Irs 2024 Plan Limits Hr Synergy Llc

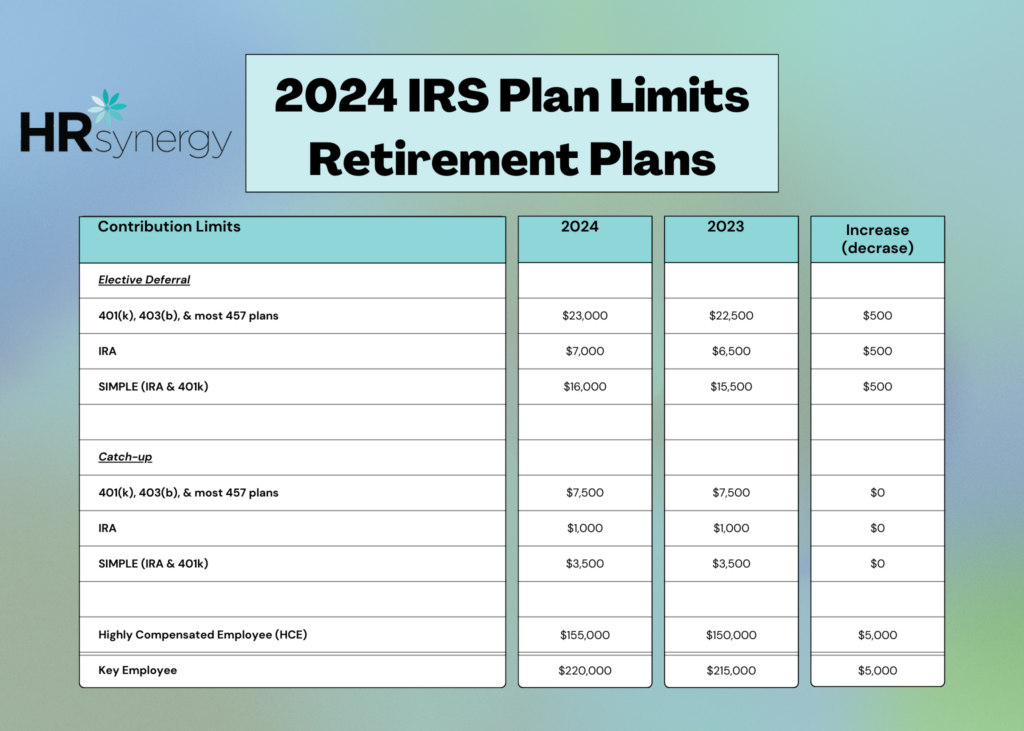

Irs 2024 Plan Limits Hr Synergy Llc The irs updated its plan limits for 2024 for 401k, 403b, 457, ira, hsa, fsa, and hra. hr synergy, llc outsourced human resource management for companies large and. Defined contribution plans: 2024: 2023: change: maximum employee elective deferral (age 49 or younger) 1 $23,000. $22,500 $500. employee catch up contribution (age 50 or older by year end) 2 $7,500.

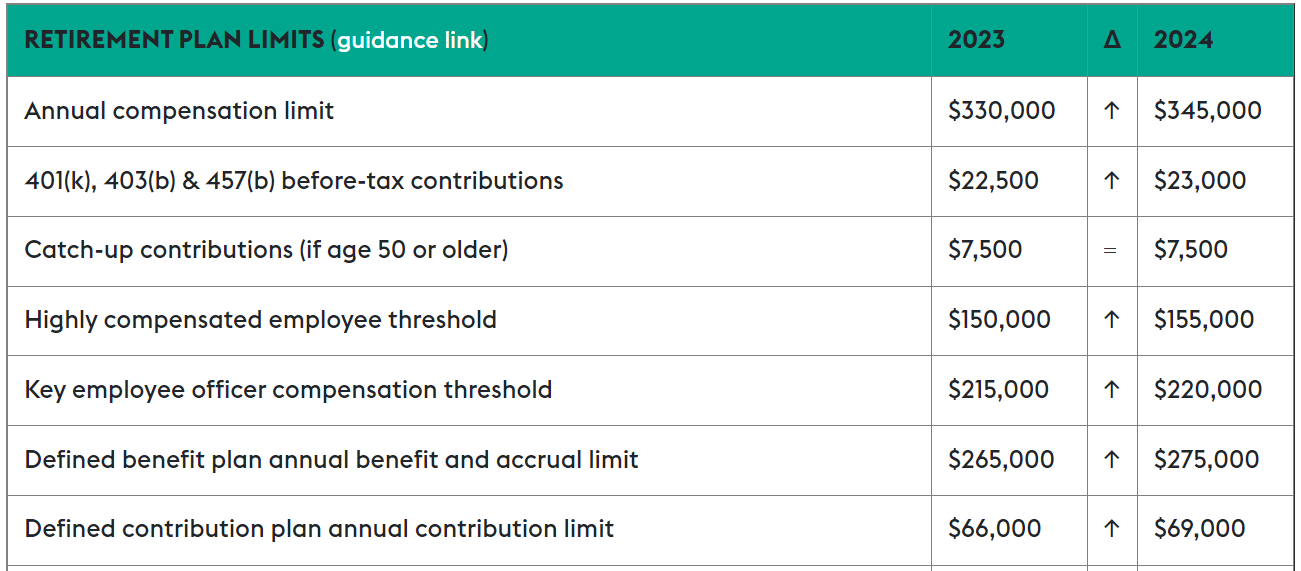

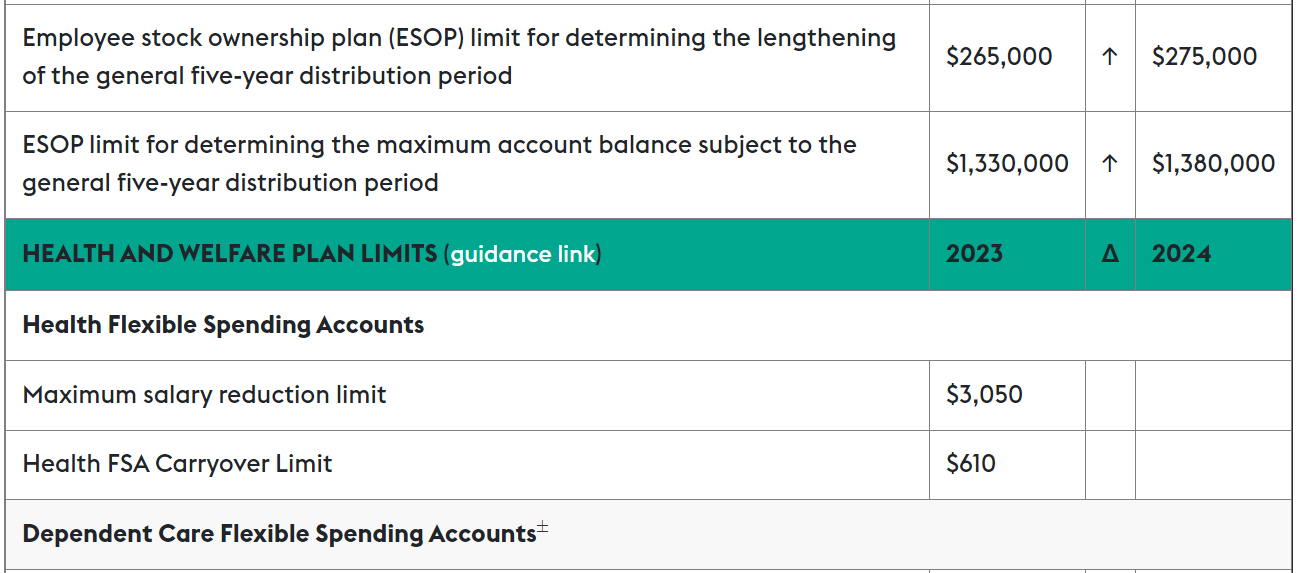

Irs Releases Updates For 2024 New Contribution Limits Benefitwerks The ira catch‑up contribution limit for individuals aged 50 and over was amended under the secure 2.0 act of 2022 (secure 2.0) to include an annual cost‑of‑living adjustment but remains $1,000 for 2024. the catch up contribution limit for employees aged 50 and over who participate in 401(k), 403(b), and most 457 plans, as well as the. The internal revenue service (irs) has released notice 2023 75, containing cost of living adjustments for 2023 that affect amounts employees can contribute to 401(k) plans and individual retirement accounts (iras). 2024 increases the employee contribution limit for 401(k) plans in 2024 has increased to $23,000, up from $22,500 for 2023. other key limit increases include the following:…. The catch up contribution limit for employees 50 and over who participate in simple plans remains $3,500 for 2024. the annual limit for defined contribution plans under section 415 (c) (1) (a) increases to $69,000 (from $66,000). the limitation on the annual benefit for a defined benefit plan under section 415 (b) (1) (a) also increases to. The annual limit on contributions will increase to $23,000 (up from $22,500) for 401 (k), 403 (b), and 457 plans, as well as for salary reduction simplified employee pension (sarsep) plans. the annual limits will rise to $16,000 (up from $15,500) for savings incentive match plans for employees (simples) and simple iras.

Hr Newsletter Irs Announces 2024 Retirement Plan Limits Employco Blog The catch up contribution limit for employees 50 and over who participate in simple plans remains $3,500 for 2024. the annual limit for defined contribution plans under section 415 (c) (1) (a) increases to $69,000 (from $66,000). the limitation on the annual benefit for a defined benefit plan under section 415 (b) (1) (a) also increases to. The annual limit on contributions will increase to $23,000 (up from $22,500) for 401 (k), 403 (b), and 457 plans, as well as for salary reduction simplified employee pension (sarsep) plans. the annual limits will rise to $16,000 (up from $15,500) for savings incentive match plans for employees (simples) and simple iras. For tax years beginning in 2024, the maximum amount that can be excluded from an employee’s gross pay for the adoption of a child with special needs is projected to be between $16,500 and $17,000, up from $15,950 in 2023. for tax years beginning in 2024, the limit is expected to be the same for amounts paid or expenses incurred by an employer. 2024 retirement plan limits now set. irs notice 2023 75 provides official 2024 limits for qualified defined benefit and defined contribution retirement plans and internal revenue code (irc) section 403 (b) plans, matching mercer’s earlier projections. almost every key limit will rise from 2023 to 2024.

Irs Announces 2024 Employee Benefit Plan Limits Lexology For tax years beginning in 2024, the maximum amount that can be excluded from an employee’s gross pay for the adoption of a child with special needs is projected to be between $16,500 and $17,000, up from $15,950 in 2023. for tax years beginning in 2024, the limit is expected to be the same for amounts paid or expenses incurred by an employer. 2024 retirement plan limits now set. irs notice 2023 75 provides official 2024 limits for qualified defined benefit and defined contribution retirement plans and internal revenue code (irc) section 403 (b) plans, matching mercer’s earlier projections. almost every key limit will rise from 2023 to 2024.

Irs Announces 2024 Employee Benefit Plan Limits Lexology

Comments are closed.