Infographic Retirement Savings Infogram Saving For Retirement

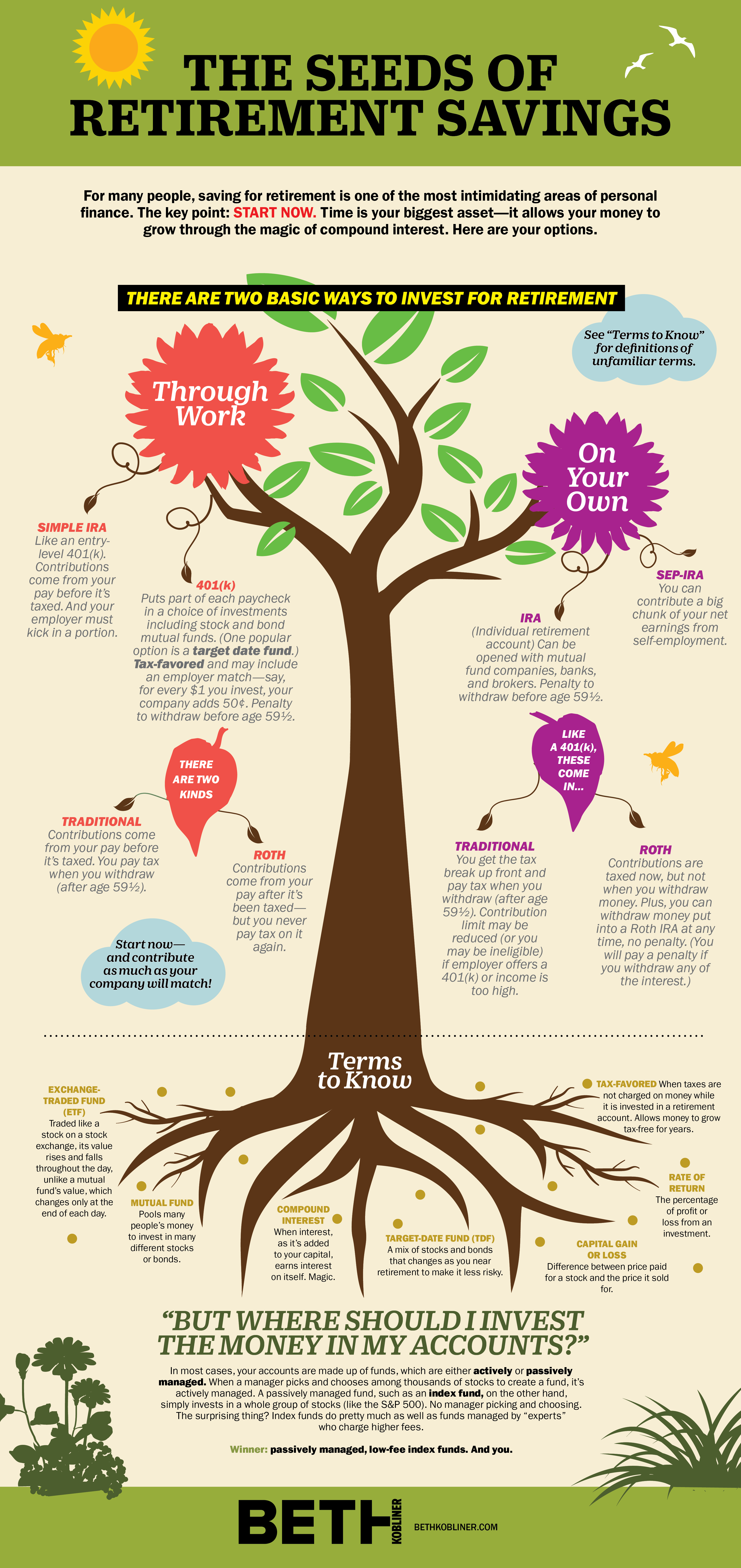

Retirement Infographic Here’s how a savings plan might look, based on two assumptions: (i) your retirement income is equal to 70% of your current annual income, and (ii) you are able to generate an annual return of 7%. the key takeaway from this table is that the earlier you start saving for retirement, the lower your monthly burden will be. With help from the seeds of retirement, you’ll get up to speed in no time. this super basic visual guide will teach you everything you need to know to get on the road toward your golden years with plenty of green. download full pdf. investing your retirement savings can be confusing. this infographic breaks down the basics so you can start.

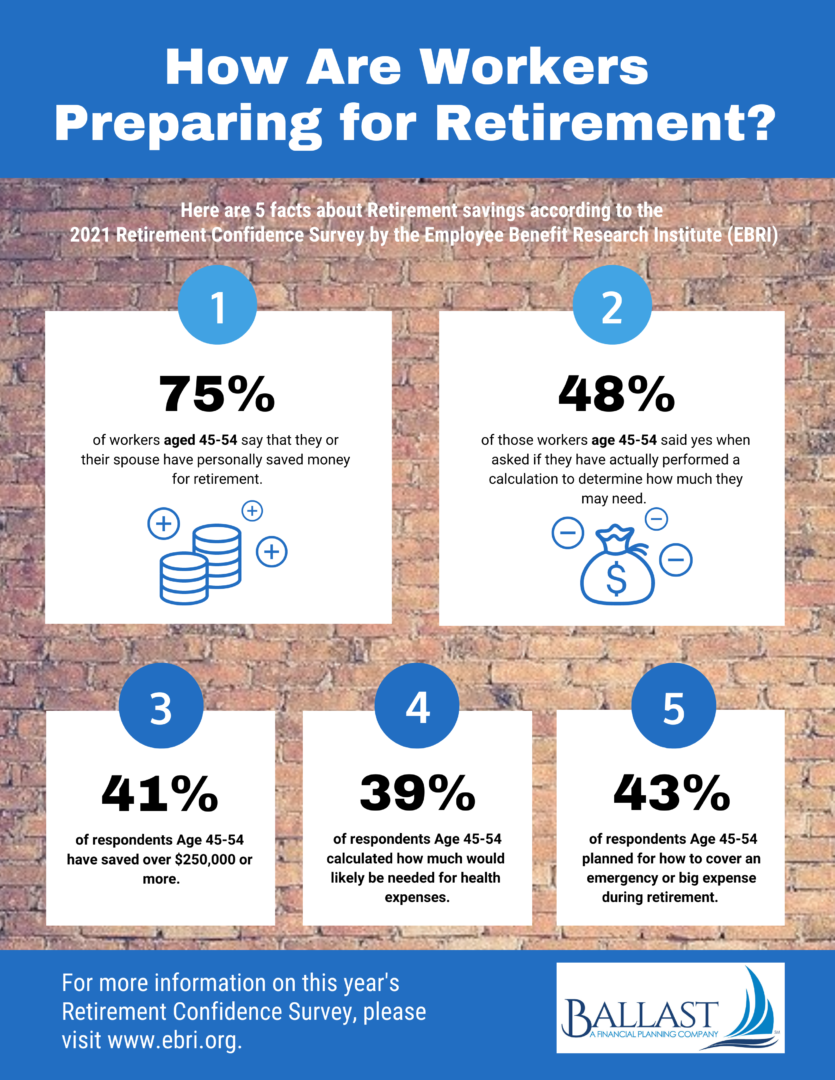

Infographic 5 Facts About Retirement Savings Ballast Advisors Here are some statistics that may surprise you: 39% of households nearing retirement do not have a formal retirement plan. only 35% of americans are confident they can rely on social security. for a couple both 62 years old, there is a 47% chance that one of them will live to be 90. are you prepared to live 25 years on your retirement savings?. In developing the series of salary multipliers corresponding to age, fidelity assumed age based asset allocations consistent with the equity glide path of a typical target date retirement fund, a 15% savings rate, a 1.5% constant real wage growth, a retirement age of 67 and a planning age through 93. the replacement annual income target is. Share your thoughts about this article or suggest a topic for a new one. no matter what your financial situation is, how old you are, or where you're at in life, here are seven steps you can take to make slow and steady progress towards retirement. Step 3: your income. in the final step of setting your retirement savings goal, you’ll need to decide how much of your current household income you will use in retirement. financial experts typically estimate you could need 70 80% of your pre retirement income. at this stage, it can be helpful to plan out a detailed budget.

Pension Infographic Financial Advisors Saving For Retirement Share your thoughts about this article or suggest a topic for a new one. no matter what your financial situation is, how old you are, or where you're at in life, here are seven steps you can take to make slow and steady progress towards retirement. Step 3: your income. in the final step of setting your retirement savings goal, you’ll need to decide how much of your current household income you will use in retirement. financial experts typically estimate you could need 70 80% of your pre retirement income. at this stage, it can be helpful to plan out a detailed budget. Retirement savings plan determine your unique needs. a common standard for post retirement income is 70% of the annual salary you made while in the workforce. for example, if you earn $50,000 a year, you’d need about $35,000 each year in retirement to maintain your standard of living. the average retirement lasts about 20 years, so plan to. When do americans start saving for retirement infogram.

How To Save 1 Million For Retirement Retirement savings plan determine your unique needs. a common standard for post retirement income is 70% of the annual salary you made while in the workforce. for example, if you earn $50,000 a year, you’d need about $35,000 each year in retirement to maintain your standard of living. the average retirement lasts about 20 years, so plan to. When do americans start saving for retirement infogram.

Recommended Retirement Savings By Age 2020 Financial Ltd

Comments are closed.