I Received A Revised Loan Estimate From My Lender Showing A Higher

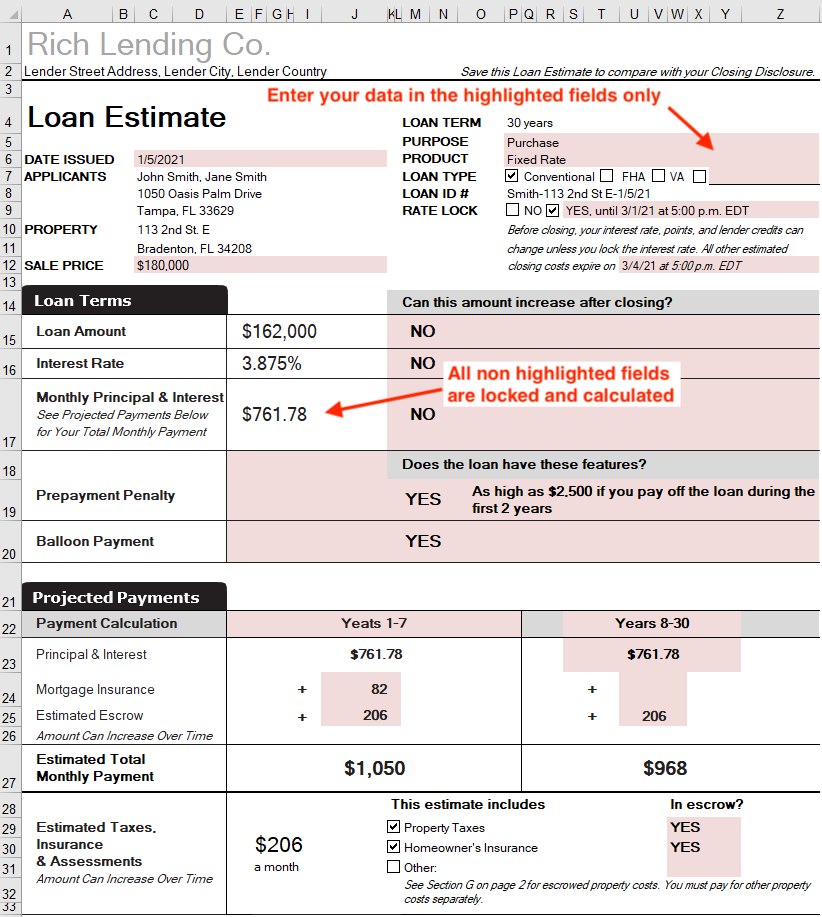

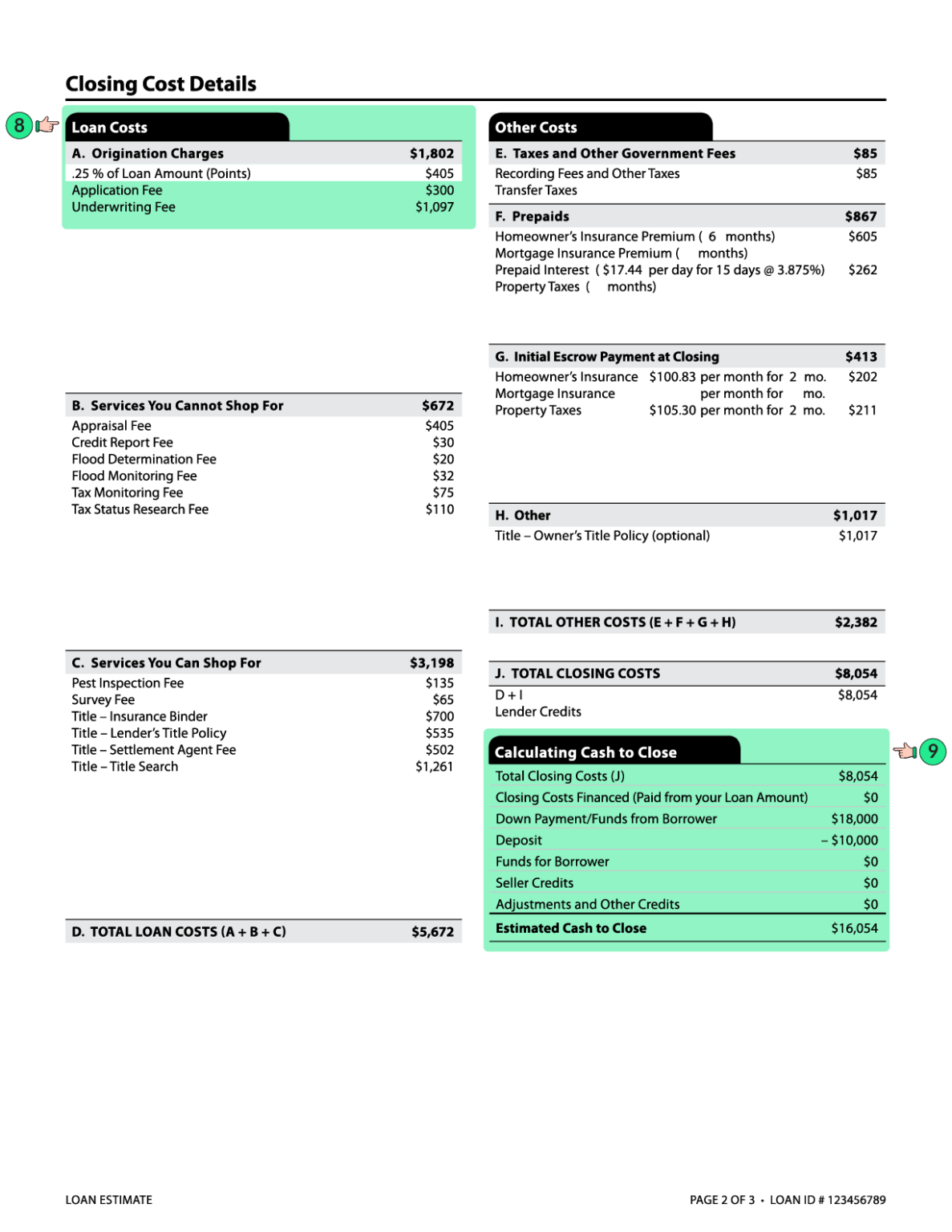

Create Example Loan Estimate Form In Lender Spreadsheet It is illegal for a lender to intentionally underestimate charges for services on the loan estimate, and then surprise you with higher charges on a revised loan estimate or closing disclosure. however, a lender may increase the fees it quoted you on the loan estimate if certain circumstances change. A revised loan estimate may be issued reflecting the increased appraisal fee of $400. by issuing a revised loan estimate, the $400 disclosed appraisal fee will now be compared to the $400 appraisal fee paid at consummation. for good faith purposes, the appraisal fee has been re set from $200 to $400 and there is no tolerance violation.

:max_bytes(150000):strip_icc()/loanestimate1-2427c5adef1348a9bf548545a1b2091d.jpg)

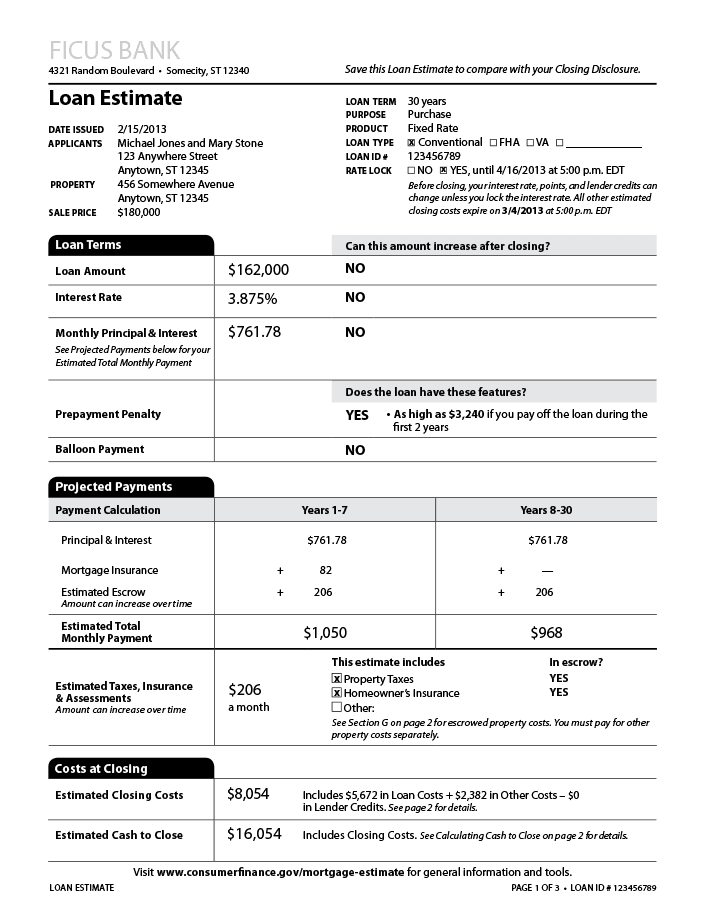

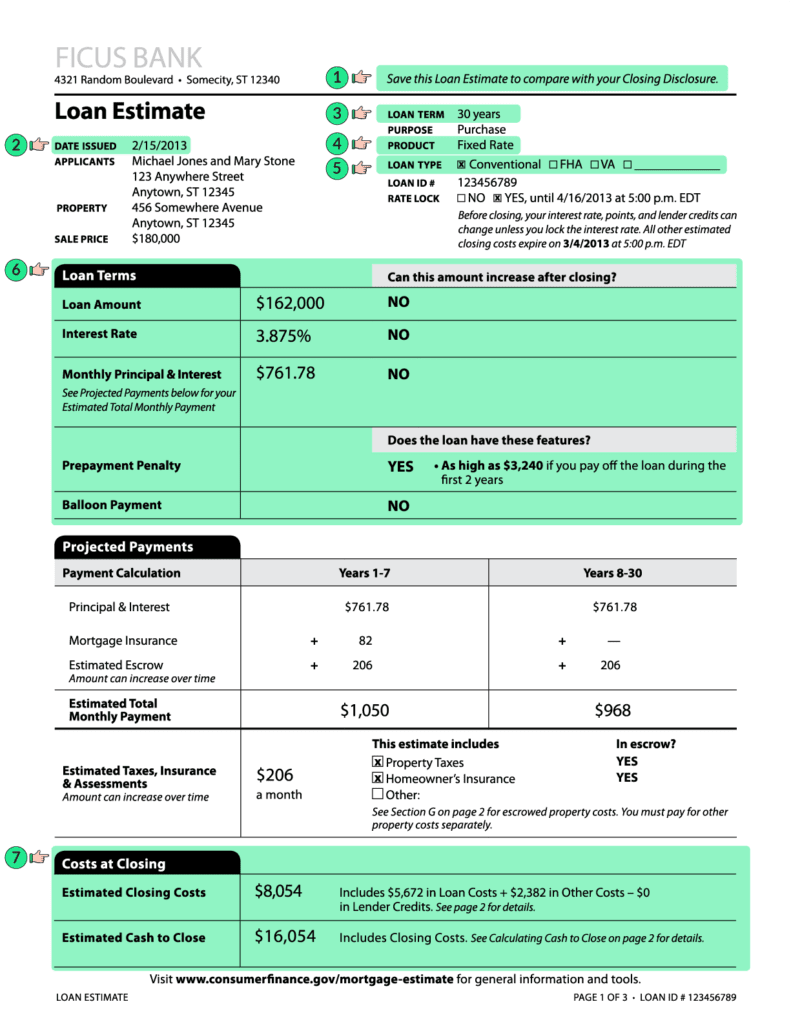

Loan Estimate What It Is How It Works How To Read It Check at the top of page 1 of your loan estimate to see whether your rate is locked, and until when. learn more about how rate locks work. closing costs. there are three categories of closing costs. some closing costs the lender can increase by any amount, some the lender can increase by up to 10 percent, and some the lender can’t increase at. Cape cod. 1. you don't need to issue a revised le if there is no change that increases a fee previously disclosed and no changed circumstance resulting in the need for a new service and related cost. you may, however issue a new le for informational purposes to keep the applicant apprised of changes. 2. When you first receive a loan estimate, find out what the lender's requirements are for proceeding with a loan application. after you have reviewed and compared loan estimates, make sure you take the next step of notifying the lender within 10 business days if you want to proceed with a loan application. The le needs to be sent to you within 3 days of the loan originator receiving 6 pieces of information: full name, income, social security number to check credit, the property address, estimate of the value of the property, the mortgage amount being requested. nothing more is needed to get a le and the loan originator cannot ask you for anything.

Loan Estimate Explainer Consumer Financial Protection Bureau When you first receive a loan estimate, find out what the lender's requirements are for proceeding with a loan application. after you have reviewed and compared loan estimates, make sure you take the next step of notifying the lender within 10 business days if you want to proceed with a loan application. The le needs to be sent to you within 3 days of the loan originator receiving 6 pieces of information: full name, income, social security number to check credit, the property address, estimate of the value of the property, the mortgage amount being requested. nothing more is needed to get a le and the loan originator cannot ask you for anything. Compliance tips. collect all application information before issuing a loan estimate. revised loan estimates are not permitted simply because the lender failed to collect all six pieces of information required in the application prior to issuing the loan estimate. for example, the failure to obtain the property address prior to issuing the. Apr 28 trid resetting tolerances with a closing disclosure. on april 26, 2018, the cfpb released a second set of trid amendments which address when mortgage lenders with a valid reason may pass on increased closing costs to consumers and disclose them on a closing disclosure instead of a loan estimate. “specifically, a timing restriction on.

Loan Estimate Explained Good Faith Estimate Definition Guaranteed Rate Compliance tips. collect all application information before issuing a loan estimate. revised loan estimates are not permitted simply because the lender failed to collect all six pieces of information required in the application prior to issuing the loan estimate. for example, the failure to obtain the property address prior to issuing the. Apr 28 trid resetting tolerances with a closing disclosure. on april 26, 2018, the cfpb released a second set of trid amendments which address when mortgage lenders with a valid reason may pass on increased closing costs to consumers and disclose them on a closing disclosure instead of a loan estimate. “specifically, a timing restriction on.

What Is A Loan Estimate How To Read And What To Look For

What Is A Loan Estimate How To Read And What To Look For

Comments are closed.