I Made 1 Right Decision And Became Financially Free

The Best Ways To Become Financially Free My Financial Hustle 9. live below your means. in other words, you’ve got to live on less than you make. this goes right along with having a budget. to reach financial freedom, you need to have self discipline and be willing to say no to some stuff you can’t afford to buy right now so you can save more in the long run. How to become financially independent with 9 helpful habits. if you’re looking to pursue financial freedom, here are 9 places to start: 1. clearly define your financial goals. the first step toward becoming financially free is to determine what your specific goals are for your finances. consider asking yourself a few of the following questions:.

Become Financially Free Is Your Responsibility Live Your Life On Your 1. change your mindset about money. one of the most important things you need to do if you want to achieve financial freedom is to change your mindset about money. too often, we view money as. Your emergency fund is crucial for becoming financially free, as it serves as a safeguard against unexpected life events such as car repairs, broken appliances, and medical deductibles. to start building your emergency fund, aim for $500 a month and gradually increase it to $500 bi weekly and beyond. These include: set financial goals – you can’t reach a goal unless you know what that goal is. in the case of reaching financial freedom, i’ll show you how to work out this goal below. avoid high interest debt – and if you have it, do everything you can to pay it off as quickly as possible. Write all amounts and deadlines down carefully and put the goal sheet at the front of your financial binder. 2. make a monthly budget. making a monthly household budget —and sticking to it —is.

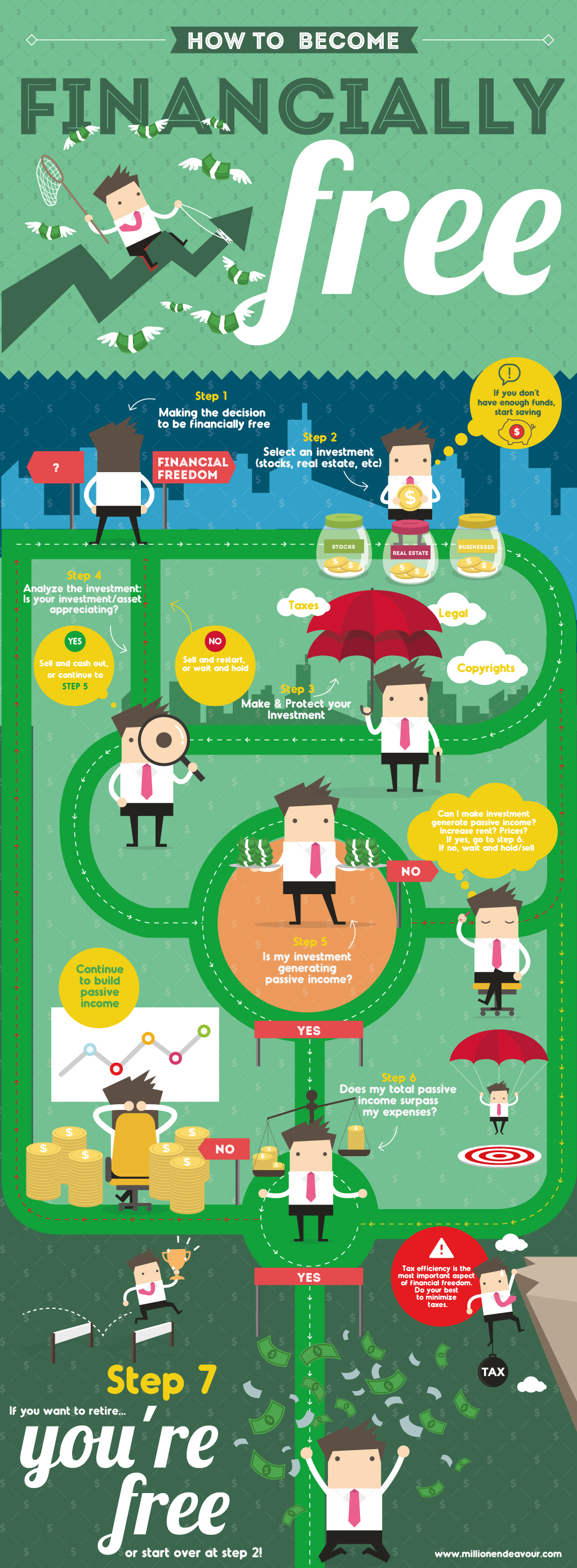

Step By Step Guide How To Become Financially Free Million Endeavour These include: set financial goals – you can’t reach a goal unless you know what that goal is. in the case of reaching financial freedom, i’ll show you how to work out this goal below. avoid high interest debt – and if you have it, do everything you can to pay it off as quickly as possible. Write all amounts and deadlines down carefully and put the goal sheet at the front of your financial binder. 2. make a monthly budget. making a monthly household budget —and sticking to it —is. This will help you make informed decisions, adapt to changing financial circumstances, and ensure your financial plan remains effective and up to date. understanding and adopting the key principles of financial independence is the first step towards living a life free from financial stress. Regardless of how you define financial freedom, the following 15 steps will help you achieve your vision for the future. determine your financial goals. know your current financial situation. open.

Comments are closed.