I Have A 27000 Credit Card Debt Mess

I Have A 27 000 Credit Card Debt Mess Youtube 💵 create your free budget! sign up for everydollar ⮕ ter.li 6h2c45 📱download the ramsey network app ⮕ ter.li ajeshj 🛒 visit the ramsey sto. If you go that route, you can do it yourself and avoid their fees which are typically 20 25% of the enrolled amount. so if you use them to settle $27k of credit card debt, they are going to charge you a minimum of $5400. if you settle with credit card companies at 50% of face value .about half of that savings would be going to them for fees.

How Chris Paid Off 27 000 Of Credit Card Debt Inspired Budget Tana williams, a digital marketer who blogs about her financial journey at debt free forties, worked with her husband to pay off $26,619 of debt in just 17 months—$3,251 of which was credit card. The most cost effective way to pay off credit card debt is with balance transfers. here are the steps to follow: apply for a balance transfer credit card. transfer as many credit card balances as. How to get out of credit card debt: 1. find a payment strategy. 2. look into debt consolidation. 3. talk with your creditors. 4. look into debt relief. 5. lower your living expenses. I have 3 cards, one with discover, bank of america, and edward jones master card. i have come to a point where playing that of the ostrich, has come to a head. i never really stuck to a budget and have gotten a few big hospital bills, that have really set me back. i was put to part time in october, so i make close to 1750 a month.

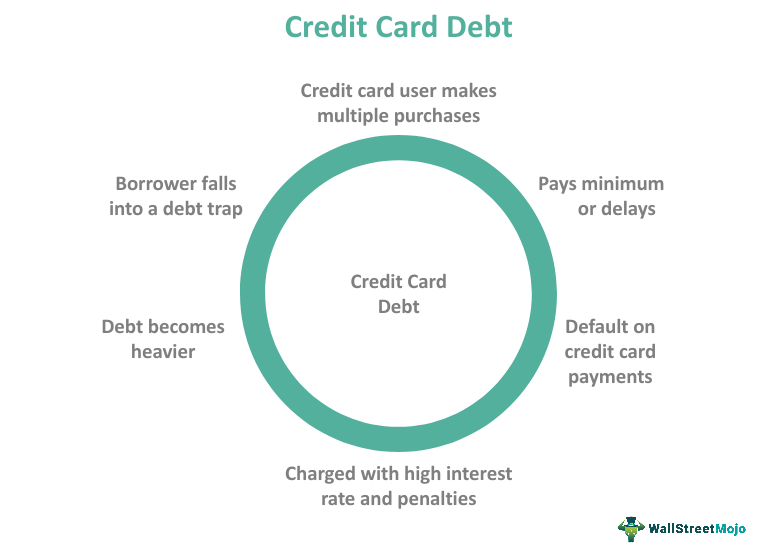

Credit Card Debt What Is It Consolidation How To Pay It Off How to get out of credit card debt: 1. find a payment strategy. 2. look into debt consolidation. 3. talk with your creditors. 4. look into debt relief. 5. lower your living expenses. I have 3 cards, one with discover, bank of america, and edward jones master card. i have come to a point where playing that of the ostrich, has come to a head. i never really stuck to a budget and have gotten a few big hospital bills, that have really set me back. i was put to part time in october, so i make close to 1750 a month. First, your income and asset levels are important, said karra kingston, a bankruptcy attorney in union city. “twenty seven thousand dollars is a lot of debt for someone who makes $30,000 to $70,000 per year,” kingston said. “however, if you make $100,000 per year, paying it off may be doable depending on your other monthly expenses.”. 1. debt snowball. the debt snowball method is the best way to pay off credit card debt—and the fastest way. (trust me: i know from personal experience!) here’s how the debt snowball works: list all your debts from smallest to largest. if you’ve got multiple credit cards, list the balances individually.

She Has 27 000 In Credit Card Debt And Doesn T How To Get Out Of The First, your income and asset levels are important, said karra kingston, a bankruptcy attorney in union city. “twenty seven thousand dollars is a lot of debt for someone who makes $30,000 to $70,000 per year,” kingston said. “however, if you make $100,000 per year, paying it off may be doable depending on your other monthly expenses.”. 1. debt snowball. the debt snowball method is the best way to pay off credit card debt—and the fastest way. (trust me: i know from personal experience!) here’s how the debt snowball works: list all your debts from smallest to largest. if you’ve got multiple credit cards, list the balances individually.

Average Credit Card Debt Statistics 2023 Credit

How Chris Paid Off 27 000 Of Credit Card Debt Inspired Budget

Comments are closed.