Irs 2024 Retirement Plan Contribution Limits Hedda Chandal

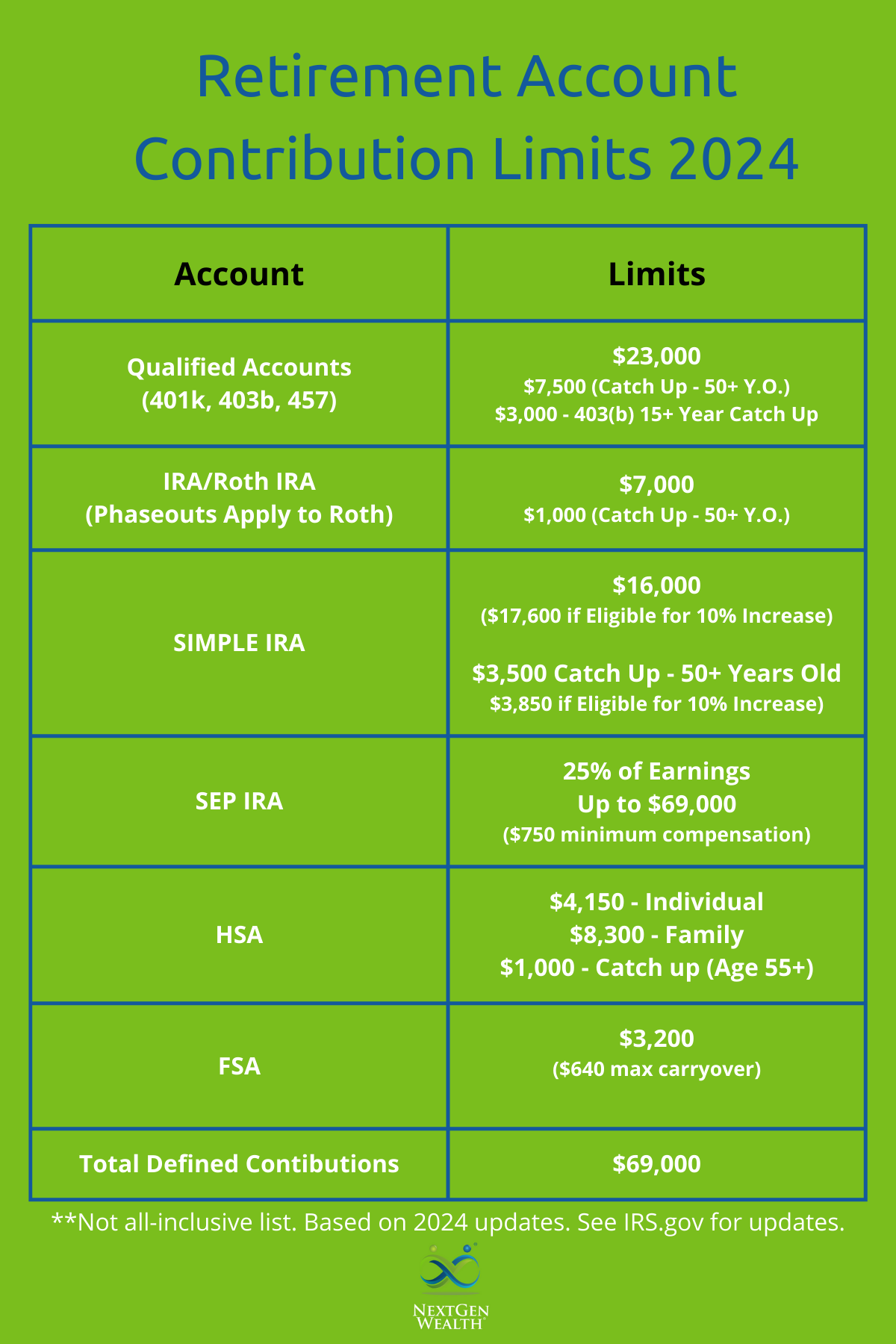

Irs 2024 Retirement Plan Contribution Limits Hedda Chandal The ira catch‑up contribution limit for individuals aged 50 and over was amended under the secure 2.0 act of 2022 (secure 2.0) to include an annual cost‑of‑living adjustment but remains $1,000 for 2024. the catch up contribution limit for employees aged 50 and over who participate in 401(k), 403(b), and most 457 plans, as well as the. For 2022, 2021, 2020 and 2019, the total contributions you make each year to all of your traditional iras and roth iras can't be more than: $6,000 ($7,000 if you're age 50 or older), or. if less, your taxable compensation for the year. the ira contribution limit does not apply to: rollover contributions. qualified reservist repayments.

Irs 2024 Retirement Plan Contribution Limits Hedda Chandal The catch up contribution limit for employees 50 and over who participate in simple plans remains $3,500 for 2024. the annual limit for defined contribution plans under section 415 (c) (1) (a) increases to $69,000 (from $66,000). the limitation on the annual benefit for a defined benefit plan under section 415 (b) (1) (a) also increases to. An employer with 26 to 100 employees would be permitted to provide these higher deferral limits, but only if the employer either provides a 4% matching contribution or a 3% “nonelective” employer contribution. 6. under a simple 401 (k) plan, compensation is generally limited to $345,000 in 2024. 7. Section 415 of the internal revenue code (code) provides for dollar limitations on benefits and contributions under qualified retirement plans. section 415(d) requires that the secretary of the treasury annually adjust these limits for cost of living increases. The additional catch up contribution limit for individuals age 50 and older was amended under the secure 2.0 act of 2022 (secure 2.0) to include an annual cost‑of‑living adjustment but remains $1,000 for 2024. details on these and other retirement related cost of living adjustments for 2024 are in the irs’ 2024 cost of living announcement.

2024 Ira And Retirement Plan Limits Intelligent Investing Section 415 of the internal revenue code (code) provides for dollar limitations on benefits and contributions under qualified retirement plans. section 415(d) requires that the secretary of the treasury annually adjust these limits for cost of living increases. The additional catch up contribution limit for individuals age 50 and older was amended under the secure 2.0 act of 2022 (secure 2.0) to include an annual cost‑of‑living adjustment but remains $1,000 for 2024. details on these and other retirement related cost of living adjustments for 2024 are in the irs’ 2024 cost of living announcement. The dollar limitation for catch up contributions for participants aged 50 or over remains at $7,500. plan participants in these plans may wish to consider the impact of the dollar limitations for 2024 in their overall financial planning. a summary of some of the cost of living adjustments for 2023 and 2024 is provided below. For anyone saving for retirement with a traditional or roth ira, the 2024 limit on annual contributions to their account goes up $500 – from $6,500 this year to $7,000 next year. the ira "catch up" contribution for savers over age 50 is not subject to an annual cost of living adjustment and stays at $1,000 for 2024 (for a total 2024.

.jpg?width=600&height=1500&name=2024 Contribution Limits Retirement Plans Infographic (1).jpg)

Irs Announces 2024 Retirement Plan Limits The dollar limitation for catch up contributions for participants aged 50 or over remains at $7,500. plan participants in these plans may wish to consider the impact of the dollar limitations for 2024 in their overall financial planning. a summary of some of the cost of living adjustments for 2023 and 2024 is provided below. For anyone saving for retirement with a traditional or roth ira, the 2024 limit on annual contributions to their account goes up $500 – from $6,500 this year to $7,000 next year. the ira "catch up" contribution for savers over age 50 is not subject to an annual cost of living adjustment and stays at $1,000 for 2024 (for a total 2024.

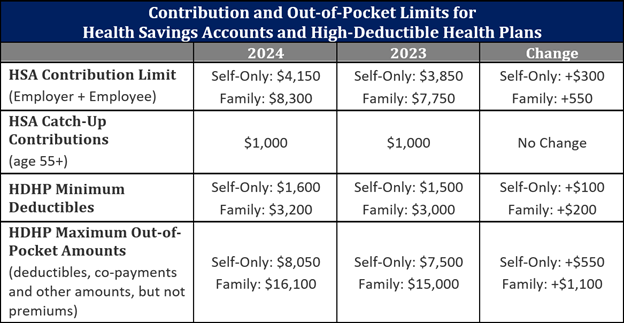

Irs Announces Hsa And Hdhp Limits For 2024

Comments are closed.