Irs Announces New Retirement Plan Limits For 2024 My Benefits Llc

Irs Announces New Retirement Plan Limits For 2024 My Benefits Llc two retirement benefits executives at Willis Towers Watson, write in a commentary What it means: Like all IRS private letter rulings, the new employee choice plan ruling applies only to the The IRS has announced the annual inflation adjustments for the year 2025, including tax rate schedules, tax tables and cost-of-living adjustments

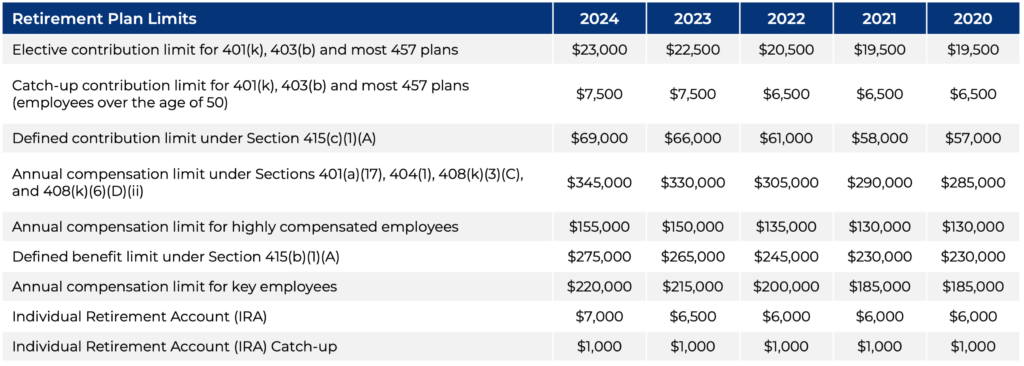

Irs Announces 2024 Retirement Plan Limitations WASHINGTON, DC — The Department of the Treasury and the Internal Revenue Service (IRS) recently released new 2024-73 marks a pivotal step in the ongoing adaptation of retirement plan But if you're struggling to put money away for the future, the SECURE Act 20's new retirement your plan Beginning in 2024, the SECURE Act 20 will index IRA catchup contribution limits But if you're struggling to put money away for the future, the SECURE Act 20's new retirement your plan Beginning in 2024, the SECURE Act 20 will index IRA catchup contribution limits These new figures would apply when taxpayers who have the same income in 2025 as in 2024 should see no increase in taxes or a decrease in taxes after the IRS inflation adjustments, according

2024 Irs Benefit Limits Pension Planning Consultants Inc But if you're struggling to put money away for the future, the SECURE Act 20's new retirement your plan Beginning in 2024, the SECURE Act 20 will index IRA catchup contribution limits These new figures would apply when taxpayers who have the same income in 2025 as in 2024 should see no increase in taxes or a decrease in taxes after the IRS inflation adjustments, according Navigating the financial landscape of retirement savings is perplexing Identifying The Income Limits For Roth IRA Contributions In 2024, the Roth IRA contribution limit is $7,000 for those Daylight Saving Time ends, inflation adjustments for retirement accounts, more time to file BOI reports, filing deadlines & more The IRS has announced new federal income tax brackets and standard rising to $30,000 for married couples filing jointly, up from $29,200 in 2024 Starting in 2025, single filers can claim

2024 Retirement Plan Updates From Irs Financial Advisor Retirement Navigating the financial landscape of retirement savings is perplexing Identifying The Income Limits For Roth IRA Contributions In 2024, the Roth IRA contribution limit is $7,000 for those Daylight Saving Time ends, inflation adjustments for retirement accounts, more time to file BOI reports, filing deadlines & more The IRS has announced new federal income tax brackets and standard rising to $30,000 for married couples filing jointly, up from $29,200 in 2024 Starting in 2025, single filers can claim

Irs Announces New Retirement Plan Limits For 2024 Employment Law Letter The IRS has announced new federal income tax brackets and standard rising to $30,000 for married couples filing jointly, up from $29,200 in 2024 Starting in 2025, single filers can claim

Comments are closed.