Irs Announces New Federal Tax Brackets For 2025

What Are The 2025 Tax Brackets 2025 Whole Year Calendar For heads of households, the standard deduction will be $22,500 for tax year 2025, an increase of $600 from the amount for tax year 2024. marginal rates. for tax year 2025, the top tax rate remains 37% for individual single taxpayers with incomes greater than $626,350 ($751,600 for married couples filing jointly). the other rates are:. For the tax year 2025, the top tax rate is 37% for individual single taxpayers with incomes greater than $626,350 ($751,600 for married couples filing jointly). the other rates are: 35% for.

Irs Announces New Federal Tax Brackets For 2025 The irs has announced new federal income tax brackets and standard deductions for 2025. in its announcement on tuesday, the agency raised the income thresholds for each bracket, which applies to. The irs on tuesday announced its new inflation adjusted tax brackets for 2025, with the annual income thresholds rising by about 2.8% from 2024 — the smallest jump in several years. the irs each. The individual tax rates will remain 10%, 12%, 22%, 24%, 32%, 35% and 37%, as set by the 2017 tcja. the upshot: you'll have to earn more income next year to reach each higher band of taxation. for. In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). the federal income tax has seven tax rates in 2025: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. the top marginal income tax rate of 37 percent will hit taxpayers with taxable.

Projected 2025 Federal Income Tax Brackets A Comprehensive Analysis The individual tax rates will remain 10%, 12%, 22%, 24%, 32%, 35% and 37%, as set by the 2017 tcja. the upshot: you'll have to earn more income next year to reach each higher band of taxation. for. In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). the federal income tax has seven tax rates in 2025: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. the top marginal income tax rate of 37 percent will hit taxpayers with taxable. On oct. 22, 2024, the irs announced the annual inflation adjustments for 2025. a handful of tax provisions, including the standard deduction and tax brackets, will see new limits and thresholds. The standard deduction climbs to $30,000 — up $800 from 2024 — for married couples filing jointly. for heads of households, the standard deduction will be $22,500 for tax year 2025 — up $600.

Irs Income Tax Brackets 2025 A Comprehensive Guide Cruise Around The On oct. 22, 2024, the irs announced the annual inflation adjustments for 2025. a handful of tax provisions, including the standard deduction and tax brackets, will see new limits and thresholds. The standard deduction climbs to $30,000 — up $800 from 2024 — for married couples filing jointly. for heads of households, the standard deduction will be $22,500 for tax year 2025 — up $600.

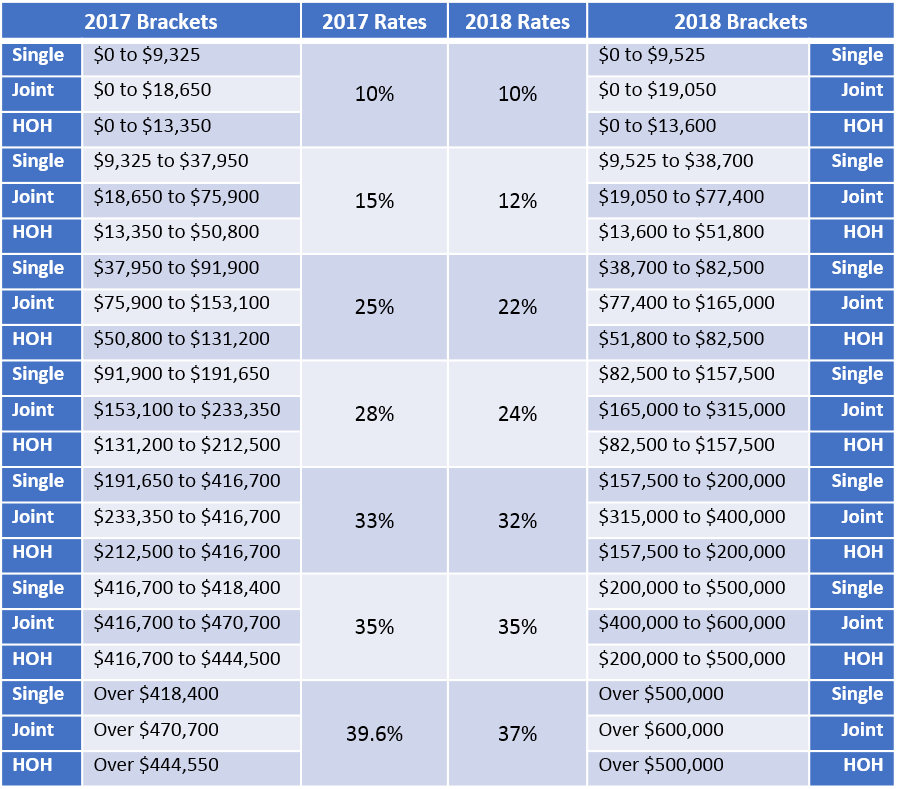

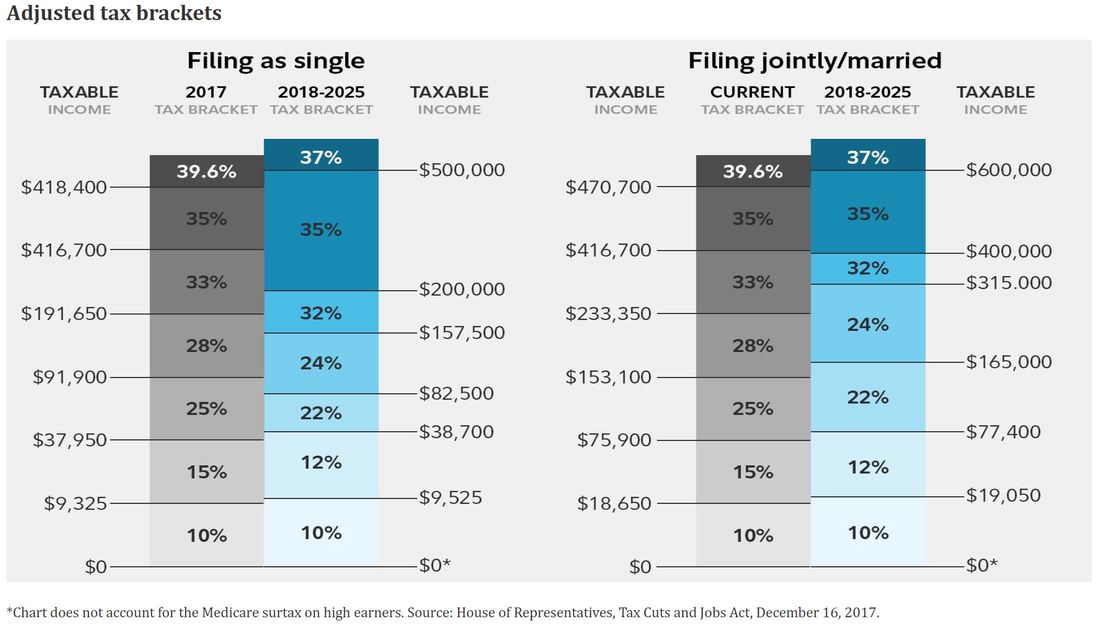

New Tax Brackets And Lower Tax Rates For 2018 2025 Pfwise

Irs Announces New Federal Tax Brackets For 2025

Comments are closed.