Hsa Contribution Limits For 2023 And 2024 Image To U

Hsa Contribution Limits For 2023 And 2024 Image To U The hsa contribution limits for 2025 are $4,300 for self only coverage and $8,550 for family coverage. those 55 and older can contribute an additional $1,000 as a catch up contribution. hsa eligibility. to contribute to an hsa, you must be enrolled in an hsa eligible health plan. for 2024, this means: it has an annual deductible of at least. You should include all contributions you or your employer made for 2023, including those made from january 1, 2024, through april 15, 2024, that are designated for 2023. you should receive form 5498 sa, hsa, archer msa, or medicare advantage msa information, from the trustee showing the amount you or your employer contributed during the year.

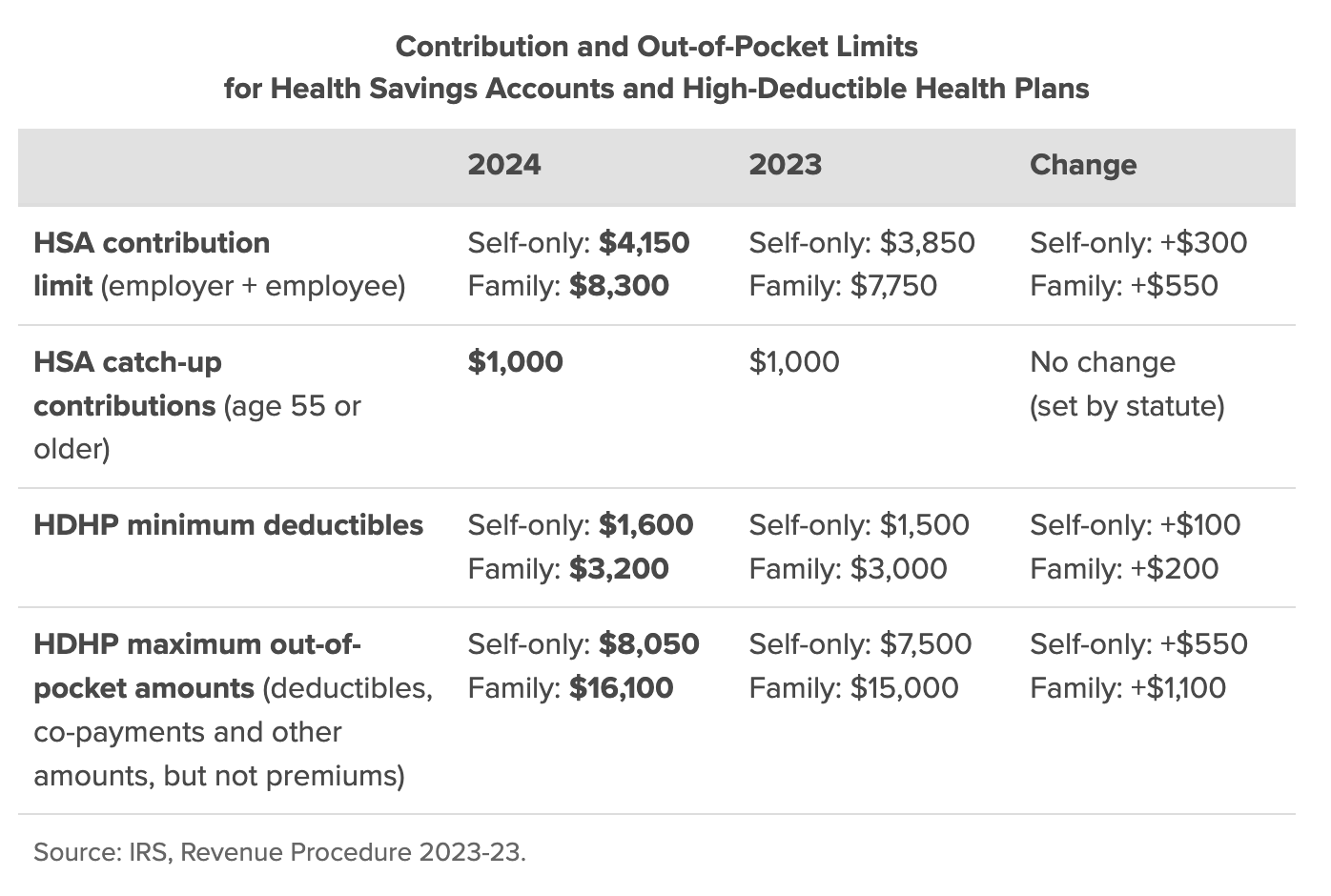

2024 Hsa Contribution Limits Claremont Insurance Services The new 2024 hsa contribution limit is $4,150 if you are single—a 7.8% increase from the maximum contribution limit of $3,850 in 2023. the 2024 hsa contribution limit for families is $8,300, a 7. 2024 hsa contribution limits. you can contribute the following amounts to an hsa in 2024 if you have an eligible hdhp: up to $4,150 if you have self only coverage. up to $8,300 if you have family. A self only healthcare plan must have a minimum annual deductible of $1,600 and an annual out of pocket limit of at least $8,050 in 2024. a family healthcare plan must have a minimum annual. For 2024, individuals under a high deductible health plan (hdhp) have an hsa annual contribution limit of $4,150. the hsa contribution limit for family coverage is $8,300. those amounts are about.

Hsa Contribution Limits 2023 And 2024 A self only healthcare plan must have a minimum annual deductible of $1,600 and an annual out of pocket limit of at least $8,050 in 2024. a family healthcare plan must have a minimum annual. For 2024, individuals under a high deductible health plan (hdhp) have an hsa annual contribution limit of $4,150. the hsa contribution limit for family coverage is $8,300. those amounts are about. Key points. you can contribute up to $4,150 to your hsa if you have self only coverage or $8,300 if you have family coverage in 2024. employer contributions count toward the annual hsa. Here are the maximum amounts you can contribute to an hsa in 2024: if you have self only coverage, you can contribute up to $4,150 ($3,850 for 2023). if you have family coverage, you can.

2024 Annual Hsa Contribution Limits Cal Annabelle Key points. you can contribute up to $4,150 to your hsa if you have self only coverage or $8,300 if you have family coverage in 2024. employer contributions count toward the annual hsa. Here are the maximum amounts you can contribute to an hsa in 2024: if you have self only coverage, you can contribute up to $4,150 ($3,850 for 2023). if you have family coverage, you can.

Comments are closed.