Know Your Customer Kyc Anti Money Laundering Aml Explained

Best Explained Know Your Customer Kyc Anti Money Laundering Aml Aml compliance is the comprehensive set of policies that a company uses to protect against criminal infiltration, money laundering, terrorism financing, human trafficking and more. kyc is an important part of aml for corporations, banks, fintechs, and other financial institutions. know your customer (kyc) is the regulatory process in which a. Know your customer and anti money laundering are often viewed as either similar or one and the same. in fact, kyc, sometimes referred to as customer due diligence , is a critical component of aml programs. to underscore the difference between the terms, consider the following definitions of aml and kyc:.

Aml Kyc Anti Money Laundering And Know Your Customer Explained In The key components of anti money laundering (aml) and know your customer (kyc) include verifying customer identities, assessing their risk levels, and monitoring transactions for suspicious activities. these measures help financial institutions prevent money laundering, terrorist financing, and other illicit activities while ensuring compliance. Aml is a set of measures that financial organizations must put in place to prevent financial crimes from happening. kyc is one of the aml measures used by the organizations to collect information about their customers and verify their identities. the type of identifying customer information collected during the kyc process includes: name. address. This has led to the implementation of stricter know your customer regulations by governments and financial authorities worldwide, ensuring that businesses take the necessary measures to protect themselves and their customers. implementing anti money laundering (aml) measures is a crucial part of the kyc and aml framework, as they are vital. Customer due diligence (cdd) refers to practices that financial institutions implement to detect and report aml violations. know your customer (kyc), also known as know your client, is a component.

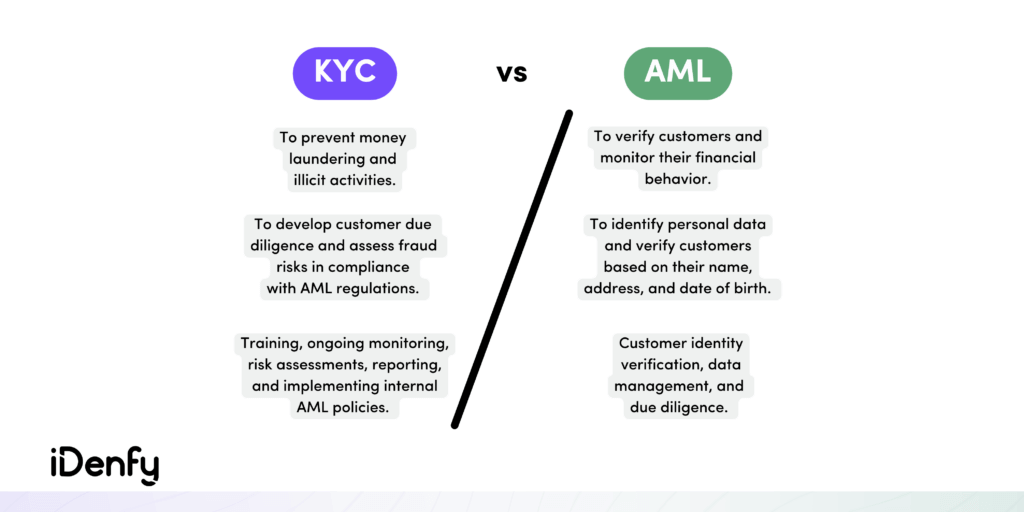

Kyc And Aml Compliance Key Differences And Best Practices Idenfy This has led to the implementation of stricter know your customer regulations by governments and financial authorities worldwide, ensuring that businesses take the necessary measures to protect themselves and their customers. implementing anti money laundering (aml) measures is a crucial part of the kyc and aml framework, as they are vital. Customer due diligence (cdd) refers to practices that financial institutions implement to detect and report aml violations. know your customer (kyc), also known as know your client, is a component. Kyc and aml checks are processes in place to safeguard businesses. know your customer (kyc) and aml are processes in the customer due diligence (cdd) framework to help regulated businesses identify customers at the point of onboarding and prevent illicit activities from taking place within a business. money laundering costs the uk alone more. That’s why it is essential to have a clear understanding of what anti money laundering (aml) and know your customer (kyc) mean in real terms, and learn about the key differences between the two. these terms are commonly used in the same context, but they mean different things. the significant difference between these two terms is that kyc is.

Comments are closed.