Irs Announces 2024 Retirement Plan Limitations

.jpg?width=600&height=1500&name=2024 Contribution Limits Retirement Plans Infographic (1).jpg)

Irs Announces 2024 Retirement Plan Limits Participant’s limitation under a defined benefit plan under section415(b)(1)(b) is computed by multiplying the participant’s compensation limitation, as adjusted through 2024, by 1.0262. the limitation for defined contribution plans under section 415(c)(1)(a) is increased in 2025 from $69,000 to $70,000. Ir 2024 285, nov. 1, 2024. washington — the internal revenue service announced today that the amount individuals can contribute to their 401 (k) plans in 2025 has increased to $23,500, up from $23,000 for 2024. the irs today also issued technical guidance regarding all cost‑of‑living adjustments affecting dollar limitations for pension.

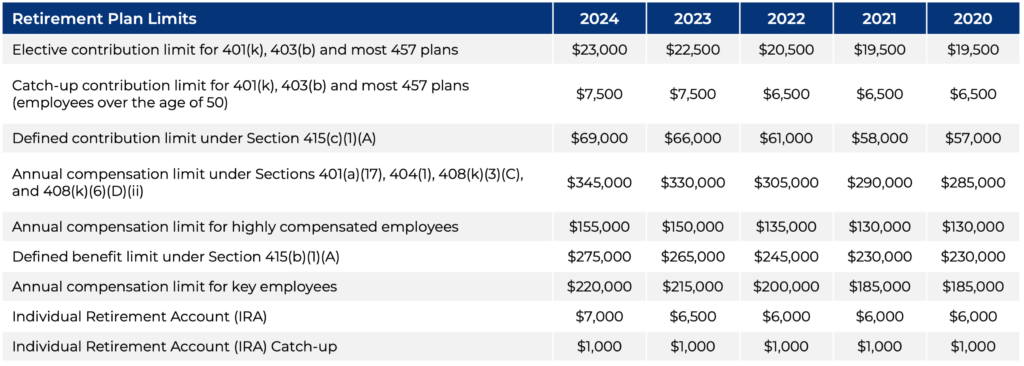

Irs Announces 2024 Retirement Plan Limitations Washington (ap) — the irs on friday announced an increase to the amount individuals can contribute to their 401 (k) plans in 2025 — to $23,500, up from $23,000 in 2024. the internal revenue service detailed the increases in its annual cost of living adjustments for pension plans and other retirement accounts. workers who participate in 403. November 5, 2024. by: emily c. kopp. on november 1, 2024, the internal revenue service issued notice 2024 80 announcing the cost of living adjustment (“cola”) applicable to pension and retirement plan dollar limitations for the 2025 calendar year. new for 2025 and courtesy of secure 2.0, a “super” catch up contribution limit for 401 (k. The dollar limitations for retirement plans and certain other dollar limitations that become effective january 1, 2024, have been released by the irs in notice 2023 75. the dollar limitations adjusted by reference to irc section 415(d) are modified annually for inflation and, consequently, most of them are changed for 2024. The employee contribution limit for 401 (k) plans in 2024 has increased to $23,000, up from $22,500 for 2023. other key limit increases include the following: the employee contribution limit for iras is increased to $7,000, up from $6,500. the ira catch‑up contribution limit for individuals aged 50 and over remains unchanged at $1,000 for.

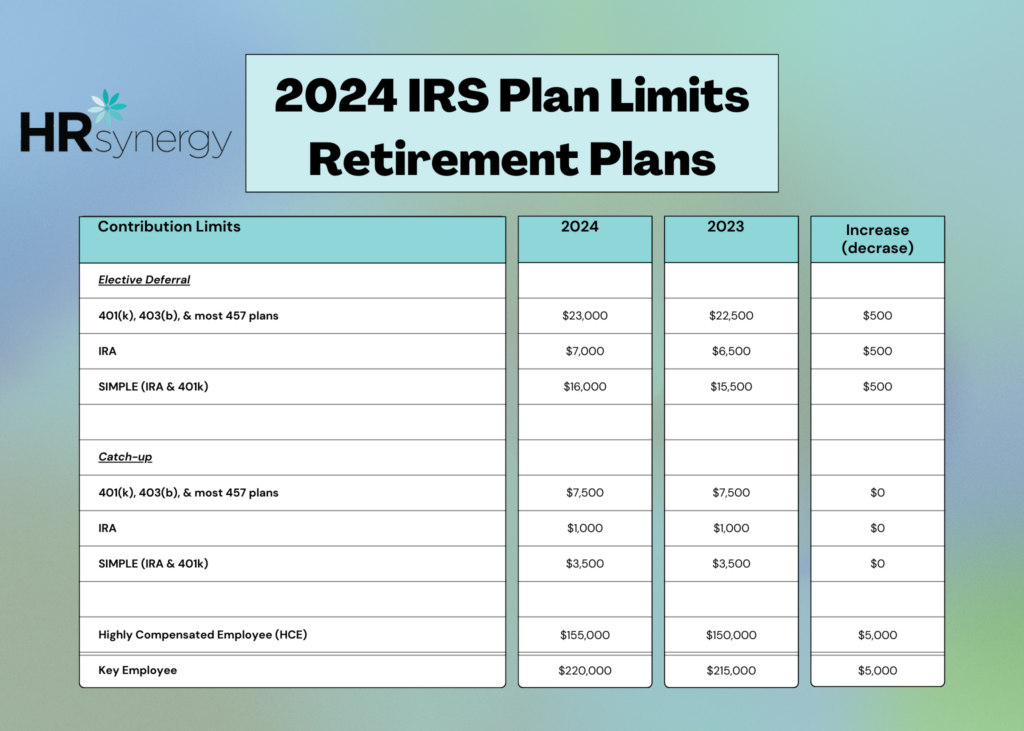

Irs 2024 Plan Limits Hr Synergy Llc The dollar limitations for retirement plans and certain other dollar limitations that become effective january 1, 2024, have been released by the irs in notice 2023 75. the dollar limitations adjusted by reference to irc section 415(d) are modified annually for inflation and, consequently, most of them are changed for 2024. The employee contribution limit for 401 (k) plans in 2024 has increased to $23,000, up from $22,500 for 2023. other key limit increases include the following: the employee contribution limit for iras is increased to $7,000, up from $6,500. the ira catch‑up contribution limit for individuals aged 50 and over remains unchanged at $1,000 for. On november 1, 2023, the internal revenue service (irs) announced cost of living adjustments to the dollar limits on benefits and contributions in retirement plans for 2024. these adjustments are in addition to previously announced increases in limits to other employee benefit plans. in addition, the social security administration recently. On november 1, 2023, the irs issued notice 2023 75, which provides certain cost of living adjustments for a wide variety of tax related items, including retirement plan contribution maximums and other limitations. several key figures are highlighted below. these cost of living adjustments are effective january 1, 2024.

Irs Announces 2024 Retirement Plan Limits Axion Rms On november 1, 2023, the internal revenue service (irs) announced cost of living adjustments to the dollar limits on benefits and contributions in retirement plans for 2024. these adjustments are in addition to previously announced increases in limits to other employee benefit plans. in addition, the social security administration recently. On november 1, 2023, the irs issued notice 2023 75, which provides certain cost of living adjustments for a wide variety of tax related items, including retirement plan contribution maximums and other limitations. several key figures are highlighted below. these cost of living adjustments are effective january 1, 2024.

Irs Announces Retirement Plan Limitations For 2024 Lexology

Irs Announces 2024 Retirement Plan Limitations

Comments are closed.