Identifying Opportunities And Challenges In 1031 Exchanges

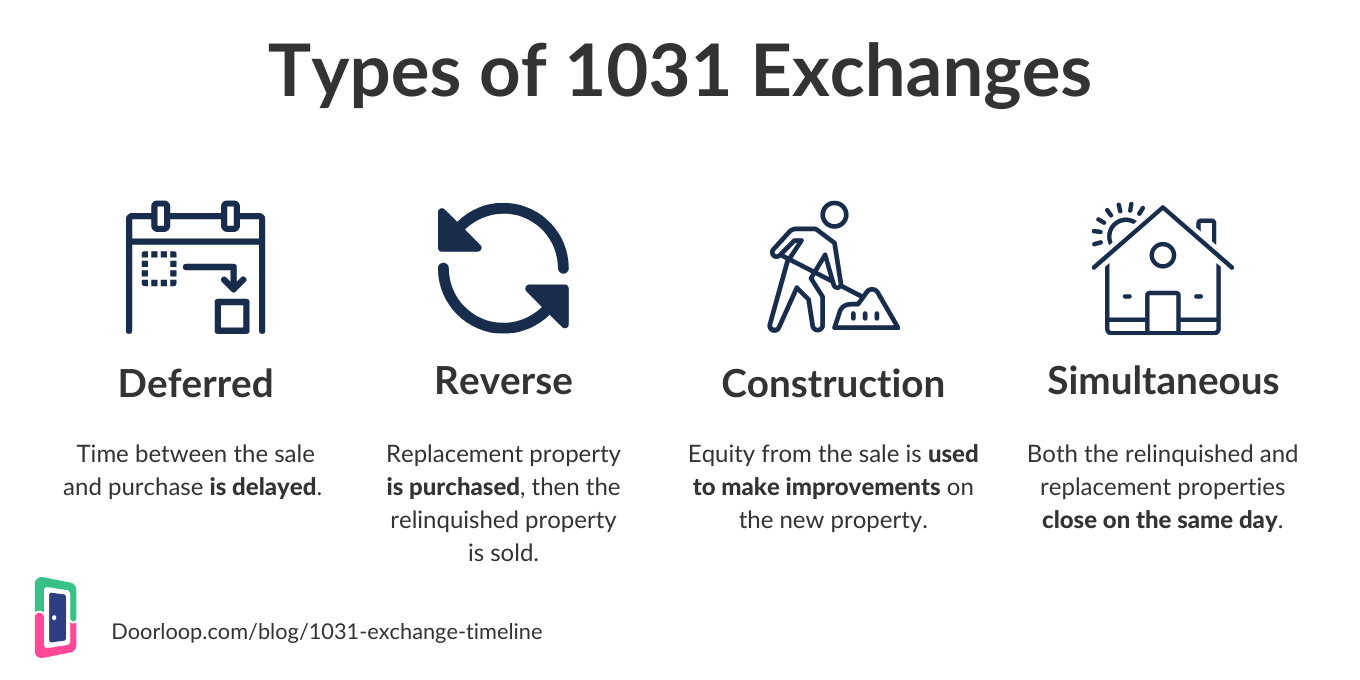

1031 Exchange Timeline What You Need To Know 2023 Edition This article aims to provide a comprehensive understanding of the opportunities and challenges associated with 1031 exchanges. whether you are a seasoned investor or just starting out, this guide will equip you with the knowledge you need to make informed decisions. understanding the basics of 1031 exchanges. Key takeaways. section 1031 can allow real estate investors to defer capital gains taxes on the sale of real property by reinvesting the proceeds into similar "like kind" properties. in a recent ruling the irs clarifies how investors can use exchange proceeds to improve replacement properties while still qualifying under section 1031.

1031 Exchange Meaning Types Regulations Risks Taxation Advance planning and research: before initiating the 1031 exchange process, exchangers should conduct thorough research and identify potential replacement properties. by proactively scouting for suitable investment opportunities, exchangers can streamline the identification process and minimize the risk of last minute decisions. A 1031 exchange can be a powerful tool for deferring capital gains taxes and building wealth through real estate investments, but it’s not without its challenges. leveraging a 1031 exchange involves navigating a complex web of rules and deadlines, and even a small mistake can lead to significant tax liabilities. In this article significance of 1031 exchanges in commercial real estate understanding 1031 exchanges the 1031 exchange process financial and tax implications strategic benefits and challenges future trends and evolving regulations final thoughts get a loan quote now! call or email us at 713 331 9463 info@hillcreekcommercialcapital by georin sanders last updated on august 12, 2024 […]. The dynamic nature of real estate markets and investment partnerships requires a forward looking perspective, ensuring that today’s decisions align with tomorrow’s opportunities and challenges. multi owner 1031 exchanges represent a sophisticated strategy for investors seeking to leverage the tax advantages of like kind exchanges within.

1031 Exchanges In Syndication Overview How It Works Tips In this article significance of 1031 exchanges in commercial real estate understanding 1031 exchanges the 1031 exchange process financial and tax implications strategic benefits and challenges future trends and evolving regulations final thoughts get a loan quote now! call or email us at 713 331 9463 info@hillcreekcommercialcapital by georin sanders last updated on august 12, 2024 […]. The dynamic nature of real estate markets and investment partnerships requires a forward looking perspective, ensuring that today’s decisions align with tomorrow’s opportunities and challenges. multi owner 1031 exchanges represent a sophisticated strategy for investors seeking to leverage the tax advantages of like kind exchanges within. A 1031 exchange empowers real estate investors to defer capital gains taxes when selling and reinvesting in property. this tax deferral strategy preserves and reinvests capital, fostering continuous growth in real estate portfolios. 1031 exchanges have strict rules and timelines that must be followed to take advantage of their tax benefits. In conclusion, a 1031 exchange for farm and agricultural properties presents numerous opportunities and challenges for farmers and landowners. understanding the basics of the 1031 exchange process, exploring the benefits and potential risks, and leveraging expert insights and tax planning strategies are key to maximizing the gains and building.

Comments are closed.