Irs Announces 2023 Hsa Contribution Limits

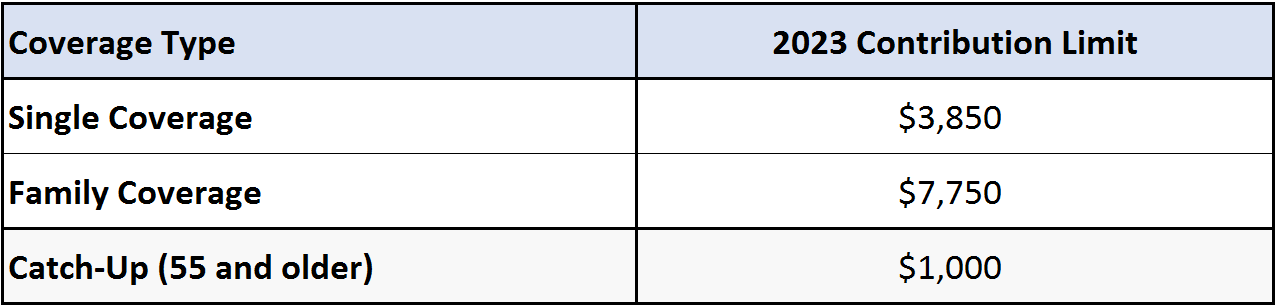

Irs Announces 2023 Hsa Contribution Limits If you are an eligible individual who is age 55 or older at the end of your tax year, your contribution limit is increased by $1,000. for example, if you have self only coverage, you can contribute up to $4,850 (the contribution limit for self only coverage ($3,850) plus the additional contribution of $1,000). Health savings account (hsa) contribution limits for 2023 are going up significantly in response to the recent inflation surge, the irs announced april 29, giving employers that sponsor high.

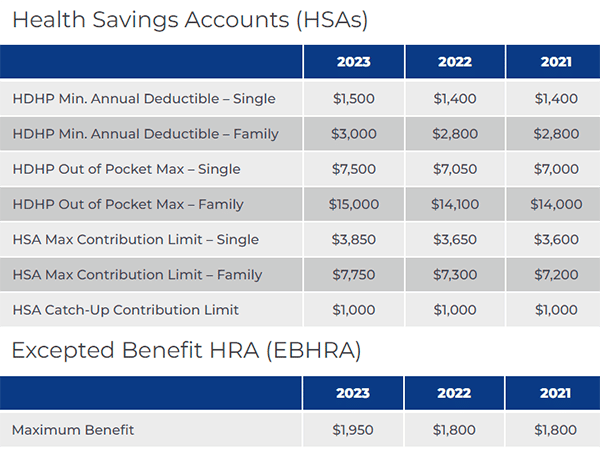

Irs Announces 2023 Hsa Limits Blog Medcom Benefits The 2023 annual hsa contribution limit is $3,850 for individuals with self only hdhp coverage (up from $3,650 in 2022), and $7,750 for individuals with family hdhp coverage (up from $7,300 in 2022). hdhp minimum deductibles. For plan years beginning in 2023, the maximum amount that may be made newly available for the plan year for an excepted health reimbursement arrangement (hra) under reg. section 54.9831 1 (c) (3) (viii) is $1,950. form w 2 reporting reminder. employer contributions and employee pre tax contributions to an hsa are required to be reported on form. On april 29, 2022, the irs announced the 2023 health savings account contribution limits and the 2023 excepted benefit hra benefit maximum within their release of revenue procedure 2022 24. the contribution limit for hsas varies based on coverage type and age, with higher limits for individuals aged 55 and older. Ir 2024 285, nov. 1, 2024. washington — the internal revenue service announced today that the amount individuals can contribute to their 401 (k) plans in 2025 has increased to $23,500, up from $23,000 for 2024. the irs today also issued technical guidance regarding all cost‑of‑living adjustments affecting dollar limitations for pension.

Irs Announces Hsa Aca Limits For 2023 Jme Insurance Agency On april 29, 2022, the irs announced the 2023 health savings account contribution limits and the 2023 excepted benefit hra benefit maximum within their release of revenue procedure 2022 24. the contribution limit for hsas varies based on coverage type and age, with higher limits for individuals aged 55 and older. Ir 2024 285, nov. 1, 2024. washington — the internal revenue service announced today that the amount individuals can contribute to their 401 (k) plans in 2025 has increased to $23,500, up from $23,000 for 2024. the irs today also issued technical guidance regarding all cost‑of‑living adjustments affecting dollar limitations for pension. The irs has issued revenue procedure 2022 24, providing inflation adjusted health savings account (hsa) contribution amounts for calendar year 2023: maximum contribution amount. individual $3,850 (increase of $200) family $7,750 (increase of $450) catch up (age 55 ) $1,000 (no increase) high deductible health plan (hdhp) deductible. In rev. proc. 2022 24, the irs released the inflation adjusted amounts for 2023 relevant to health savings accounts (hsas) and high deductible health plans (hdhps). the table below summarizes those adjustments and other applicable limits. 2023. 2022. change. annual hsa contribution limit. (employer and employee) self only: $3,850 family: $7,750.

Irs Announces 2023 Hsa High Deductible Health Plan Limits Burnham The irs has issued revenue procedure 2022 24, providing inflation adjusted health savings account (hsa) contribution amounts for calendar year 2023: maximum contribution amount. individual $3,850 (increase of $200) family $7,750 (increase of $450) catch up (age 55 ) $1,000 (no increase) high deductible health plan (hdhp) deductible. In rev. proc. 2022 24, the irs released the inflation adjusted amounts for 2023 relevant to health savings accounts (hsas) and high deductible health plans (hdhps). the table below summarizes those adjustments and other applicable limits. 2023. 2022. change. annual hsa contribution limit. (employer and employee) self only: $3,850 family: $7,750.

Irs Announced 2023 Health Savings Account Hsa Contribution Limits Hrpro

Comments are closed.