Is Carvana Cvna Stock Overvalued

Carvana Is It Still Overvalued Cvna Stock Analysis Aconomics The company currently has a p e 27,271.43. this is the highest indicator in the history of the markets. after the "best" latest report, income caravans fell from 714.00m to 17.00m. carvana q3. One of the hottest stocks this year has been carvana (cvna 7.37%), which has risen over 228% in 2024. the online auto retailer looked like it was on the brink of bankruptcy a couple of years ago.

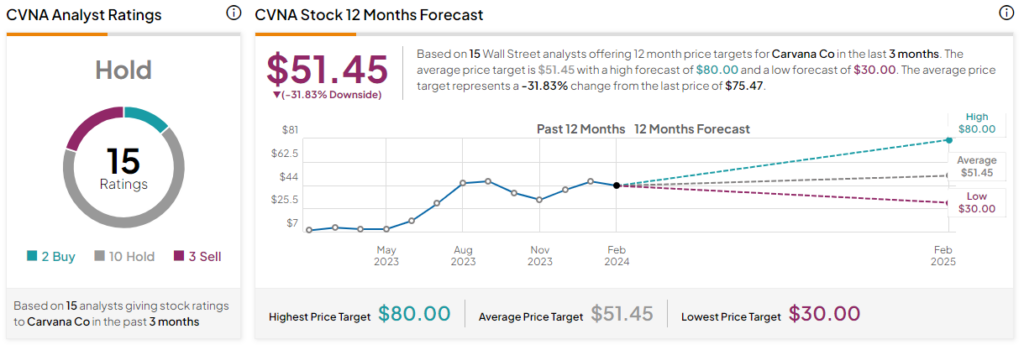

Carvana Stock Nyse Cvna Overvalued Despite Improving Financials Carvana is insanely overvalued. oct. 09, 2024 7:05 am et carvana co. (cvna) stock 301 comments 1 like. the fractal bottom in the cvna stock price occurred december 28, 2022 at $3.62. On the back of these gains, carvana stock looks overvalued today despite the improving fundamentals. carvana still enjoys a long runway to grow, but this expected growth seems priced in already. Cvna is currently trading at a premium to the average analyst price target of $58.73. the street high price target of $90, assigned by rbc capital in march, indicates that the stock could rally as. Stock to watch: carvana (cvna) headquartered in phoenix, az, carvana co. is a leading e commerce platform for buying and selling used cars. the company, which had filed for its ipo in 2017, has.

Carvana Stock Nyse Cvna Overvalued Despite Improving Financials Cvna is currently trading at a premium to the average analyst price target of $58.73. the street high price target of $90, assigned by rbc capital in march, indicates that the stock could rally as. Stock to watch: carvana (cvna) headquartered in phoenix, az, carvana co. is a leading e commerce platform for buying and selling used cars. the company, which had filed for its ipo in 2017, has. Read our full analysis here, it’s free. this quarter, analysts are expecting carvana’s revenue to grow 25.1% year on year to $3.47 billion, a reversal from the 18.1% decrease it recorded in. Investors might want to bet on carvana (cvna), as earnings estimates for this company have been showing solid improvement lately. the stock has already gained solid short term price momentum, and.

Comments are closed.