Irs Printable W 9 Form 2023 Printable Cards

Irs Printable W 9 Form 2023 Printable Cards Information about form w 9, request for taxpayer identification number (tin) and certification, including recent updates, related forms, and instructions on how to file. form w 9 is used to provide a correct tin to payers (or brokers) required to file information returns with irs. See pub. 515, withholding of tax on nonresident aliens and foreign entities. the following persons must provide form w 9 to the payor for purposes of establishing its non foreign status. in the case of a disregarded entity with a u.s. owner, the u.s. owner of the disregarded entity and not the disregarded entity.

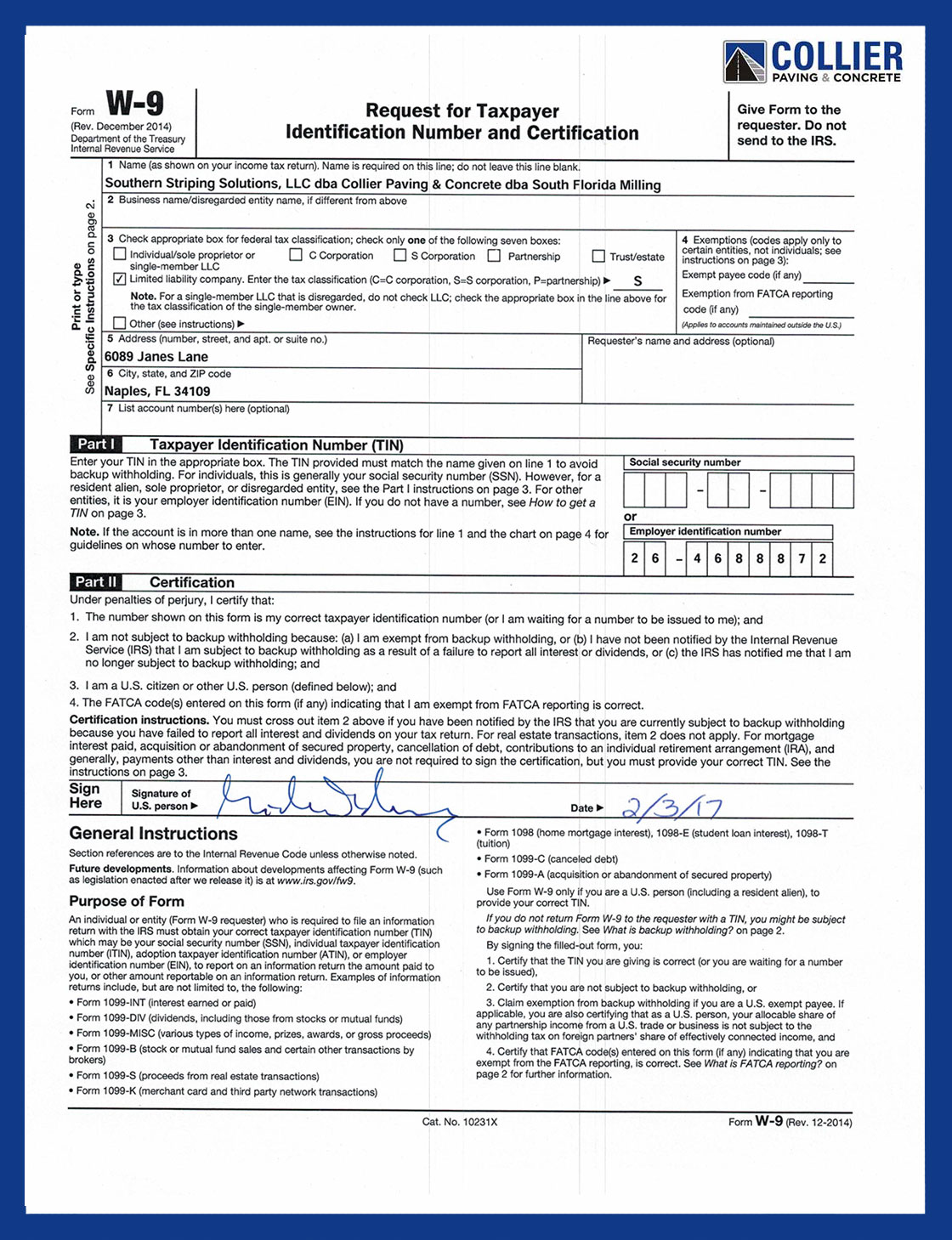

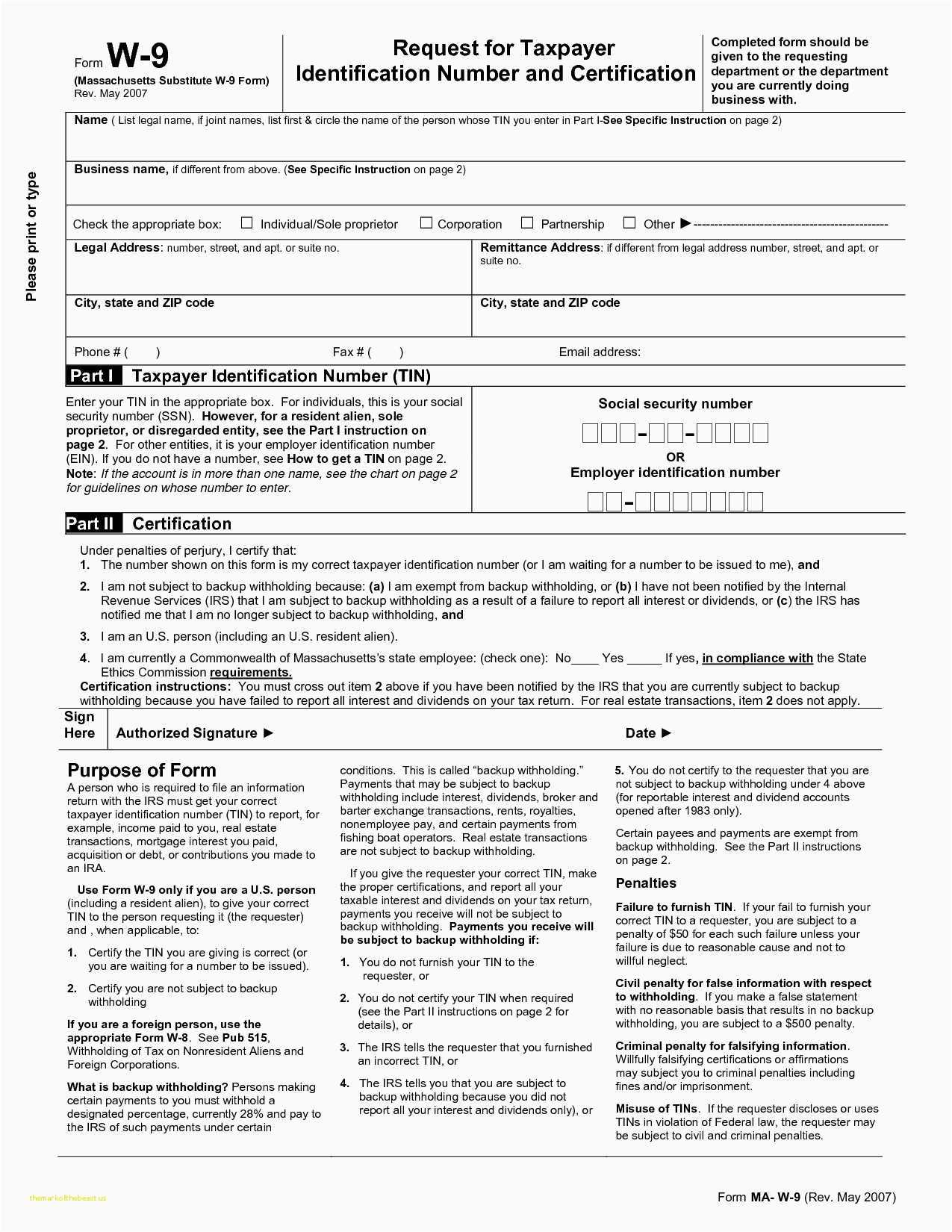

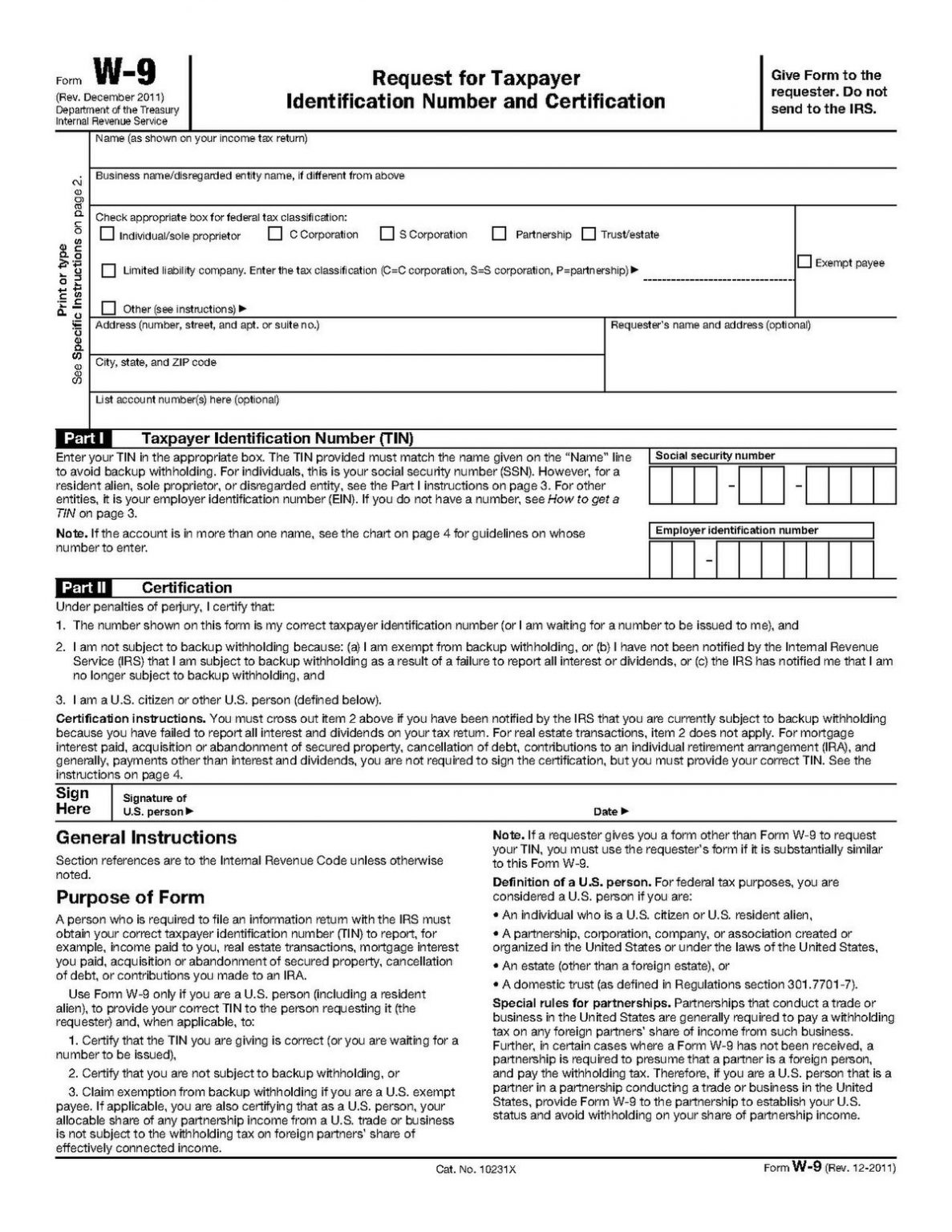

2023 Irs Forms W9 Form 2023 Chapter 4. for chapter 4 purposes, form w 9 is used to withhold on payments to foreign financial institutions (ffi) and non financial foreign entities (nffe) if they don't report all specified u.s. account holders. if an account holder fails to provide its tin, then the withholding rate is 30%. tin matching e services. An irs form w 9, or "request for taxpayer identification number and certification," is a document used to obtain the legal name and tax identification number (tin) of an individual or business entity. it is commonly required when making a payment and withholding taxes are not being deducted. create document. pdf. updated october 24, 2024. Form w 9 is an irs document that businesses use to collect a person's tax identification number (tin). independent contractors who were paid at least $600 during the year need to fill out a w 9. Filling out w 9s. filling out the form isn't difficult since it only requires a few pieces of basic information. when the w 9 is for a business, enter the business name at the top of the form and check the appropriate box to identity the type of entity. the tin is entered on part one of the form. part two is to certify that the information is.

Irs W9 Printable Form 2023 Printable Forms Free Online Form w 9 is an irs document that businesses use to collect a person's tax identification number (tin). independent contractors who were paid at least $600 during the year need to fill out a w 9. Filling out w 9s. filling out the form isn't difficult since it only requires a few pieces of basic information. when the w 9 is for a business, enter the business name at the top of the form and check the appropriate box to identity the type of entity. the tin is entered on part one of the form. part two is to certify that the information is. More about the federal w 9 tax return. we last updated federal w 9 in february 2024 from the federal internal revenue service. this form is for income earned in tax year 2023, with tax returns due in april 2024. we will update this page with a new version of the form for 2025 as soon as it is made available by the federal government. Filling out the w 9 form with smallpdf. with our online pdf editor, we have made sure you’ll find the latest version of the w 9 form from the irs website (for the 2023 tax year) for you to work on. right after accessing the web tool, you can start to fill out the blank w 9 by clicking on each box and entering your personal information.

Formulário W 9 De Irs Baixar Criar Editar Preencher E Imprimir More about the federal w 9 tax return. we last updated federal w 9 in february 2024 from the federal internal revenue service. this form is for income earned in tax year 2023, with tax returns due in april 2024. we will update this page with a new version of the form for 2025 as soon as it is made available by the federal government. Filling out the w 9 form with smallpdf. with our online pdf editor, we have made sure you’ll find the latest version of the w 9 form from the irs website (for the 2023 tax year) for you to work on. right after accessing the web tool, you can start to fill out the blank w 9 by clicking on each box and entering your personal information.

W9 Form 2023 Pdf Editable

Irs Form W 9 Printable Printable W9 Form 2023 Updated Version

Comments are closed.