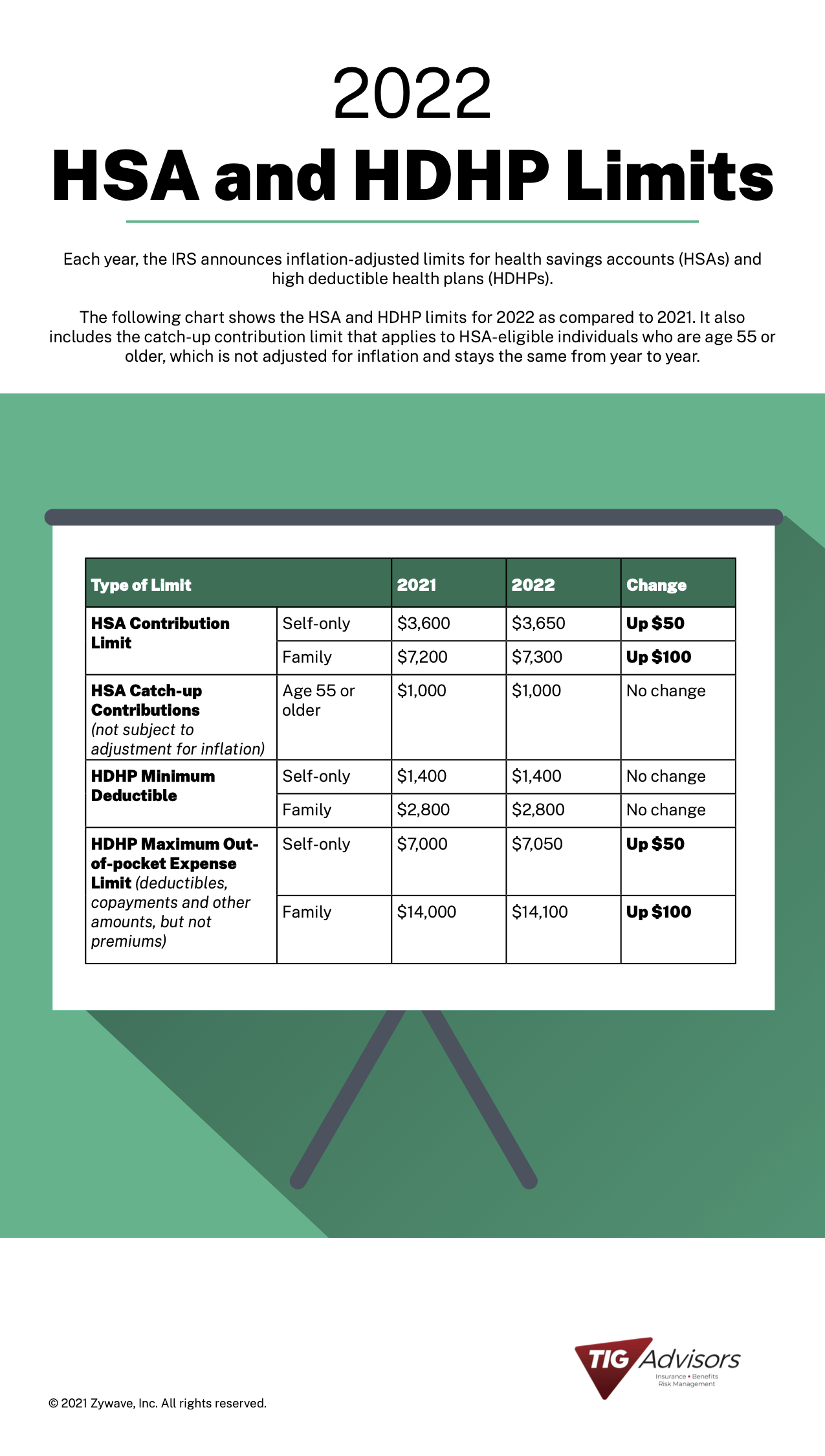

Hsa And Hdhp Limits For 2022

How Do Your 2022 Hsa Hdhp Limits Compare To 2021 S Tig Advisors 2022 wage cap rises to $147,000 for social security payroll taxes, shrm online, october 2021. health savings account (hsa) contribution limits for 2022 are going up $50 for self only coverage and. Telehealth and other remote care services. public law 117 328, december 29, 2022, amended section 223 to provide that an hdhp may have a $0 deductible for telehealth and other remote care services for plan years beginning before 2022; months beginning after march 2022 and before 2023; and plan years beginning after 2022 and before 2025. also, an “eligible individual” remains eligible to.

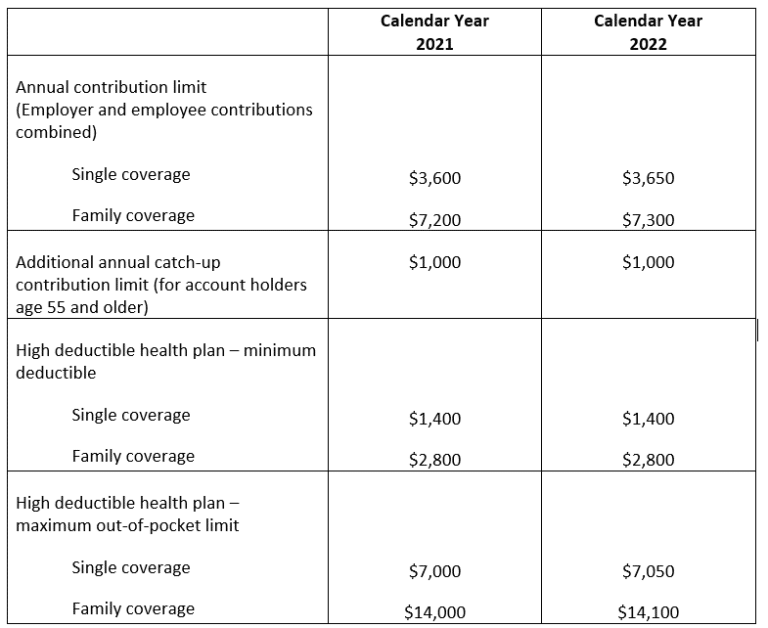

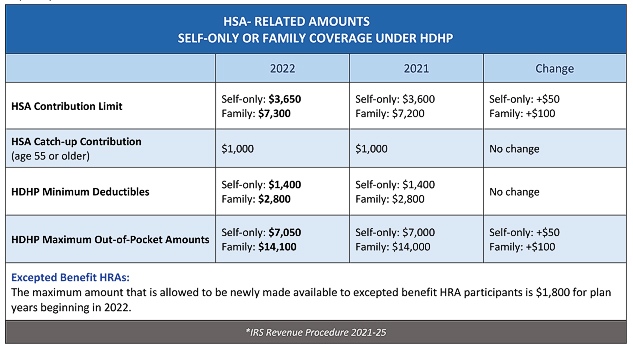

2022 Hsa And Hdhp Limits Capital Services The 2022 annual hsa contribution limit is $3,650 for individuals with self only hdhp coverage (up from $3,600 in 2021), and $7,300 for individuals with family hdhp coverage (up from $7,200 in 2021). hdhp minimum deductibles. Public law 117 328, december 29, 2022, amended section 223 to provide that an hdhp may have a $0 deductible for tel ehealth and other remote care services for plan years be ginning before 2022; months beginning after march 2022 and before 2023; and plan years beginning after 2022 and before 2025. Your contributions to an hsa are limited each year. for 2023, you can contribute up to $3,850 if you have self only coverage or up to $7,750 for family coverage. for 2022, the limits are $3,650. The above limits means that an hdhp in 2022 is a health plan “with an annual deductible that is not less than $1,400 for self only coverage or $2,800 for family coverage, and the annual out of pocket expenses do not exceed $7,050 for self only coverage or $14,100 for family coverage,” according to the irs notice.

New Hsa Hdhp Limits For 2022 Miller Johnson Your contributions to an hsa are limited each year. for 2023, you can contribute up to $3,850 if you have self only coverage or up to $7,750 for family coverage. for 2022, the limits are $3,650. The above limits means that an hdhp in 2022 is a health plan “with an annual deductible that is not less than $1,400 for self only coverage or $2,800 for family coverage, and the annual out of pocket expenses do not exceed $7,050 for self only coverage or $14,100 for family coverage,” according to the irs notice. Here is what you need to know about the hsa contribution limits for the 2022 calendar year: an individual with coverage under a qualifying high deductible health plan (deductible not less than $1,400) can contribute up to $3,650 — up $50 from 2021 — for the year to their hsa. the maximum out of pocket has been capped at $7,050. an. Rev. proc. 2021 25. section 1. purpose. this revenue procedure provides the 2022 inflation adjusted amounts for health. savings accounts (hsas) as determined under § 223 of the internal revenue code and. the maximum amount that may be made newly available for excepted benefit health. reimbursement arrangements (hras) provided under § 54.9831.

Sterling Administration 2022 Hsa And Hdhp Limits Claremont Here is what you need to know about the hsa contribution limits for the 2022 calendar year: an individual with coverage under a qualifying high deductible health plan (deductible not less than $1,400) can contribute up to $3,650 — up $50 from 2021 — for the year to their hsa. the maximum out of pocket has been capped at $7,050. an. Rev. proc. 2021 25. section 1. purpose. this revenue procedure provides the 2022 inflation adjusted amounts for health. savings accounts (hsas) as determined under § 223 of the internal revenue code and. the maximum amount that may be made newly available for excepted benefit health. reimbursement arrangements (hras) provided under § 54.9831.

Irs Releases 2022 Hsa Contribution Limits And Hdhp Deductible And Out

Comments are closed.