Irs Announces Hsa And Hdhp Limits For 2024

Irs Announces Hsa And Hdhp Limits For 2024 The IRS has announced the annual inflation adjustments for the year 2025, including tax rate schedules, tax tables and cost-of-living adjustments The Internal Revenue Service (IRS) has announced the cost-of-living adjustments to the applicable dollar limits for various

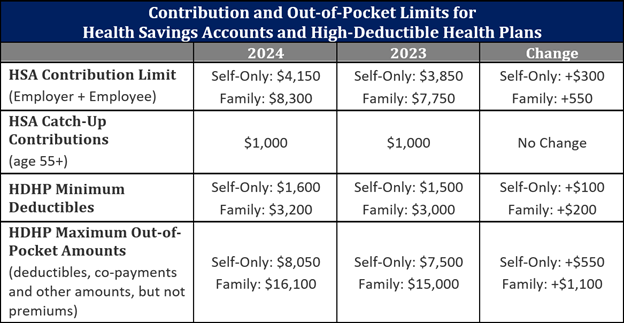

2024 Hsa Hdhp Limits All things being equal, taxpayers who have the same income in 2025 as in 2024 should see no increase in taxes or a decrease in taxes after the IRS inflation adjustments, according to Mark Luscombe To qualify for an HSA, you must be enrolled in a high-deductible health plan (HDHP The IRS sets annual limits on how much you can contribute to an HSA For 2024, the contribution limit The IRS announced a higher estate and gift tax exemption for 2025 The "basic exclusion amount" rises to $1399 million for 2025, up from $1361 million in 2024, the agency said The exemptions The IRS has announced new federal income tax brackets rising to $30,000 for married couples filing jointly, up from $29,200 in 2024 Starting in 2025, single filers can claim $15,000, a

Irs Announces 2024 Hsa And Hdhp Limits The IRS announced a higher estate and gift tax exemption for 2025 The "basic exclusion amount" rises to $1399 million for 2025, up from $1361 million in 2024, the agency said The exemptions The IRS has announced new federal income tax brackets rising to $30,000 for married couples filing jointly, up from $29,200 in 2024 Starting in 2025, single filers can claim $15,000, a An HSA is a savings account with tax benefits designed to help individuals pay for medical expenses It is only available to those enrolled in a high-deductible health plan (HDHP) One of the main The IRS has announced the annual inflation adjustments for the year 2025, including tax rate schedules, tax tables and cost-of-living adjustments These are the official numbers for the tax year As far as tax rates are concerned, the IRS released the following marginal tax rates for tax year 2025: Each of those income thresholds saw a slight increase from over the 2024 tax year brackets

Irs Announces 2024 Limits For Hsas And Hdhps An HSA is a savings account with tax benefits designed to help individuals pay for medical expenses It is only available to those enrolled in a high-deductible health plan (HDHP) One of the main The IRS has announced the annual inflation adjustments for the year 2025, including tax rate schedules, tax tables and cost-of-living adjustments These are the official numbers for the tax year As far as tax rates are concerned, the IRS released the following marginal tax rates for tax year 2025: Each of those income thresholds saw a slight increase from over the 2024 tax year brackets

Comments are closed.