Ira Contribution Limits And Income Limits For 2023 And 2024 Forex

Ira Contribution Limits And Income Limits For 2023 And 2024 Forex In addition to the general contribution limit that applies to both roth and traditional iras, your roth ira contribution may be limited based on your filing status and income. 2024 amount of roth ira contributions you can make for 2024; 2023 amount of roth ira contributions you can make for 2023; ira contributions after age 70½. for 2020. Ir 2024 285, nov. 1, 2024. washington — the internal revenue service announced today that the amount individuals can contribute to their 401 (k) plans in 2025 has increased to $23,500, up from $23,000 for 2024. the irs today also issued technical guidance regarding all cost‑of‑living adjustments affecting dollar limitations for pension.

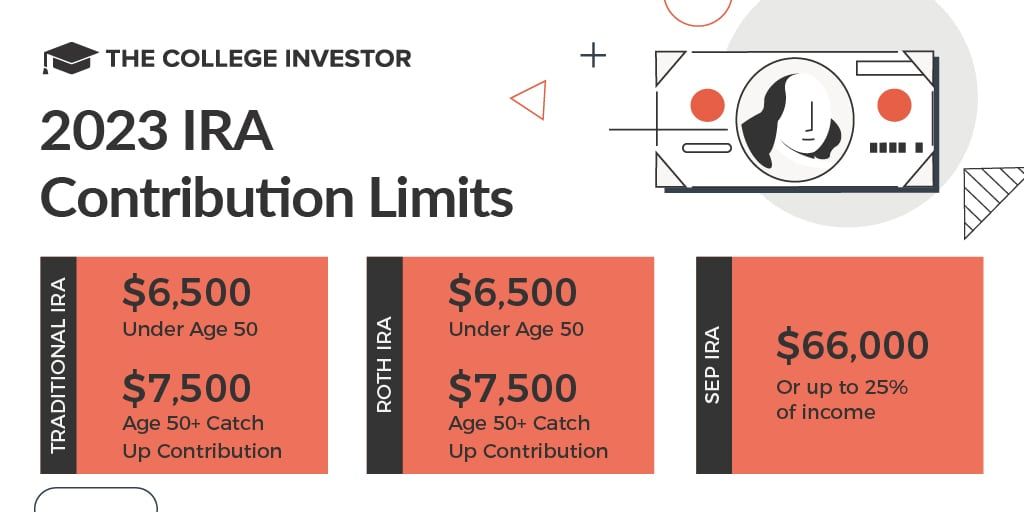

Ira Contribution Limits In 2023 Meld Financial The ira contribution limit is $7,000, or $8,000 for individuals 50 or older in 2024 and 2025. anyone can contribute to a traditional ira, but your ability to deduct contributions is based on your. 2024. ira deduction if you are covered by a retirement plan at work 2024; ira deduction if you are not covered by a retirement plan at work 2024 (deduction is limited only if your spouse is covered by a retirement plan) 2023. ira deduction if you are covered by a retirement plan at work 2023. Key takeaways. for 2024, the ira contribution limits are $7,000 for those under age 50 and $8,000 for those age 50 or older. for 2025, the ira contribution limits remain the same as 2024, at $7,000 for those under age 50 and $8,000 for those age 50 or older. individual retirement accounts, or iras, can help you save and invest for retirement. The 2024 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older. the annual contribution limit for a traditional ira in 2023 was $6,500 or your taxable income.

Simple Ira Contribution Limits For 2024 Joyce Lorilyn Key takeaways. for 2024, the ira contribution limits are $7,000 for those under age 50 and $8,000 for those age 50 or older. for 2025, the ira contribution limits remain the same as 2024, at $7,000 for those under age 50 and $8,000 for those age 50 or older. individual retirement accounts, or iras, can help you save and invest for retirement. The 2024 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older. the annual contribution limit for a traditional ira in 2023 was $6,500 or your taxable income. In 2024, married couples filing jointly can contribute to a roth ira if their magi is less than $230,000. each spouse can have their own roth ira, allowing both to contribute independently. the total contribution limit for each spouse is $7,000, or $8,000 if they're 50 years or older. therefore, if both qualify, a married couple can. Key points. ira contribution limits for 2024 and 2025 are $7,000 for adults under 50 and $8,000 for those 50 and older. the sep ira contribution limit is the lesser of 25% of income or $69,000 in.

Ira Contribution Limits And Income Limits For 2023 And 2024 Forex In 2024, married couples filing jointly can contribute to a roth ira if their magi is less than $230,000. each spouse can have their own roth ira, allowing both to contribute independently. the total contribution limit for each spouse is $7,000, or $8,000 if they're 50 years or older. therefore, if both qualify, a married couple can. Key points. ira contribution limits for 2024 and 2025 are $7,000 for adults under 50 and $8,000 for those 50 and older. the sep ira contribution limit is the lesser of 25% of income or $69,000 in.

Ira Contribution Limits In 2023 Meld Financial

Comments are closed.