Hsa Hdhp Requirements 2024 Adey Loleta

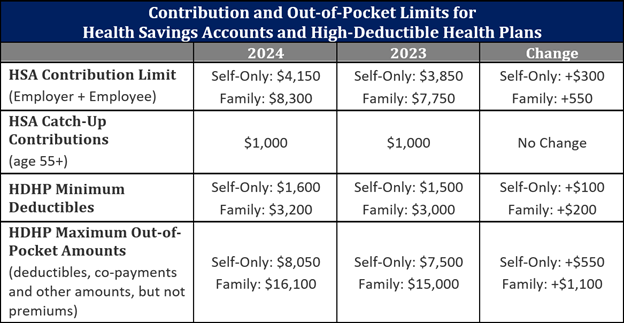

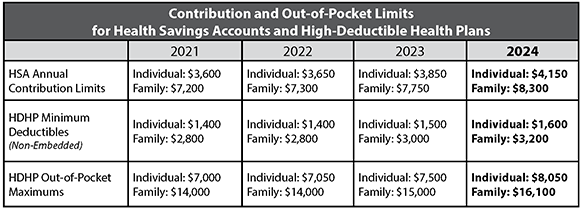

Irs Announces Hsa And Hdhp Limits For 2024 Telehealth and other remote care services. public law 117 328, december 29, 2022, amended section 223 to provide that an hdhp may have a $0 deductible for telehealth and other remote care services for plan years beginning before 2022; months beginning after march 2022 and before 2023; and plan years beginning after 2022 and before 2025. also, an “eligible individual” remains eligible to. If you have one plan for self only and family coverage and have a non embedded oop, the maximum amounts for 2024 are $8,050 for an individual and $9,450 for a family. hsa contribution limits: $4,150 for self only coverage ($300 increase from 2023) $8,300 for family coverage ($550 increase from 2023) the annual “catch up” contribution amount.

Hsa Hdhp Limits Will Increase For 2024 American Health Wellness The new 2024 hsa contribution limit is $4,150 if you are single—a 7.8% increase from the maximum contribution limit of $3,850 in 2023. the 2024 hsa contribution limit for families is $8,300, a 7. For family coverage, the hsa contribution limit jumps to $8,300, up 7.1 percent from $7,750 in 2023. participants 55 and older can contribute an extra $1,000 to their hsas. this amount will remain. You must participate in a high deductible health plan to contribute to an hsa. for 2024, this means: an annual deductible of $1,600 or more for individual coverage and $3,200 or more for family. Here are the maximum amounts you can contribute to an hsa in 2024: if you have self only coverage, you can contribute up to $4,150 ($3,850 for 2023). if you have family coverage, you can.

Hsa Hdhp Requirements 2024 Adey Loleta You must participate in a high deductible health plan to contribute to an hsa. for 2024, this means: an annual deductible of $1,600 or more for individual coverage and $3,200 or more for family. Here are the maximum amounts you can contribute to an hsa in 2024: if you have self only coverage, you can contribute up to $4,150 ($3,850 for 2023). if you have family coverage, you can. The hsa contribution limits for 2025 are $4,300 for self only coverage and $8,550 for family coverage. those 55 and older can contribute an additional $1,000 as a catch up contribution. hsa eligibility. to contribute to an hsa, you must be enrolled in an hsa eligible health plan. for 2024, this means: it has an annual deductible of at least. A high deductible health plan (hdhp) generally has lower monthly premiums and a higher deductible. before you pay the deductible, an hdhp may cover 100% of your in network preventive care. for 2024, the minimum deductible on an hdhp is $1,600 for an individual and $3,200 for a family. the maximum out of pocket expenses allowed are $8,050 for an.

Hsa Hdhp Limits Will Increase For 2024 The hsa contribution limits for 2025 are $4,300 for self only coverage and $8,550 for family coverage. those 55 and older can contribute an additional $1,000 as a catch up contribution. hsa eligibility. to contribute to an hsa, you must be enrolled in an hsa eligible health plan. for 2024, this means: it has an annual deductible of at least. A high deductible health plan (hdhp) generally has lower monthly premiums and a higher deductible. before you pay the deductible, an hdhp may cover 100% of your in network preventive care. for 2024, the minimum deductible on an hdhp is $1,600 for an individual and $3,200 for a family. the maximum out of pocket expenses allowed are $8,050 for an.

2024 Out Of Pocket Limits Hdhp Minimum Deductibles And Hsa

Hsa Hdhp Limits Will Increase For 2024 Benefit Analysts Incbenefit

Comments are closed.