Hsa Contribution Limits 2023 Millennial Investor

Hsa Contribution Limits 2023 Millennial Investor The hsa contribution limit for 2023 for an individual is $3,850, while for a family, it stands at $7,750. there is also a catch up contribution of $1,000 for those over 55. hsa contribution limits 2024. Your employer can make contributions to your hsa from january 1, 2024, through april 15, 2024, that are allocated to 2023. your employer must notify you and the trustee of your hsa that the contribution is for 2023. the contribution will be reported on your 2024 form w 2, wage and tax statement.

Hsa Contribution Limits 2023 Millennial Investor The hsa contribution limits for 2025 are $4,300 for self only coverage and $8,550 for family coverage. those 55 and older can contribute an additional $1,000 as a catch up contribution. hsa eligibility. to contribute to an hsa, you must be enrolled in an hsa eligible health plan. for 2024, this means: it has an annual deductible of at least. The downside of not investing hsa money, especially for investors in their 20s, 30s and 40s, is simple. making it easier for them to save and invest their hsa contributions. in 2023, you can. Your contributions to an hsa are limited each year. for 2023, you can contribute up to $3,850 if you have self only coverage or up to $7,750 for family coverage. for 2022, the limits are $3,650. For 2023, the maximum hsa contribution limit is $3,850 for an individual, up from $3,650 in 2022. you can contribute up to $7,750 to a family hsa for 2023, up from $7,300 in 2022. health savings accounts (hsas) have grown in popularity over the last decade. over 60 million people were covered by an hsa as of december 31, 2020, according to devenir.

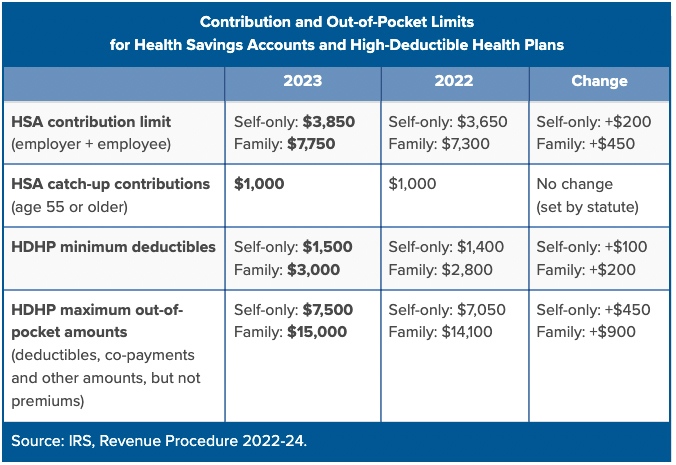

Irs Announces 2023 Hsa Contribution Limits Your contributions to an hsa are limited each year. for 2023, you can contribute up to $3,850 if you have self only coverage or up to $7,750 for family coverage. for 2022, the limits are $3,650. For 2023, the maximum hsa contribution limit is $3,850 for an individual, up from $3,650 in 2022. you can contribute up to $7,750 to a family hsa for 2023, up from $7,300 in 2022. health savings accounts (hsas) have grown in popularity over the last decade. over 60 million people were covered by an hsa as of december 31, 2020, according to devenir. The contribution limit for 2024 is $4,150 for individual coverage and $8,300 for family coverage. 4. hsas can grow on their own over time. funds in an hsa can be invested, giving that money the potential to grow like any other investment account. if you invest early, you could benefit from compound growth. Contribution and out of pocket limits for health savings accounts and high deductible health plans ; 2023 2022 change ; hsa contribution limit (employer employee): self only: $3,850 family.

2023 Hsa Contribution Limits Increase Considerably Due To Inflation The contribution limit for 2024 is $4,150 for individual coverage and $8,300 for family coverage. 4. hsas can grow on their own over time. funds in an hsa can be invested, giving that money the potential to grow like any other investment account. if you invest early, you could benefit from compound growth. Contribution and out of pocket limits for health savings accounts and high deductible health plans ; 2023 2022 change ; hsa contribution limit (employer employee): self only: $3,850 family.

Hsa Contribution Limits For 2023 And 2024 Image To U

2023 New Hsa Limits Claremont Insurance Services

Comments are closed.