Invest In A House Or Sp 500 Which Makes More Money

How To Invest In The S P 500 The Best Guide For Beginners Some years are up, some years are down, but over time, if you invested in an s&p 500 index fund, you'd average about 10% minus inflation. from 1972 to 2019, reits, on average, returned an 11.8%. Returns. historically, stocks have offered better returns than real estate investments. "stocks have returned, on average, about 8% to 12% per year while real estate has generated returns of 2% to.

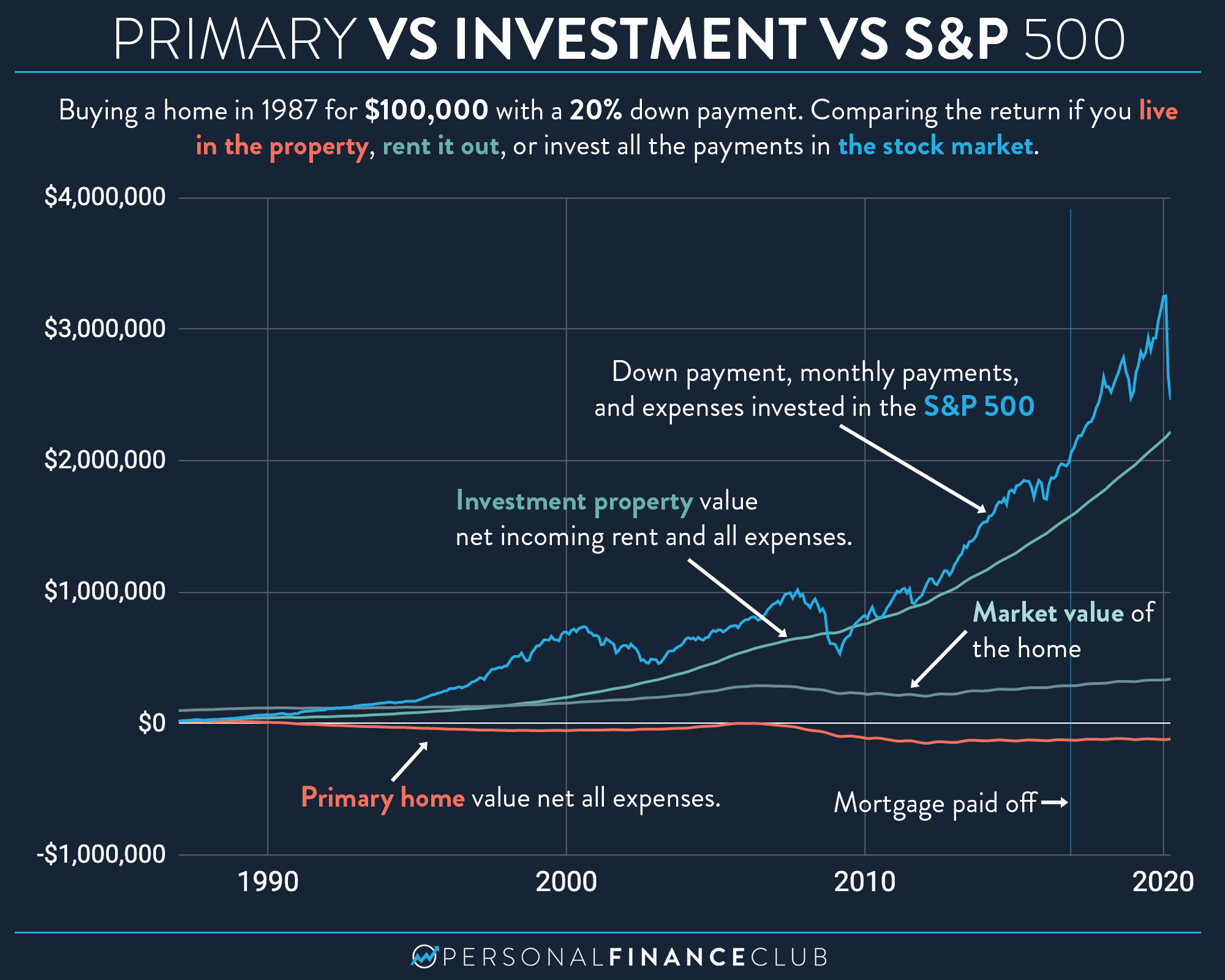

Primary Home Vs Investment Property Vs S P 500 Personal Finance Club Meanwhile, the s&p 500 averaged an 7.5% return; small cap stocks averaged 11.5% per year. the rate of inflation was around 4.6%. we don't expect real estate investments to grow much more than. Both real estate and stocks performed well in 2020 and 2021. but in 2022, the s&p 500 declined by about 20% while the median home price in america climbed by 7%. this 27% outperformance is massive, and indicative of how well real estate can perform in a bear market. stocks gave us all a fright in march 2020 when the s&p 500 collapsed by ~32%. Stocks still beat real estate as the best investment long term — even following the coronavirus stock market crash and other tough markets, says new data. the s&p 500 is down 11% this year. and. However, given the s&p 500’s average 10 percent annual return, dropping a cool $500,000 in an investment account can ultimately skyrocket well into the millions by the time you reach retirement.

How To Invest In The S P 500 Uk Nuts About Money Stocks still beat real estate as the best investment long term — even following the coronavirus stock market crash and other tough markets, says new data. the s&p 500 is down 11% this year. and. However, given the s&p 500’s average 10 percent annual return, dropping a cool $500,000 in an investment account can ultimately skyrocket well into the millions by the time you reach retirement. But [compared to your] three million dollar home, if you made those investments [in the s&p], that'd be worth $10 million today, a one time lump sum investment of $42,000 back in 1972. However, when purchasing property, investors have more leverage over their money, enabling them to buy a more valuable investment vehicle. putting $25,000 into securities buys $25,000 in value.

How To Invest In The S P 500 2024 But [compared to your] three million dollar home, if you made those investments [in the s&p], that'd be worth $10 million today, a one time lump sum investment of $42,000 back in 1972. However, when purchasing property, investors have more leverage over their money, enabling them to buy a more valuable investment vehicle. putting $25,000 into securities buys $25,000 in value.

Comments are closed.