Irs Announces Hsa 2020 Contribution Limits Advantage Administrators

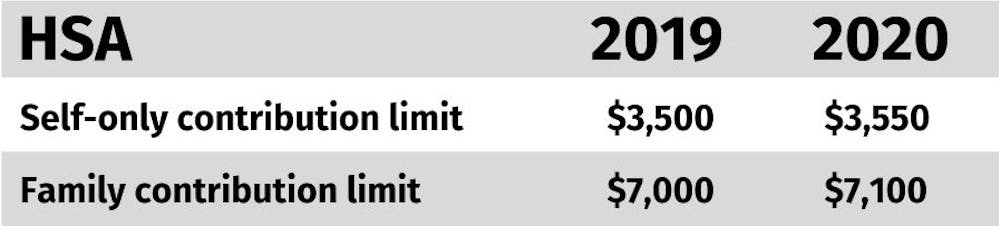

Irs Announces Hsa 2020 Contribution Limits Advantage Administrators In 2020, the annual limit on health savings account (hsa) contributions will be $3,550 for self only and $7,100 for family coverage. see the shrm online article irs announces 2021 limits for. In 2021, the self only contribution limit will rise from $3,550 in 2020 to $3,600. the family contribution limit will rise from $7,100 in 2020 to $7,200. the irs also announced 2021 high deductible health plan amounts and expense limits: if you have questions or need more information, please contact your advantage administrators representative.

Irs Announces 2020 Contribution Limits By Admin Partners Llc Medium Earlier today, the internal revenue service issued a bulletin announcing 2020 health savings account (hsa) contribution limits will increase slightly, reflecting an adjustment for inflation. for 2020, the hsa contribution limits are $3,550 for individuals with self only coverage under a high deductible health plan (hdhp), a $50 increase from 2019. The 2020 annual hsa contribution limit is $3,550 for individuals with self only hdhp coverage (up from $3,500 in 2019), and $7,100 for individuals with family hdhp coverage (up from $7,000 in 2019). hdhp minimum deductibles. The internal revenue service announced new, higher contribution limits for health savings accounts for 2020 today. hsas are the best way to save courtesy of uncle sam, with triple tax benefits. For the 2020 calendar year, the contribution limit for individual hsas will increase to $3,550 per year, up from $3,500 in 2019. for the 2020 calendar year, the contribution limit for family hsas will increase to $7,100 per year, up from $7,000 in 2019. if the hsa owner is 55 years of age or older, they can make an additional $1,000 catch up.

Irs Releases 2020 Hsa Contribution Limits And Hdhp Deductible And Out The internal revenue service announced new, higher contribution limits for health savings accounts for 2020 today. hsas are the best way to save courtesy of uncle sam, with triple tax benefits. For the 2020 calendar year, the contribution limit for individual hsas will increase to $3,550 per year, up from $3,500 in 2019. for the 2020 calendar year, the contribution limit for family hsas will increase to $7,100 per year, up from $7,000 in 2019. if the hsa owner is 55 years of age or older, they can make an additional $1,000 catch up. An out of pocket maximum of $6,900 individual $13,800 family. 2020 hsa contribution limits: individual coverage – $3,550. family coverage $7,100. age 55 — additional $1,000 catch up contribution, meaning you can deposit an additional $1,000 per year. if your spouse is also 55 or older, he or she may establish a separate hsa and make a. The irs has announced 2020 hsa and hdhp limits as follows: annual hsa contribution limitation. for calendar year 2020, the annual limitation on deductions for hsa contributions under § 223(b)(2)(a) for an individual with self only coverage under a high deductible health plan is $3,550 (up from $3,500 in 2019), and the annual limitation on deductions for hsa contributions under § 223(b)(2)(b.

2020 Hsa Contribution Limits Key Information An out of pocket maximum of $6,900 individual $13,800 family. 2020 hsa contribution limits: individual coverage – $3,550. family coverage $7,100. age 55 — additional $1,000 catch up contribution, meaning you can deposit an additional $1,000 per year. if your spouse is also 55 or older, he or she may establish a separate hsa and make a. The irs has announced 2020 hsa and hdhp limits as follows: annual hsa contribution limitation. for calendar year 2020, the annual limitation on deductions for hsa contributions under § 223(b)(2)(a) for an individual with self only coverage under a high deductible health plan is $3,550 (up from $3,500 in 2019), and the annual limitation on deductions for hsa contributions under § 223(b)(2)(b.

Legal Alert Irs Releases 2020 Hsa Contribution Limits Ban High

Comments are closed.