Irs 1031 Exchange Rules For 2024 Everything You Need To Know

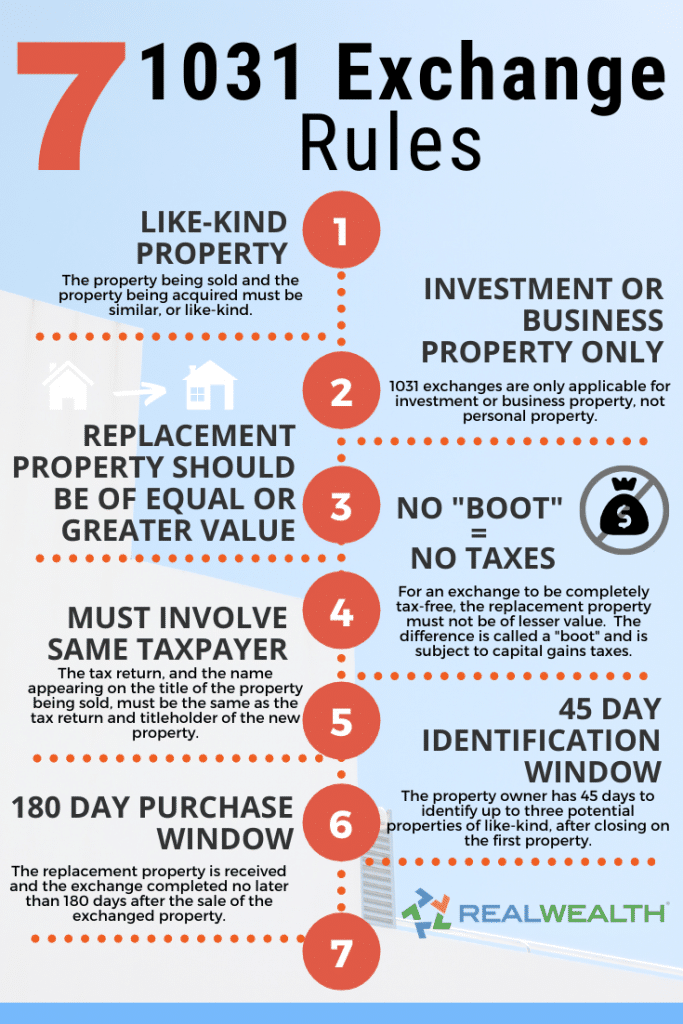

Irs 1031 Exchange Rules For 2024 Everything You Need To Know 2. needs to be the same taxpayer. this might be obvious, but it’s worth noting: in a 1031 exchange, both the property being sold exchanged and the property being bought need to be purchased by the same party. if the names on the sale property and the exchange property are different, it won’t be accepted. 3. 1. 1031 exchanges are also known as 'like kind' exchanges, and that matters. section 1031 of the irc defines a 1031 exchange as when you exchange real property used for business or held as an.

1031 Exchange Rules 2024 1031 Exchange For Beginners Guide A 1031 exchange, named after section 1031 of the u.s. internal revenue code, is a strategic tool for deferring tax on capital gains. you can leverage it to sell an investment property and reinvest. Our guide covers everything you need to know about 1031 exchanges, including how clever's co founder, ben mizes, used the 1031 strategy to expand his real estate portfolio from one unit to 26 units. given their complexity, consulting an accountant or tax professional before starting an exchange is your best bet. An exchange of real property held primarily for sale still does not qualify as a like kind exchange. a transition rule in the new law provides that section 1031 applies to a qualifying exchange of personal or intangible property if the taxpayer disposed of the exchanged property on or before december 31, 2017, or received replacement property. Use the same buyer & seller. this requirement seems pretty straightforward, but it’s important to mention. both the official buyer and the official seller within a 1031 exchange must be the same person. you can’t do something like list your wife as the seller of one property and yourself as the buyer of the other property in the exchange.

1031 Exchange Rules Success Stories For Real Estate Investors 2021 An exchange of real property held primarily for sale still does not qualify as a like kind exchange. a transition rule in the new law provides that section 1031 applies to a qualifying exchange of personal or intangible property if the taxpayer disposed of the exchanged property on or before december 31, 2017, or received replacement property. Use the same buyer & seller. this requirement seems pretty straightforward, but it’s important to mention. both the official buyer and the official seller within a 1031 exchange must be the same person. you can’t do something like list your wife as the seller of one property and yourself as the buyer of the other property in the exchange. 4. decide how much of the sale proceeds to use to buy the new property. the goal in a 1031 exchange is often to defer all capital gains taxes. to achieve this, you should use all the proceeds from the sale of your original property to purchase the replacement property. if you only use part of the proceeds, the remaining funds are taxed right away. For a 1031 exchange eligibility, both relinquished and replacement properties must be held for investment or business purposes. while the irs hasn't defined a specific holding period, it's generally recommended to hold properties for at least a year. exchanging or selling properties before this period may result in higher capital gains tax or.

New 1031 Exchange Rules 2024 Nanci Analiese 4. decide how much of the sale proceeds to use to buy the new property. the goal in a 1031 exchange is often to defer all capital gains taxes. to achieve this, you should use all the proceeds from the sale of your original property to purchase the replacement property. if you only use part of the proceeds, the remaining funds are taxed right away. For a 1031 exchange eligibility, both relinquished and replacement properties must be held for investment or business purposes. while the irs hasn't defined a specific holding period, it's generally recommended to hold properties for at least a year. exchanging or selling properties before this period may result in higher capital gains tax or.

Comments are closed.