Impact Of Your Daily Financial Decisions On Your Retirement Plans

Impact Of Your Daily Financial Decisions On Your Retirement Plans We spent about $150 a week on massages during an 11 year period (2003–2014). that’s $85,800 over 11 years. over that time, our investment portfolio averaged 8.34% per year. if we had invested the money we spent on massages, we would have had an extra $143,239 in our investment account by 2014. that’s a lot of money. Take advantage of retirement planning tax breaks. you can defer paying income tax on up to $23,000 in 2024 by contributing to a traditional 401 (k) plan, and that amount jumps to $30,000 if you.

The Ultimate Guide To Retirement Financial Planning Lazlobane Using the calculations for the time value of money will help you make informed decisions about your retirement savings. for example, if you have $10,000 and can earn an 8% interest rate, compounded annually, for the next three years, you can utilize the following formula to calculate the future value of your investment. Those in good health entering retirement tend to spend less on health care during their golden years. get a high level view of your retirement with these numerical guides, then move on and get. Zachary nelson. “financial planning” has long been associated with long term decision making things like building a nest egg, saving for retirement, and so on. it’s for stuff you don’t. But there are some common motivations for blowing up a retirement plan. so, here are five reasons why you might find yourself reaching for the proverbial dynamite. 1. your retirement reality doesn.

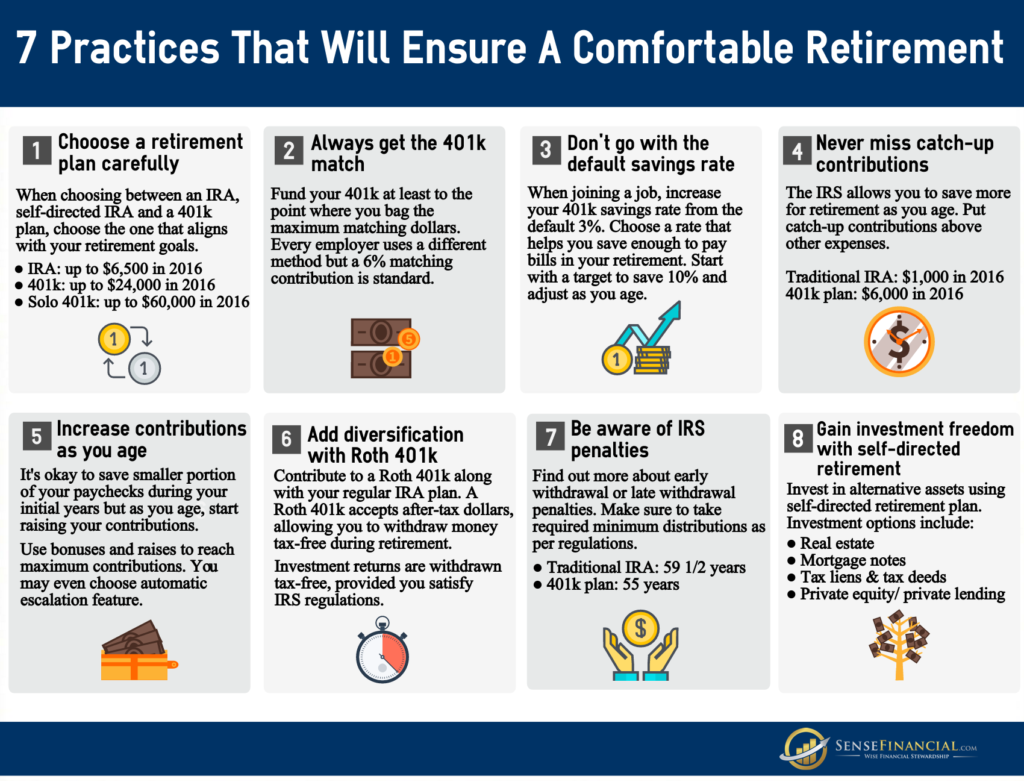

Infographic 8 Retirement Tips That Will Ensure A Comfortable Retirement Zachary nelson. “financial planning” has long been associated with long term decision making things like building a nest egg, saving for retirement, and so on. it’s for stuff you don’t. But there are some common motivations for blowing up a retirement plan. so, here are five reasons why you might find yourself reaching for the proverbial dynamite. 1. your retirement reality doesn. 2. estimate your expenses. once you know how you want to spend retirement, you can plan how to pay for it. this starts by determining your expenses. one rule of thumb says to expect your expenses. Retirement planning is the process of preparing and organizing your finances to ensure a secure and comfortable lifestyle after you stop working. it involves setting financial goals, estimating.

Fincun Financial Planning 2. estimate your expenses. once you know how you want to spend retirement, you can plan how to pay for it. this starts by determining your expenses. one rule of thumb says to expect your expenses. Retirement planning is the process of preparing and organizing your finances to ensure a secure and comfortable lifestyle after you stop working. it involves setting financial goals, estimating.

While You May Not Be Working Full Time In Retirement You Can Still

Retirement Planning How To Secure Your Financial Future

Comments are closed.