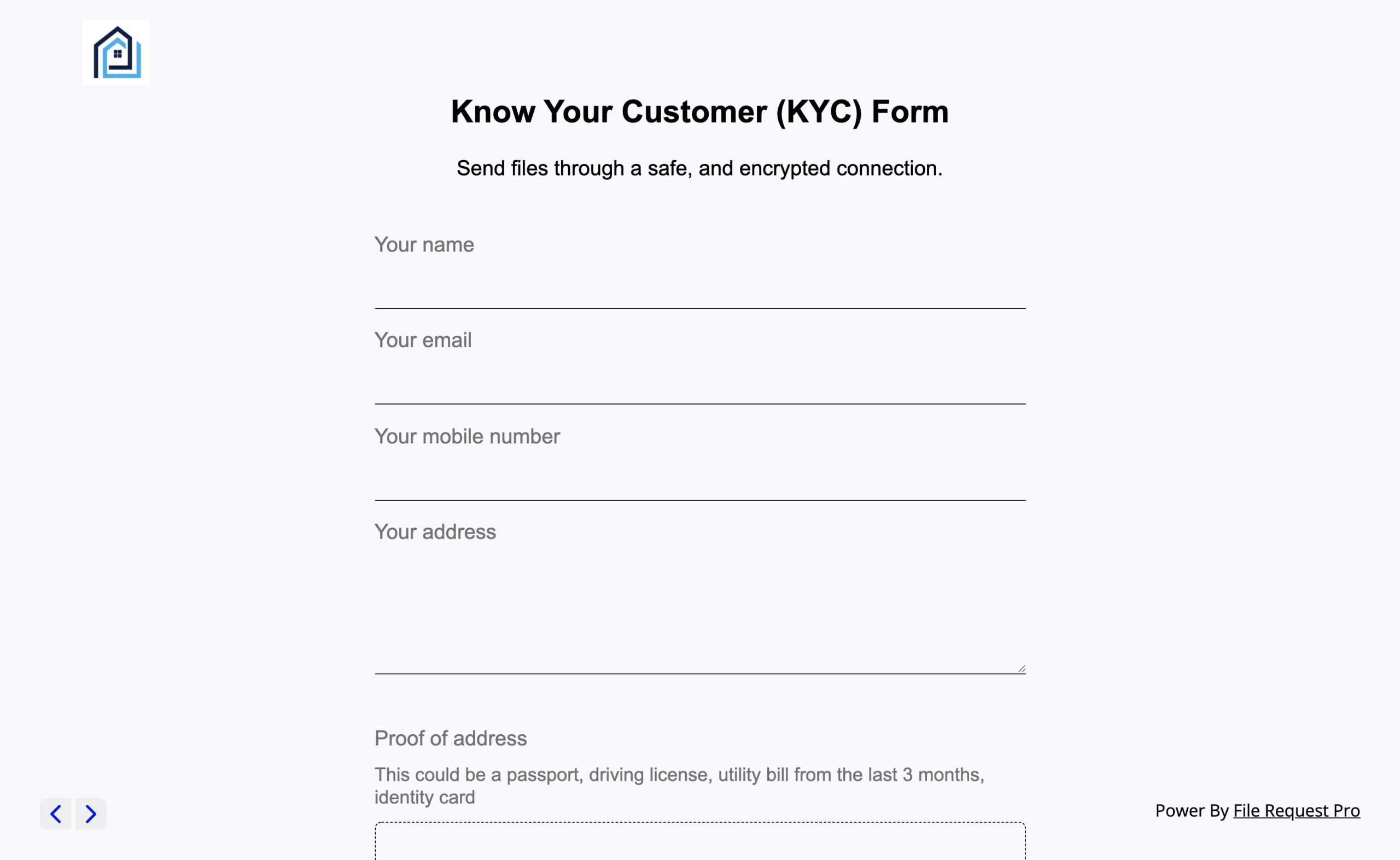

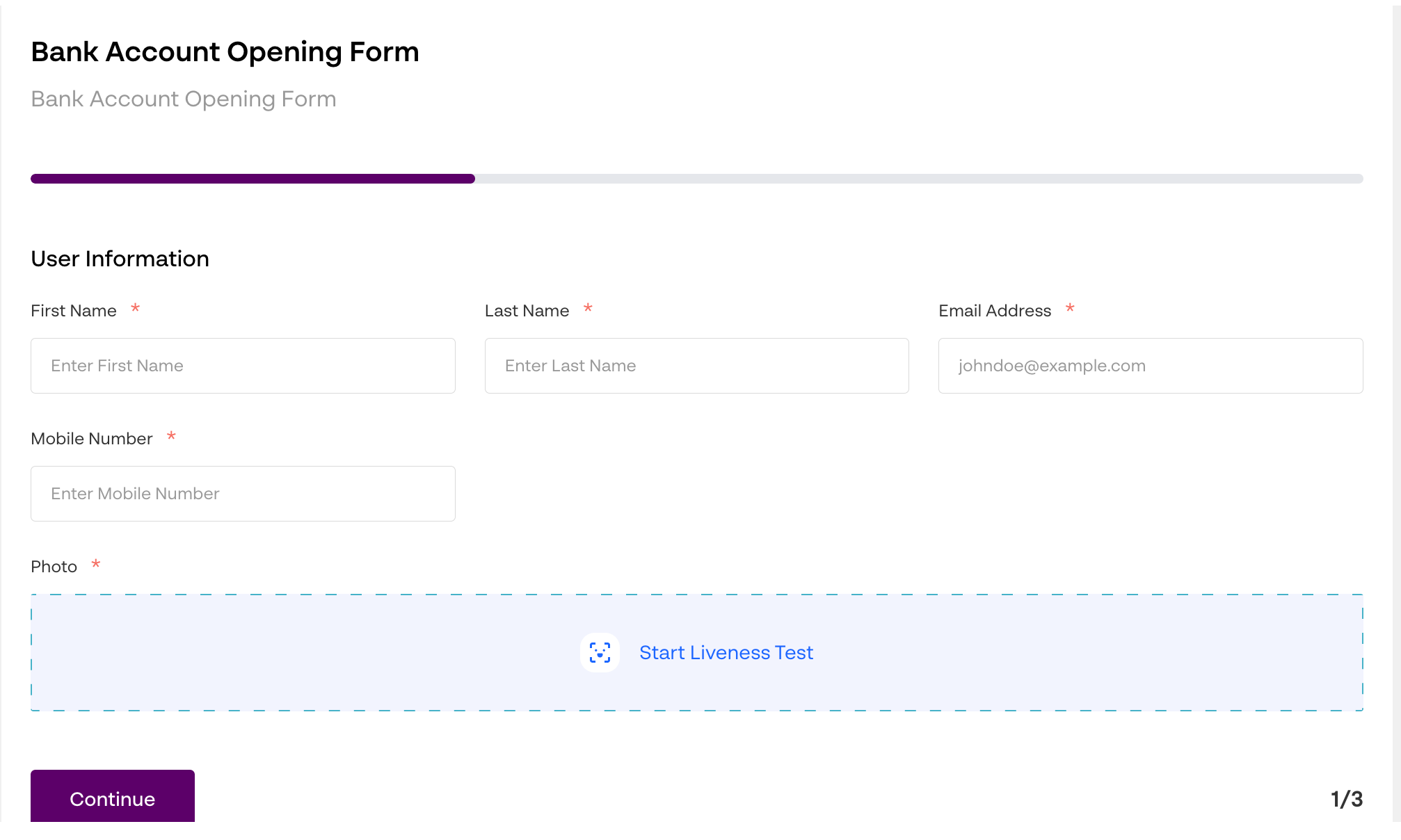

Ultimate Guide To Crafting The Perfect Know Your Customer Kyc Checklist The 3 step know your customer (kyc) checklist. we’ve created a practical checklist to simplify the kyc processes across your organisation: 1. customer identification programme (cip) the customer identification programme (cip) is a crucial aspect of kyc processes, typically occurring during the onboarding phase. Know your customer checklist: kyc documents and customer identification. kyc and customer due diligence procedures for new customers start with customer identification. some common kyc documents include the following: a photo identity card; proof of address — utility bills and other official correspondence can be used; passport; voter’s id card. 2. identify the customer’s information. identifying the information you need to gather on your customer is key in building an effective kyc checklist. typically, this can include their first and last name, date of birth, address, phone number, email address, social security number or any government issued identification number. when gathering. Know your customer (kyc) framework. an effective strategy for gathering customer information is to divide the process into three stages. 1. customer identification: ascertain the identity of customers. customer identification refers to the process of confirming and verifying the identity of individuals who are seeking to engage in a transaction.

Know Your Customer Kyc Checklist How To Create A Kyc Checklist For 2. identify the customer’s information. identifying the information you need to gather on your customer is key in building an effective kyc checklist. typically, this can include their first and last name, date of birth, address, phone number, email address, social security number or any government issued identification number. when gathering. Know your customer (kyc) framework. an effective strategy for gathering customer information is to divide the process into three stages. 1. customer identification: ascertain the identity of customers. customer identification refers to the process of confirming and verifying the identity of individuals who are seeking to engage in a transaction. An effective know your customer (kyc) checklist is essential for maintaining compliance with regulatory requirements and ensuring the security of financial services. here, we outline the critical components of a comprehensive kyc checklist that financial institutions should implement to streamline their compliance processes. Know your customer or kyc is an essential process for financial institutions, helping them verify their customers’ identity and assess the risks associated with them. in this beginner’s guide, we’ll delve into the world of kyc, its components, its importance, and various kyc regulations and solutions. financial crime is a serious issue.

Comments are closed.