Irs Sets 2024 Tax Brackets With Inflation Adjustments

Irs Sets 2024 Tax Brackets With Inflation Adjustments The tax year 2024 adjustments described below generally apply to income tax returns filed in 2025. the tax items for tax year 2024 of greatest interest to most taxpayers include the following dollar amounts: the standard deduction for married couples filing jointly for tax year 2024 rises to $29,200, an increase of $1,500 from tax year 2023. By factoring inflation into the tax rates and certain other amounts, the law protects taxpayers from losing the value of various benefits. each fall, the irs issues two documents detailing the results of these adjustments for the coming year. 2024. ir 2023 208, irs provides tax inflation adjustments for tax year 2024.

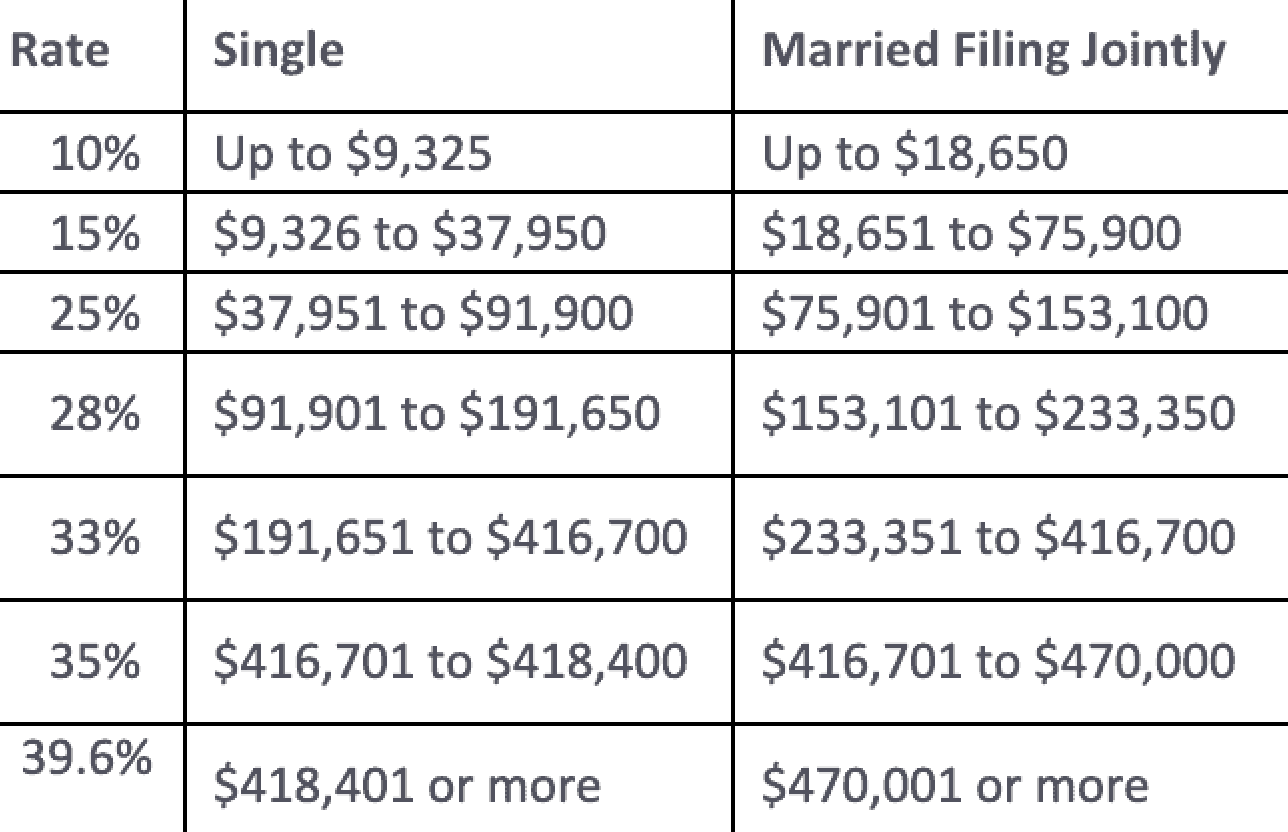

2024 Tax Brackets Irs Makes Inflation Adjustments Modern Wealth For family coverage in tax year 2025, the annual deductible is not less than $5,700, increasing from $5,550 in tax year 2024; however, the deductible cannot be more than $8,550, an increase of $200 versus the limit for tax year 2024. for family coverage, the out of pocket expense limit is $10,500 for tax year 2025, rising from $10,200 in tax. Tax rates for individual taxpayers, adjusted for inflation. with the inflation adjustment, rev. proc. 2024 40 provides that for tax year 2025: the top income tax rate remains 37% for individual single taxpayers with incomes greater than $626,350 ($751,600 for married couples filing jointly). the other income tax rates for single taxpayers will be:. The irs announced thursday annual inflation adjustments for over 60 tax provisions in tax year 2024, including increases in the standard deduction for married couples and single individuals. these tax year 2024 adjustments generally apply to tax returns that will be filed in 2025. included are the tax rate schedules and other tax changes. The irs also announced that the annual gift tax exclusion amount for 2024 remains at $15,000 per individual per year, unchanged from 2023. the basic exclusion amount for an estate of a person who.

Irs Income Tax Brackets 2024 Jemmy Verine The irs announced thursday annual inflation adjustments for over 60 tax provisions in tax year 2024, including increases in the standard deduction for married couples and single individuals. these tax year 2024 adjustments generally apply to tax returns that will be filed in 2025. included are the tax rate schedules and other tax changes. The irs also announced that the annual gift tax exclusion amount for 2024 remains at $15,000 per individual per year, unchanged from 2023. the basic exclusion amount for an estate of a person who. The irs announced new adjusted for inflation income tax brackets and deductions for tax year 2024. the standard deduction for married couples filing jointly increases to $29,200 and will be. Executive summary. the irs revenue procedure provides the amount for inflation adjusted items for 2024. amounts adjusted for inflation include the individual tax brackets, the section 199a qualified business income thresholds, the average annual gross receipt limit to qualify as a small taxpayer, the limitations for section 179 expensing, estate and gift exemptions, as well as several other.

Comments are closed.