Income Assets And Wealth Formula

Income Assets And Wealth Formula Income, assets, and wealth formula. regardless of the definition, here is a formula to remember if you want to build wealth: income assets = wealth. if you increase your income and assets, you should be able to increase your wealth. for the purposes of this discussion, i consider wealth in the financial sense but also as a means to facilitate. A car loan of $10,000. the couple’s net worth would therefore be calculated like this: [$250,000 $100,000 $25,000] [$100,000 $10,000] = $265,000. assume that the couple's financial.

Earned Income And Earning From Investment The net worth formula is: assets – liabilities = net worth. so to calculate your net worth, add up the value of everything you own and subtract from it the value of everything you owe (aka your liabilities). assets are anything you own that has financial value, like money in your bank accounts, investment accounts, and retirement plans; the. Here’s a quick overview of personal assets versus liabilities. assets. your assets include everything you own that has monetary value. they may be liquid like a checking account or non liquid like your home. a liquid asset simply means you don’t have to sell it first to realize its monetary value. a few common examples of assets are:. The net worth formula isn't complicated. simply add up all of your assets. then, subtract your total debts from your total assets. jeff busch, a financial advisor and owner of elysium financial in. Average net worth of us population with income up to $25,300 is $6,700. the net worth calculator helps you evaluate your current financial strength. it computes your net worth by subtracting the total value of everything you owe (your liabilities) from the total value of everything you have (your assets).

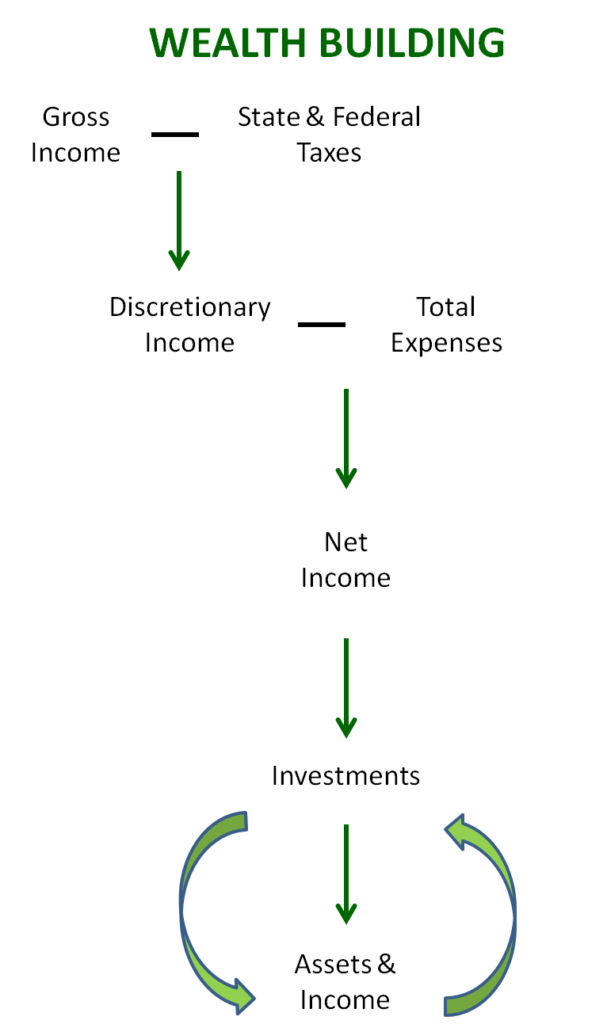

The Super Simple Wealth Formula Pocket Of Money Llc The net worth formula isn't complicated. simply add up all of your assets. then, subtract your total debts from your total assets. jeff busch, a financial advisor and owner of elysium financial in. Average net worth of us population with income up to $25,300 is $6,700. the net worth calculator helps you evaluate your current financial strength. it computes your net worth by subtracting the total value of everything you owe (your liabilities) from the total value of everything you have (your assets). For example, if you have a mortgage on a house with a market value of $200,000 and the balance on your loan is $150,000, you can add $50,000 to your net worth. basically, the formula is: assets. How to figure out net worth. the basic formula to calculate your net worth is to add up all of your assets, and then add up all of your liabilities. once you have those two numbers, subtract your.

Comments are closed.