If You Re Struggling With Credit Card Debt A Nonprofit Credit

If You Re Struggling With Credit Card Debt A Nonprofit Credit If you're trying to pay off credit card debt but struggling to do it on your own, you might want to consider nonprofit debt consolidation. here's what to consider to help you determine if free. Founded in 1951, the nfcc’s mission is to promote financially responsible behavior and help member organizations like mmi deliver the highest quality financial education and counseling services. money management international is a 501 (c) (3) nonprofit organization. we do not lend money. we help consumers create, restore, and maintain a life.

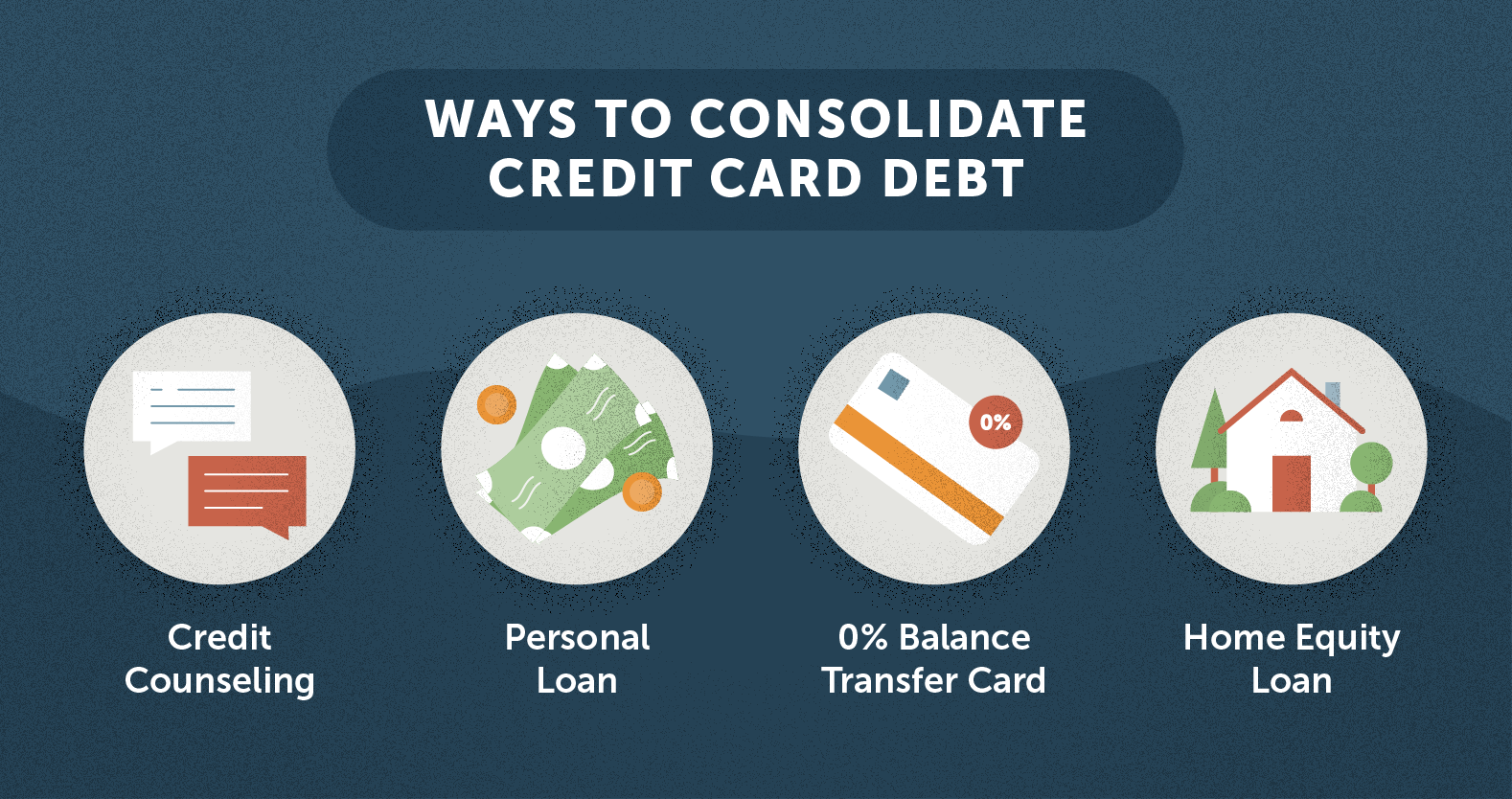

How To Consolidate Credit Card Debt Lexington Law Paying down debt is never easy, but with increases in inflation and high credit card interest rates (24.66% as of april), it may get even harder.if you’re struggling with debt, a nonprofit debt consolidation agency might be able to help you pay off your debts faster and for less money in the long run. The average annual interest rate on a new credit card is 24.71%, according to lendingtree, the highest since the company began tracking in 2019. that’s in part because the federal reserve has raised its key interest rate rate to a 23 year high to combat the highest inflation in four decades, which peaked at 9.1% in june 2022. The initial free credit counseling consultation takes about half an hour. in that time, you and the counselor review your debts, credit and budget to find your best option for relief. on average, consumers who enroll in a dmp will take 3 to 5 years to pay off their debt completely. If you’re struggling with credit card debt and aren’t sure what tactic will bring you the most relief, it’s worth considering talking to a nonprofit credit counselor. a reputable credit counseling organization may be able to help you understand your options and develop a plan to manage your finances and pay off debt.

Struggling With Credit Card Debt Try These Tips Hammonds Life The initial free credit counseling consultation takes about half an hour. in that time, you and the counselor review your debts, credit and budget to find your best option for relief. on average, consumers who enroll in a dmp will take 3 to 5 years to pay off their debt completely. If you’re struggling with credit card debt and aren’t sure what tactic will bring you the most relief, it’s worth considering talking to a nonprofit credit counselor. a reputable credit counseling organization may be able to help you understand your options and develop a plan to manage your finances and pay off debt. Step 3: customize a plan to get out of debt. finally, the counselor will help you understand your options for getting out of debt. credit counseling services can help you set up a debt management plan. however, as long as you work with a nonprofit credit counseling agency, they won’t push you into that solution. Sadly, payplan isn’t rated by guidestar or charity navigator either. 7. national foundation for credit counseling (nfcc) when discussing debt, the nfcc is a foundation that naturally comes to mind. as a non profit organization, they provide credit counseling and debt management services to individuals and families.

Comments are closed.