Irs W 9 And 1099 Forms Full Guide Free Form Downloads

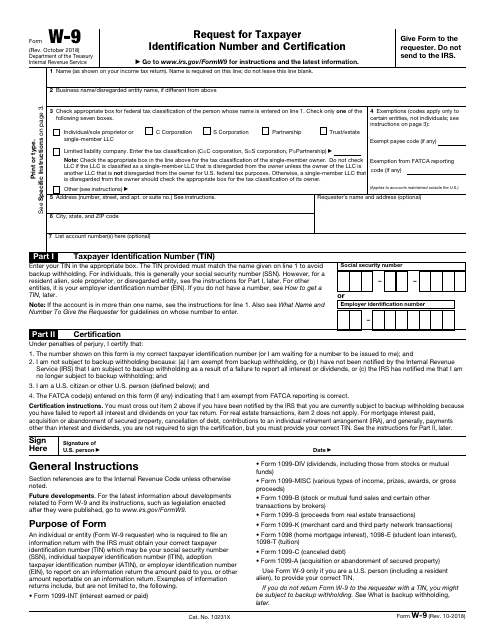

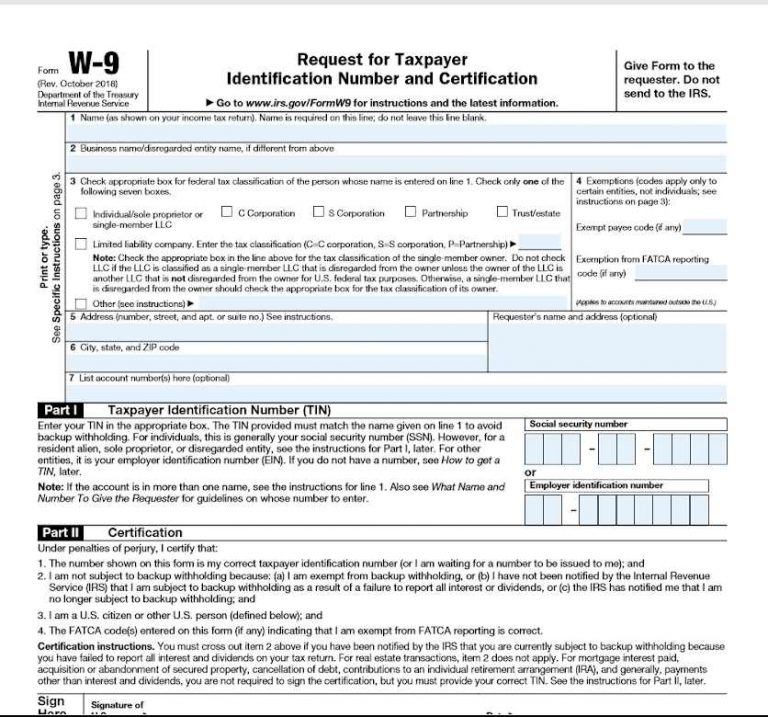

Irs W 9 And 1099 Forms Full Guide Free Form Downloads Form 1099 a (acquisition or abandonment of secured property). use form w 9 only if you are a u.s. person (including a resident alien), to provide your correct tin. caution: if you don’t return form w 9 to the requester with a tin, you might be subject to backup withholding. see what is backup withholding, later. Chapter 4. for chapter 4 purposes, form w 9 is used to withhold on payments to foreign financial institutions (ffi) and non financial foreign entities (nffe) if they don't report all specified u.s. account holders. if an account holder fails to provide its tin, then the withholding rate is 30%. tin matching e services.

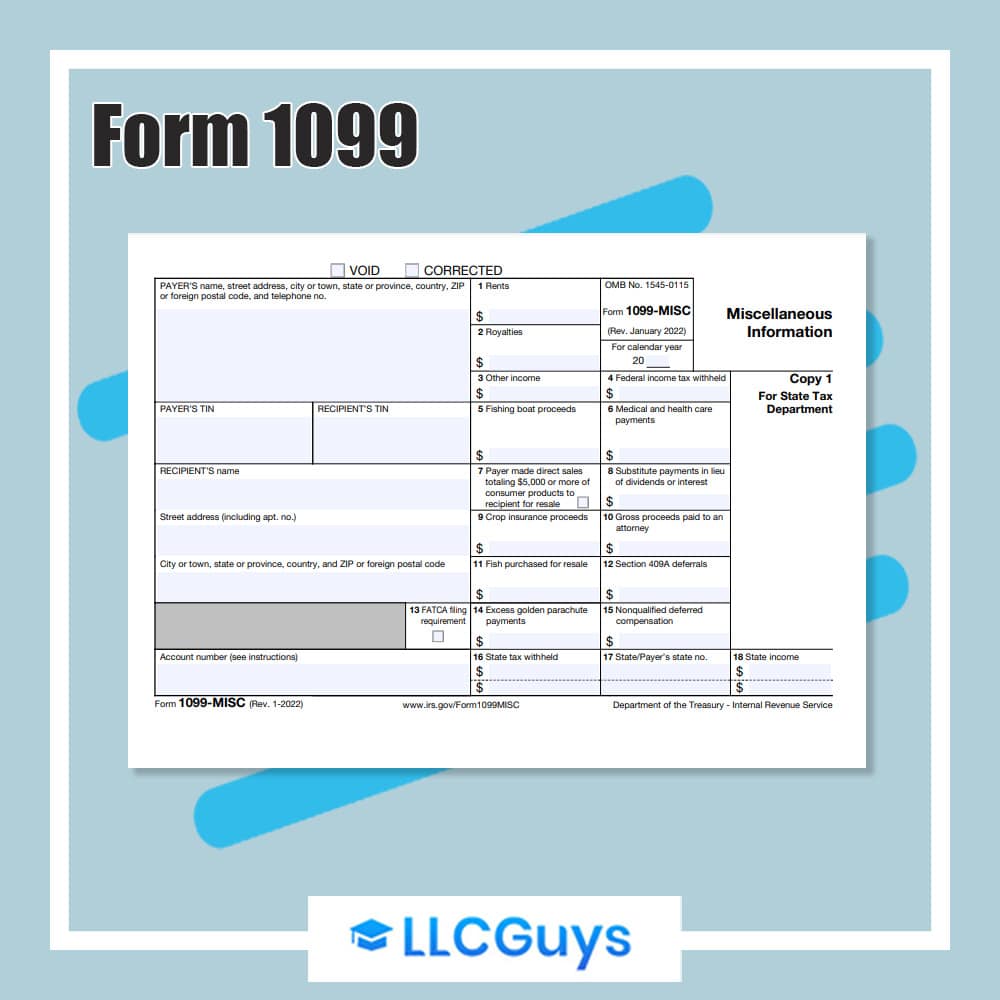

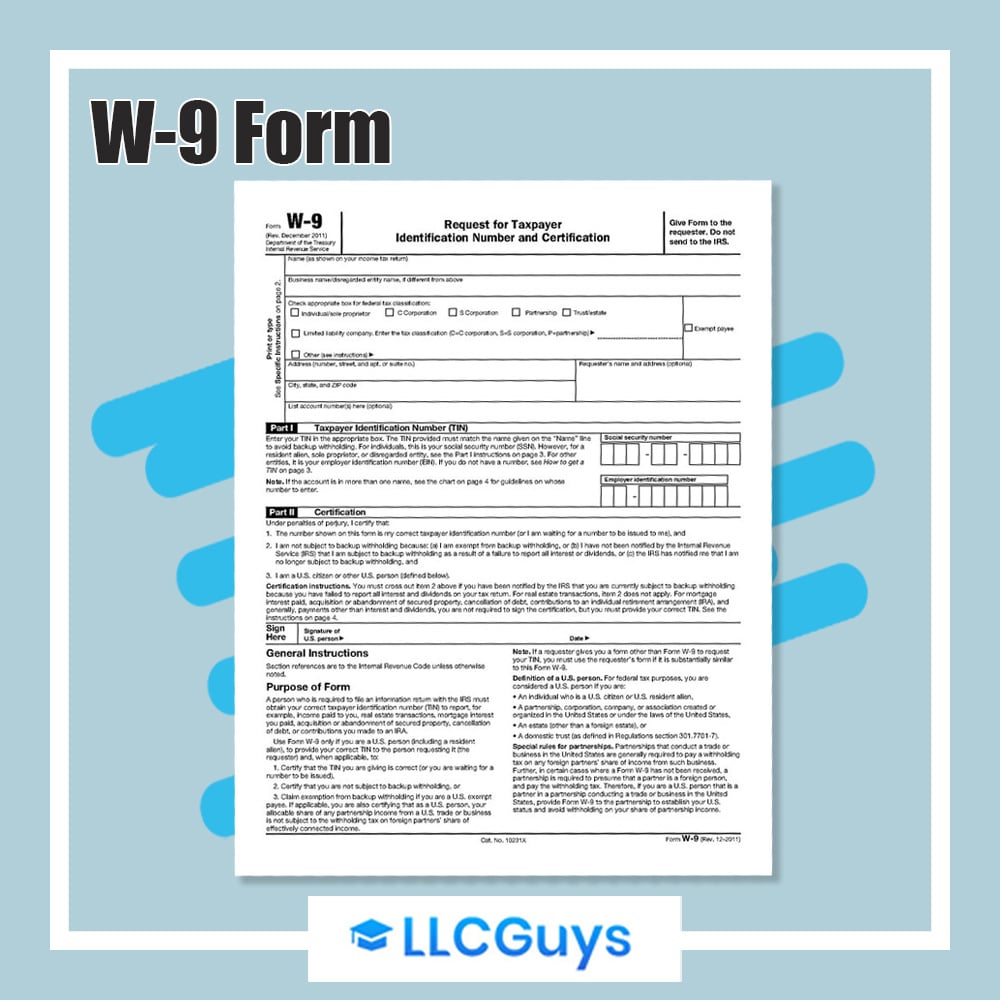

Irs W 9 And 1099 Forms Full Guide Free Form Downloads Use form w 9 to provide your correct taxpayer identification number (tin) to the person who is required to file an information return with the irs to report, for example: income paid to you. real estate transactions. mortgage interest you paid. acquisition or abandonment of secured property. cancellation of debt. contributions you made to an ira. The primary difference between these two forms is that form w 9 is used to request information from the individual being paid, while form 1099 is used to report income to the irs. form w 9 requests the taxpayer’s information, such as name, address, and social security number. the taxpayer must then sign the form for them to be issued a 1099 form. Information about an independent contractor who must pay them is provided on the w 9 form. the contractor’s compensation is disclosed on form 1099 by the employer or other party. the form is filled out and delivered to the employer by the independent contractor. the 1099 form is completed by the employer and sent to the irs. Independent contractors receive 1099 forms rather than w 2s as a record of income earned. you will be issued a 1099 form at the end of the year with the information that was provided on your w 9.

Irs W 9 And 1099 Forms Full Guide Free Form Downloads Information about an independent contractor who must pay them is provided on the w 9 form. the contractor’s compensation is disclosed on form 1099 by the employer or other party. the form is filled out and delivered to the employer by the independent contractor. the 1099 form is completed by the employer and sent to the irs. Independent contractors receive 1099 forms rather than w 2s as a record of income earned. you will be issued a 1099 form at the end of the year with the information that was provided on your w 9. Forms and associated taxes for independent contractors. independent contractor (self employed) or employee?" instructions for forms 1099 misc and 1099 nec (2020) form w 9 is a request for taxpayer information from businesses paying for and using the services of independent contractors. learn more about this form. A w 9 form is one of the shortest and usually considered simplest self employment tax forms. form w 9 provides your taxpayer identification number to a client, bank, or other financial institution. your taxpayer identification number, or tin, is the number the irs uses to uniquely identify you in its system. for most self employed people, it.

Irs Printable 1099 Form Printable Form 2024 Forms and associated taxes for independent contractors. independent contractor (self employed) or employee?" instructions for forms 1099 misc and 1099 nec (2020) form w 9 is a request for taxpayer information from businesses paying for and using the services of independent contractors. learn more about this form. A w 9 form is one of the shortest and usually considered simplest self employment tax forms. form w 9 provides your taxpayer identification number to a client, bank, or other financial institution. your taxpayer identification number, or tin, is the number the irs uses to uniquely identify you in its system. for most self employed people, it.

Free Printable Irs W 9 Form Printable Forms Free Online

W 9 Vs 1099 Irs Forms Differences And When To Use Them

Comments are closed.