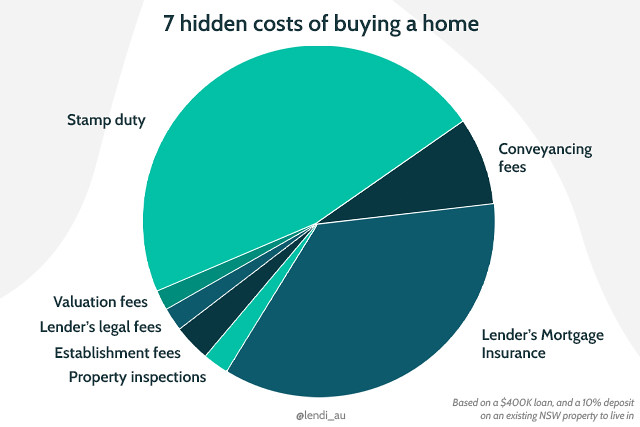

Ig Graphic 7 Hidden Costs Of Buying A Home

Ig Graphic 7 Hidden Costs Of Buying A Home Boydton, va 23917. view. $117,000. 3 bed 1 bath 920 sqft. 580 wilkerson rd. clarksville, va 23927. view. in fact, there are lots of hidden costs to anticipate. these fees might affect your overall. Appraisal fee. appraisal fees cover the costs of your home appraisal, which is almost always required if you are applying for a mortgage loan. appraisal costs range between $448 and $784 for the average single family home, but larger homes or unique homes typically cost more to appraise. 4. credit report fee.

Infographic Archives Zurple The average annual cost of owning and maintaining a single family home in the u.s. is $18,118 a year, or an additional $1,510 per month on top of a mortgage payment, according to a recent study. For a $300,000 home, that's $9,000 to $15,000. ouch. be sure to negotiate with the seller to cover some costs or shop around for lenders who offer credits towards closing. also, carefully review the closing disclosure to ensure all charges are justified and no unnecessary fees are included. The best time to get a sense of the costs involved in home ownership is before you begin to look for one, especially since the “hidden costs” of owning a home can top $14,000 a year for the average u.s. homeowner and exceed $22,000 in pricey metros such as san francisco and new york. the sum — which pencils out to $1,180 a month for the. Costs of buying a home #1: earnest money. to prove you’re “earnest” in your purchase commitment, expect to plunk down 1% to 2% of the total purchase price as an earnest money deposit. this.

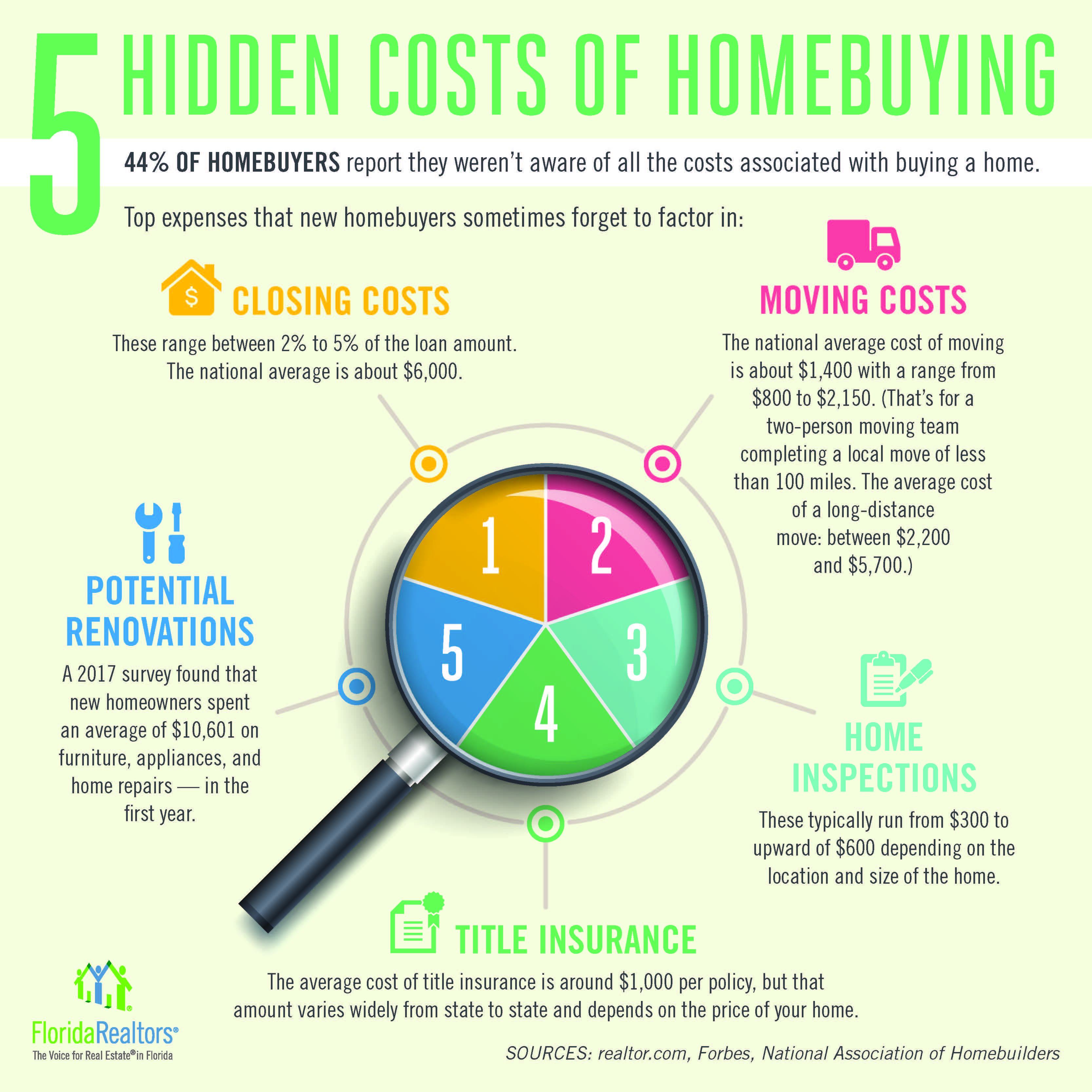

Hidden Costs Of Homebuying The best time to get a sense of the costs involved in home ownership is before you begin to look for one, especially since the “hidden costs” of owning a home can top $14,000 a year for the average u.s. homeowner and exceed $22,000 in pricey metros such as san francisco and new york. the sum — which pencils out to $1,180 a month for the. Costs of buying a home #1: earnest money. to prove you’re “earnest” in your purchase commitment, expect to plunk down 1% to 2% of the total purchase price as an earnest money deposit. this. Home appraisals typically cost around $300 or $400. 2. home inspection. while a home inspection is another upfront cost to tackle, it can actually save you a lot of money in the long run. you will need to pay $300 to $500 for a home inspection that will reveal if there are any major issues or concerns with the home. Buying a home is a big purchase, and the hidden costs of buying one might be shocking if you're a first time buyer. as much as possible, you want to avoid being caught by surprise. before you buy a home, make sure you know what you're getting into—and whether you can afford the payments and the upkeep.

Comments are closed.