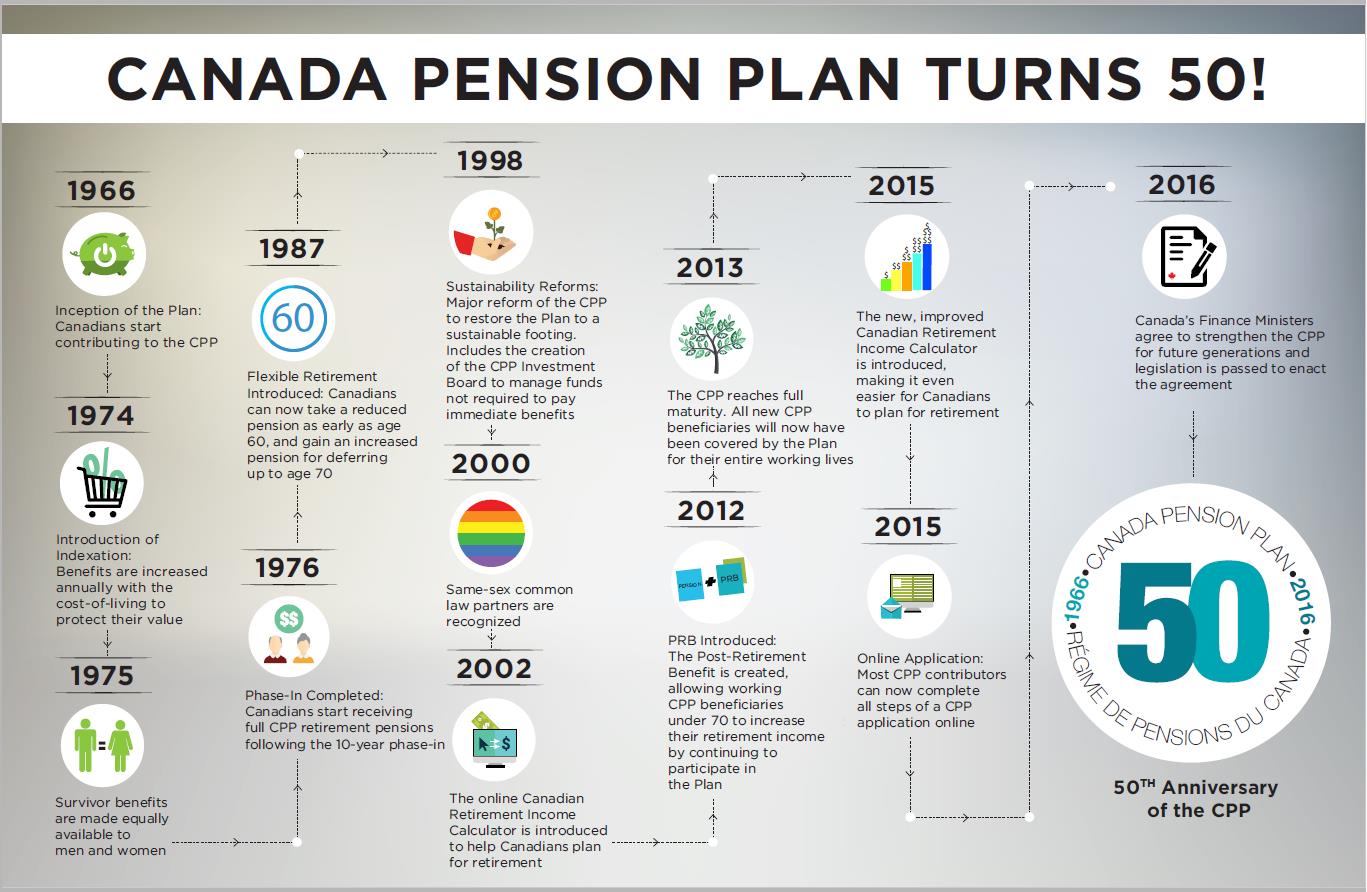

Infographic Canada Pension Plan Turns 50 Canada Ca

Infographic Canada Pension Plan Turns 50 Canada Ca 1976: canadians start receiving full cpp retirement pensions following the 10 year phase in. 1987: flexible retirement introduced: canadians can now take a reduced pension as early as age 60, and gain an increased pension for deferring up to age 70. 1998: sustainability reforms: major reform of the cpp to restore the plan to a sustainable footing. The maximum pensionable earnings of the canada pension plan (cpp) increased from $53,600 in 2015 to $54,900 in 2016. the contribution rate remained unchanged at 9.9%. cpp contributions totalled $46.1 billion this year. 5.5 million cpp beneficiaries were paid, representing a total annual benefit value of $40.8 billion.

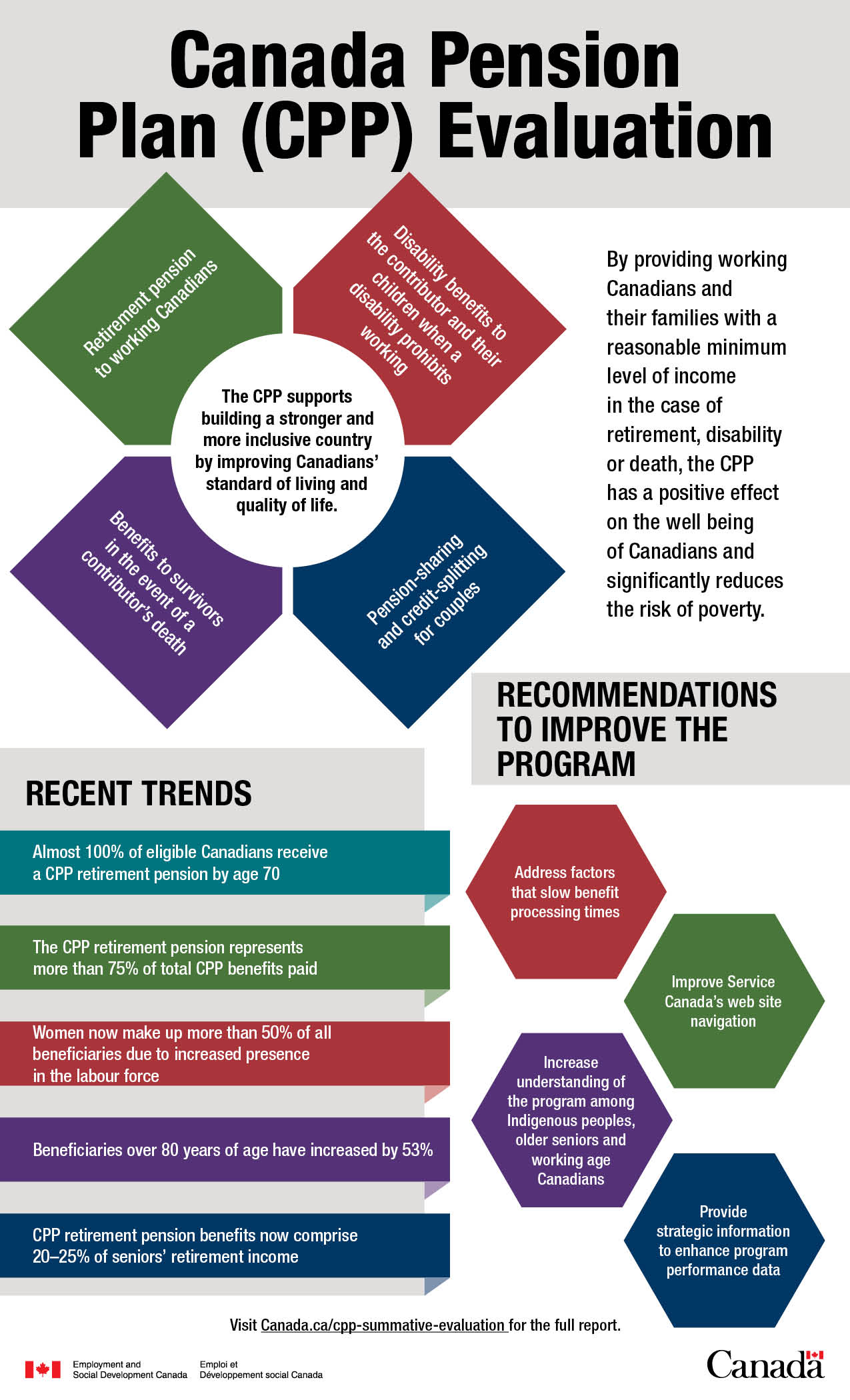

Infographic Canada Pension Plan Cpp Evaluation Canada Ca The cpp retirement pension represents more than 75% of total cpp benefits paid. women now make up more than 50% of all beneficiaries due to increased presence in the labour force. beneficiaries over 80 years of age have increased by 53%. cpp retirement pension benefits now comprise 20–25% of seniors’ retirement income. 06.12.2023. the canada pension plan (cpp) is a crucial part of the canadian social security system, providing financial support to eligible individuals upon retirement, disability, or death. it is a contributory, earnings related social insurance program that helps canadians maintain a basic standard of living in their later years. The canada pension plan (cpp) is a government sponsored retirement pension plan that provides income support to canadian citizens and residents in their retirement years. it is one of the two pillars of canada’s public retirement income system, alongside the old age security (oas) program. the cpp is designed to provide a basic level of. You can notify service canada by phone at 1 800 277 9914 from 8:30 a.m. to 4:30 p.m. local time, monday to friday. a beneficiary’s estate may qualify for a one time cpp death benefit of $2,500.

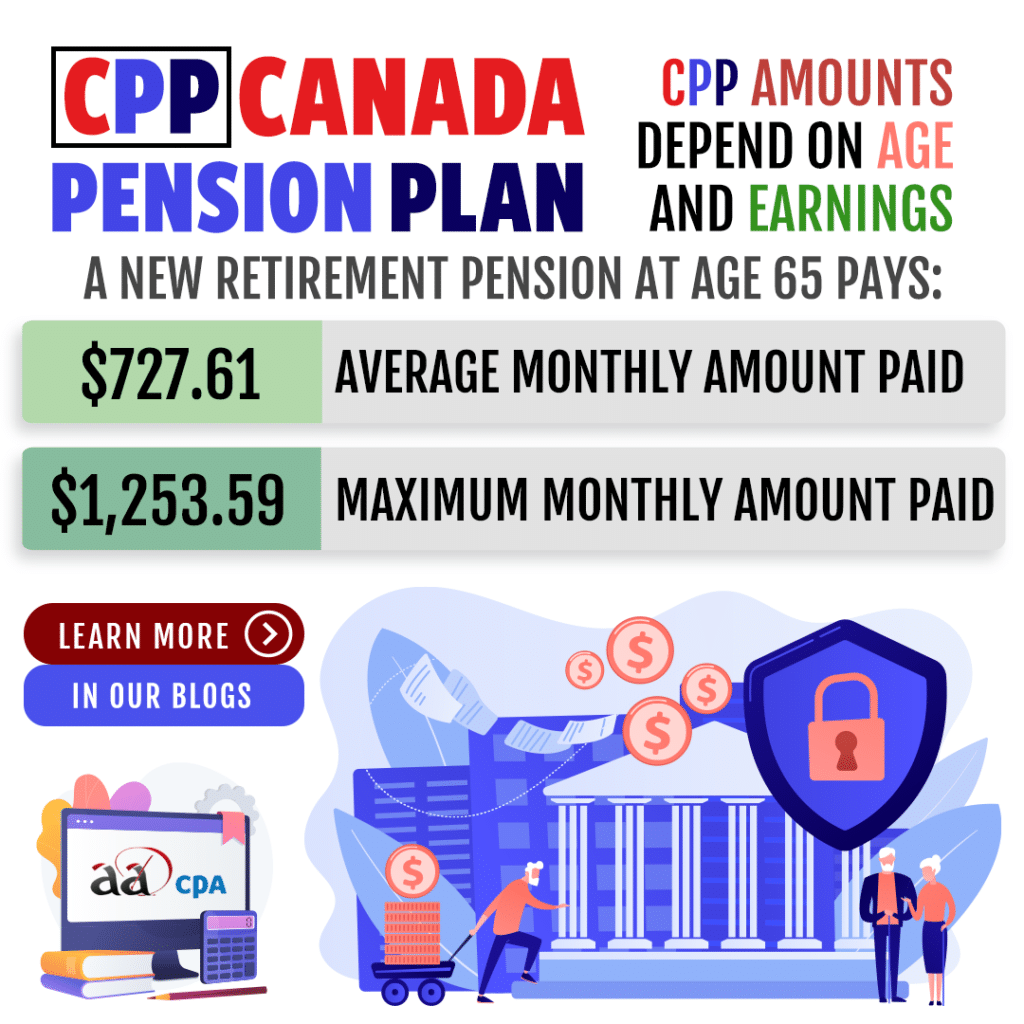

Expansion Of The Canada Pension Plan Infographic Jpg Fraser Institute The canada pension plan (cpp) is a government sponsored retirement pension plan that provides income support to canadian citizens and residents in their retirement years. it is one of the two pillars of canada’s public retirement income system, alongside the old age security (oas) program. the cpp is designed to provide a basic level of. You can notify service canada by phone at 1 800 277 9914 from 8:30 a.m. to 4:30 p.m. local time, monday to friday. a beneficiary’s estate may qualify for a one time cpp death benefit of $2,500. Wowa’s canada pension plan calculator (cpp calculator) calculates the base cpp pension you would receive each month. you need to enter your birth year and the year you plan to retire. then, you need to enter your income for each year since you turned 18 until you want to start receiving your pension. we are using each year's maximum. Cpp contributions are mandatory for all employed and self employed individuals aged 18 to 64 inclusive. employees must contribute 5.95% of pensionable earnings, up to a maximum of $3,867.50 in 2024. self employed individuals must contribute 11.9% of pensionable earnings, up to a maximum of $7,735 in 2024.

What You Must Know About Canada Pension Plan Cpp Retirement Pension Wowa’s canada pension plan calculator (cpp calculator) calculates the base cpp pension you would receive each month. you need to enter your birth year and the year you plan to retire. then, you need to enter your income for each year since you turned 18 until you want to start receiving your pension. we are using each year's maximum. Cpp contributions are mandatory for all employed and self employed individuals aged 18 to 64 inclusive. employees must contribute 5.95% of pensionable earnings, up to a maximum of $3,867.50 in 2024. self employed individuals must contribute 11.9% of pensionable earnings, up to a maximum of $7,735 in 2024.

Information On Cpp Canada Pension Plan Aadcpa

Advisorsavvy Canada Pension Plan Cpp A Complete Guide

Comments are closed.