Is British American Tobacco A Buy Amid A Recession

Is British American Tobacco A Buy Amid A Recession Youtube Buy british american tobacco. the best reason to invest in bat may be its attractive dividend yield of 8.2%. its dividend is well funded, and the company took the unusual step of taking a $30. Today's change. (1.80%) $0.62. current price. $34.98. price as of october 31, 2024, 4:00 p.m. et. british american tobacco won't be attractive to most investors, but it is working to ensure it has.

British American Tobacco An Attractive Investment Amidst Recession British american tobacco is clearly rewarding dividend investors with a dividend yield of 9.8%, but is the stock a buy today? to answer that question, let's look at the reasons to buy, sell, or. British american tobacco has a $16.5 billion hidden asset. the company trades at just 6 times free cash flow. a recession resistant product and a 10% dividend yield make bti a valuable investment. Just because british american tobacco's 9% dividend yield is sustainable in the short term doesn't necessarily make the stock a buy for everyone. the biggest issue plaguing the company is the. British american tobacco's 9.4% dividend yield is exceptionally high versus even the 4% yield of the 10 year u.s. treasury. yet, all indications point to this payout being relatively safe for a.

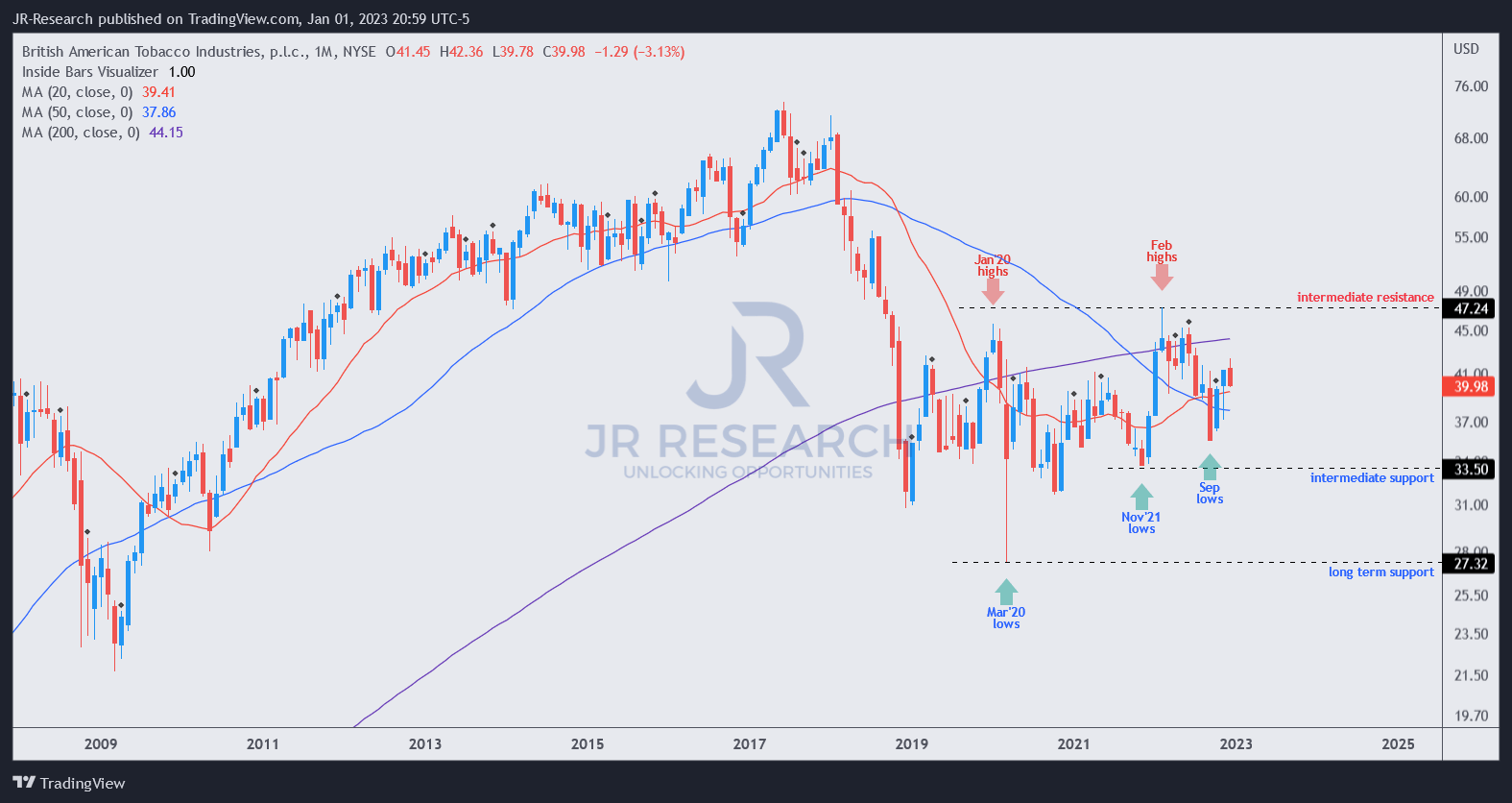

British American Tobacco Cheap Enough To Take On A Recession Nyse Bti Just because british american tobacco's 9% dividend yield is sustainable in the short term doesn't necessarily make the stock a buy for everyone. the biggest issue plaguing the company is the. British american tobacco's 9.4% dividend yield is exceptionally high versus even the 4% yield of the 10 year u.s. treasury. yet, all indications point to this payout being relatively safe for a. Gbx 3,237.50. according to the 4 analysts' twelve month price targets for british american tobacco, the average price target is gbx 3,237.50. the highest price target for bats is gbx 3,500, while the lowest price target for bats is gbx 2,700. the average price target represents a forecasted upside of 14.83% from the current price of gbx 2,801. The future of british american tobacco's 8% dividend. british american tobacco offers a reliable and growing 8.43% dividend, supported by strong cash flows and appealing in a volatile market environment. facing the long term decline in smoking, bti's tra 25 days ago seeking alpha.

British American Tobacco An Attractive Investment Amidst Recession Gbx 3,237.50. according to the 4 analysts' twelve month price targets for british american tobacco, the average price target is gbx 3,237.50. the highest price target for bats is gbx 3,500, while the lowest price target for bats is gbx 2,700. the average price target represents a forecasted upside of 14.83% from the current price of gbx 2,801. The future of british american tobacco's 8% dividend. british american tobacco offers a reliable and growing 8.43% dividend, supported by strong cash flows and appealing in a volatile market environment. facing the long term decline in smoking, bti's tra 25 days ago seeking alpha.

Recession Or No Recession British American Tobacco Is A Great Stock To

Comments are closed.