Investigative Consumer Report

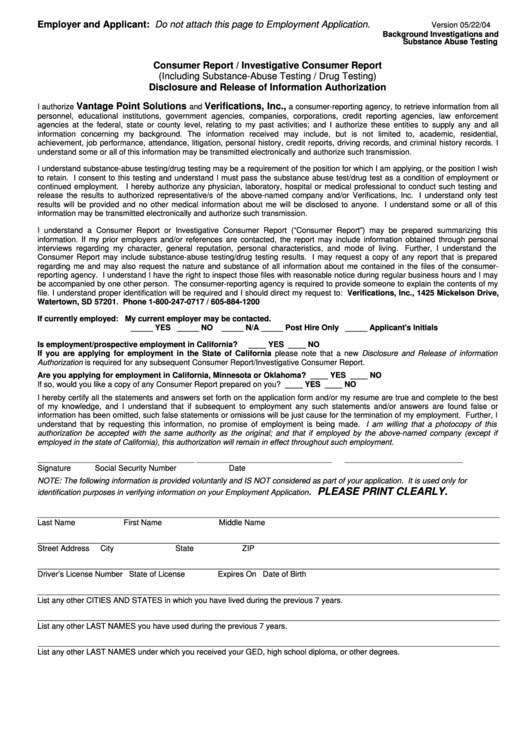

Consumer Report Form Investigative Consumer Report Form Including Learn the key differences between credit reports and investigative consumer reports, which are both regulated by the fair credit reporting act. find out what information they contain, who can request them, and how to access them. An investigative consumer report (icr) is a report that includes personal or professional opinions or assessments of a consumer's character, reputation, or mode of living. learn what icrs are, how to comply with fcra and state laws, and what benefits and risks they offer for employers.

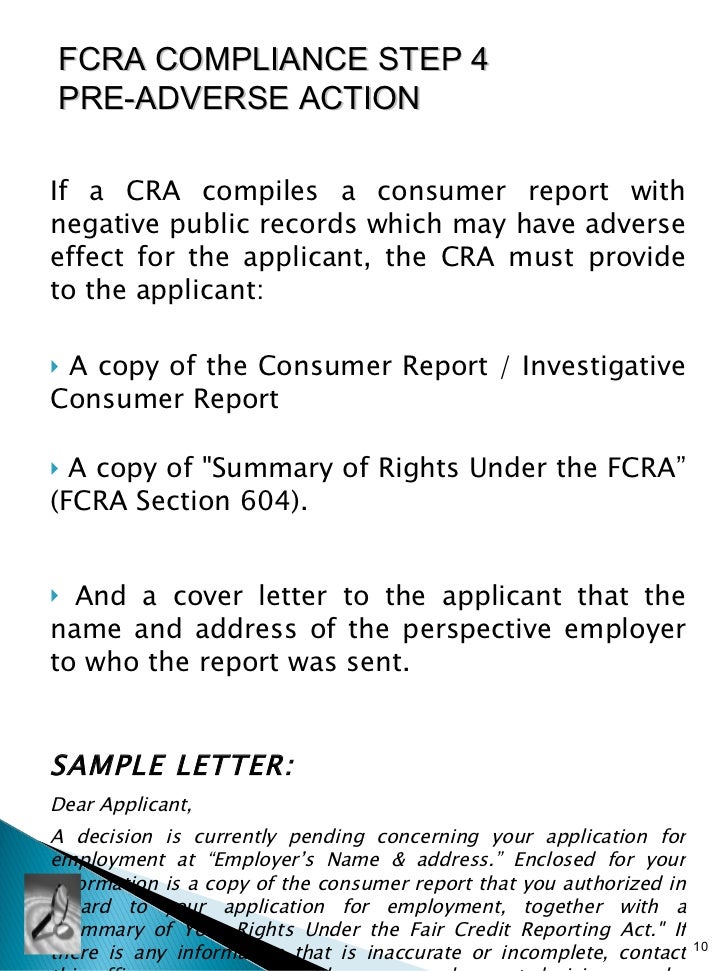

Investigative Consumer Report Presentation Jun 09 07 Version An investigative consumer report is a report by an agency that includes personal information on a consumer, such as character, reputation, or mode of living. it may be used for employment or housing purposes and is regulated by civil statutes. Learn how to comply with the fair credit reporting act (fcra) when you use consumer reports, including investigative reports, for employment decisions. find out the steps, notices, and rights involved in getting, using, and disposing of consumer reports. The ftc’s interpretation of the definition of an investigative consumer report notes that “an ‘investigative consumer report’ is a type of ‘consumer report’ that includes information obtained through personal interviews with the consumer’s neighbors, friends, associates, or others. Learn the key differences between investigative consumer reports and credit reports, how they are used and regulated, and what information they contain. find out how to access and dispute your reports and protect your rights as a consumer.

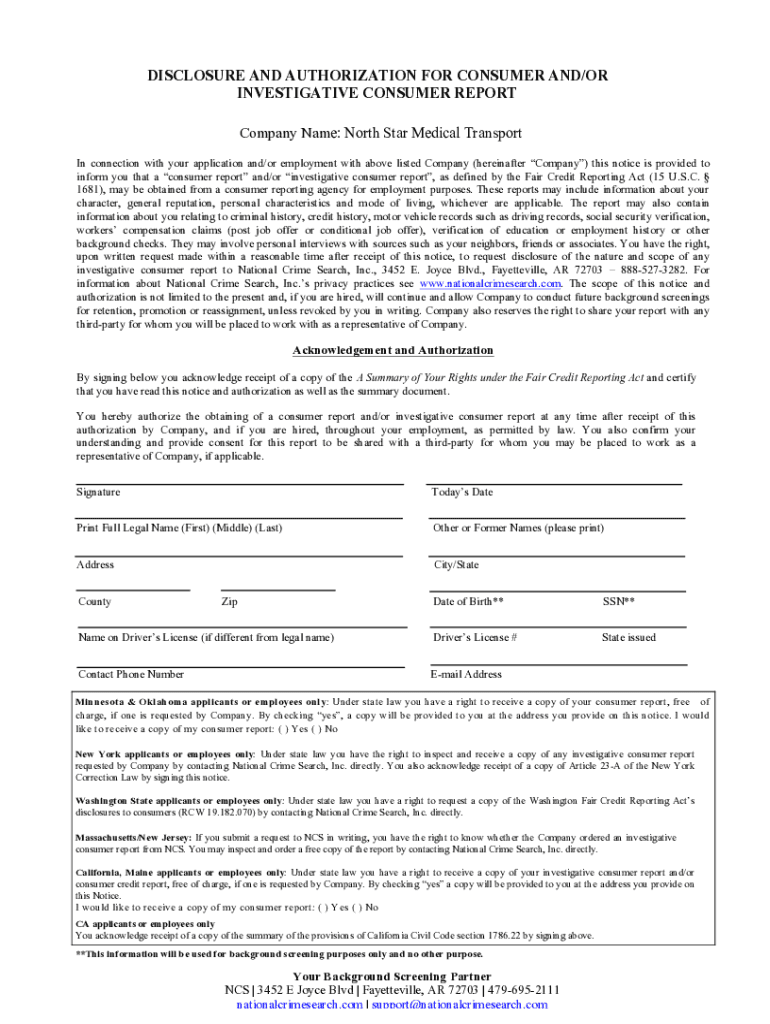

Free 10 Investigative Consumer Report Samples Disclosure The ftc’s interpretation of the definition of an investigative consumer report notes that “an ‘investigative consumer report’ is a type of ‘consumer report’ that includes information obtained through personal interviews with the consumer’s neighbors, friends, associates, or others. Learn the key differences between investigative consumer reports and credit reports, how they are used and regulated, and what information they contain. find out how to access and dispute your reports and protect your rights as a consumer. Investigative consumer reports are pulled less frequently by fewer kinds of businesses and for a broader range of information. investigative consumer reports. think of a very detailed background check with an investigative consumer report. Fcra compliant background checks are investigations conducted by an employer or a third party consumer reporting agency (cra) to gather information on a job candidate’s criminal history, credit history, employment history, and other relevant factors.

Free 10 Investigative Consumer Report Samples Disclosure Investigative consumer reports are pulled less frequently by fewer kinds of businesses and for a broader range of information. investigative consumer reports. think of a very detailed background check with an investigative consumer report. Fcra compliant background checks are investigations conducted by an employer or a third party consumer reporting agency (cra) to gather information on a job candidate’s criminal history, credit history, employment history, and other relevant factors.

Fillable Online Investigative Consumer Report Disclosure And Fax

Comments are closed.