Insurance Sector Trade Ideas Analysis 9 1 17

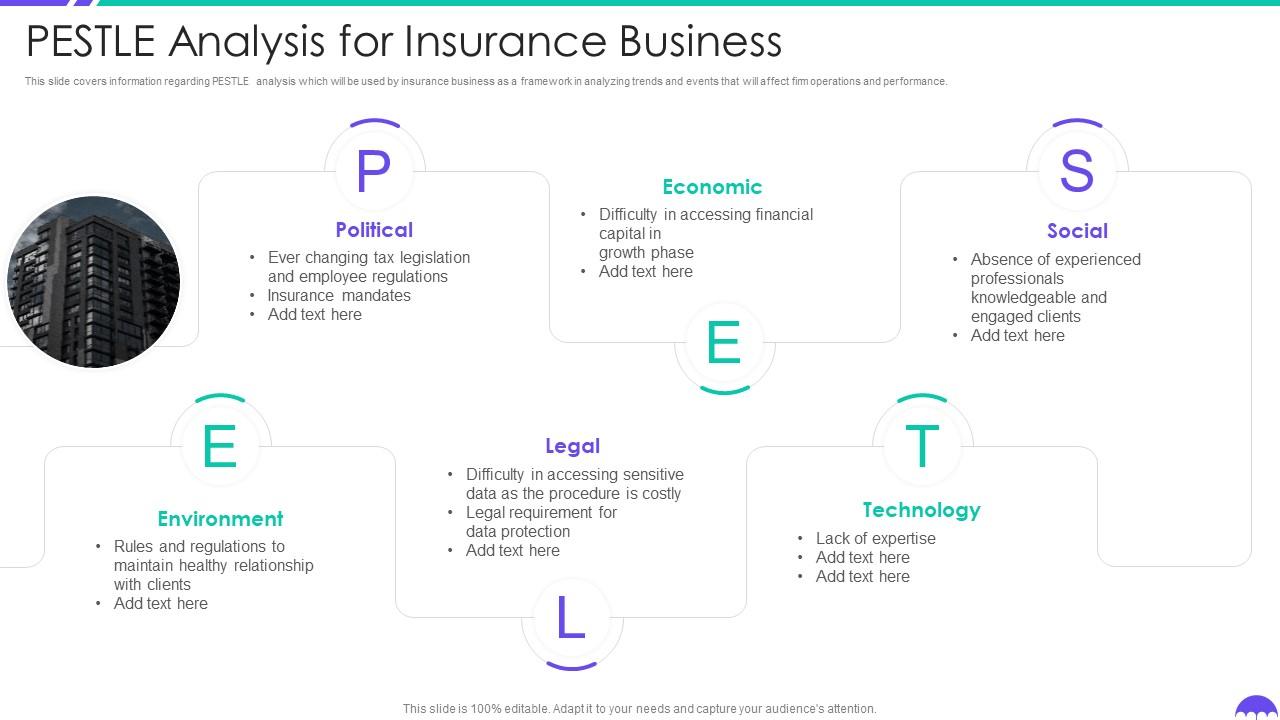

Pestle Analysis For Insurance Business Building Insurance Agency Deloitte economists forecast us unemployment to rise above 4% by 2026 and the employment cost index to decline to 3.3% in 2025, from 4% in 2023. 50 group carriers may need to consider some alternative avenues for growth in 2025. 51. group life insurance sales for the fourth quarter of 2023 totaled us$857 million, an 8% increase year over year. Q2 2024 represented the most positive market in the us since q3 2017. new capacity entered parts of the market as many insurers shifted their focus toward growth. insurer growth goals and positive insurer performance continued to lead to more aggressive pricing, albeit still dependent on the risk, loss experience and geography.

Indian Insurance Sector Market Analysis Globally, the insurance industry experienced strong premium growth in 2015, at 5.6 percent, whereas growth in 2016 is expected to be noticeably slower, at 4.4 percent. total premiums are expected to reach €4.6 trillion, up from €4.4 trillion in 2015. what factors help explain the industry’s performance? the global insurance industry is. Wells fargo equity research outlined in a thursday note its ideas for three tactical trades targeting the insurance sector ahead of q2 earnings season. property and casualty insurers: bullish. Accenture’s global disruption index—a composite measure that covers economic, social, geopolitical, climate, consumer and technology disruption—shows that levels of disruption have increased by 200% from 2017 to 2022. previously, the index rose by a mere 4% from 2011 to 2016. insurance will reinvent and expand in new directions. 7. disruptive. ideas. changing. the. insurance. industry. the insurance industry has been greatly disrupted in recent years, in large part due to digital transformation. the ripple effects of that transformation have driven widespread insurance innovation — no aspect of insurance functions (for both carriers and their customers) is exempt.

India S Insurance Sector Analysis Share Review Yadnya Investment Accenture’s global disruption index—a composite measure that covers economic, social, geopolitical, climate, consumer and technology disruption—shows that levels of disruption have increased by 200% from 2017 to 2022. previously, the index rose by a mere 4% from 2011 to 2016. insurance will reinvent and expand in new directions. 7. disruptive. ideas. changing. the. insurance. industry. the insurance industry has been greatly disrupted in recent years, in large part due to digital transformation. the ripple effects of that transformation have driven widespread insurance innovation — no aspect of insurance functions (for both carriers and their customers) is exempt. Search our library. your guide to insurance trends. the naic financial regulatory services department prepares insurance industry snapshots and analysis reports to help consumers stay informed about evolving trends in insurance. these comprehensive reports cover the property & casualty, title, life, fraternal, and health insurance industries. One of the crucial aspects to consider while conducting a pestel analysis of the insurance industry is the economic factor. economic factors such as inflation rates, interest rates, taxation policies, and changes in gdp strongly impact this industry’s growth potential. the current covid 19 pandemic has also disrupted global financial markets.

Comments are closed.