How To Use The Fibonacci Retracement Tool Video Included

How To Use The Fibonacci Retracement Tool Video Included In this video i explain how to correctly use the fibonnaci retracement tool. please comment, like, and subscribe if you like the content!instagram:. Step 2: draw fibonacci retracement levels. now the fun step; drawing the fibonacci retracement tool. after selecting the tool, you start from the swing low point and drag the levels to the highest point in an uptrend and vice versa in a downtrend. simple as that.

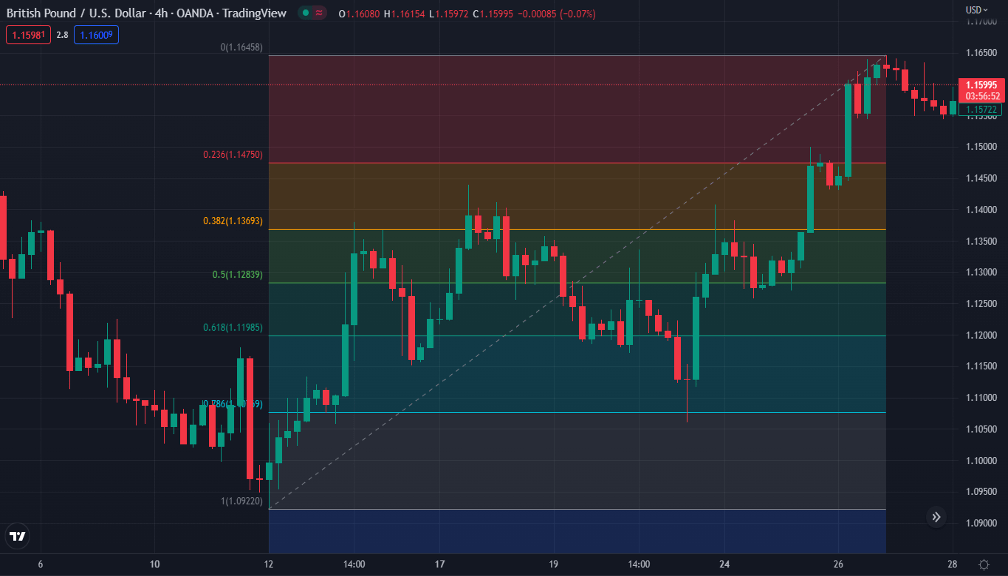

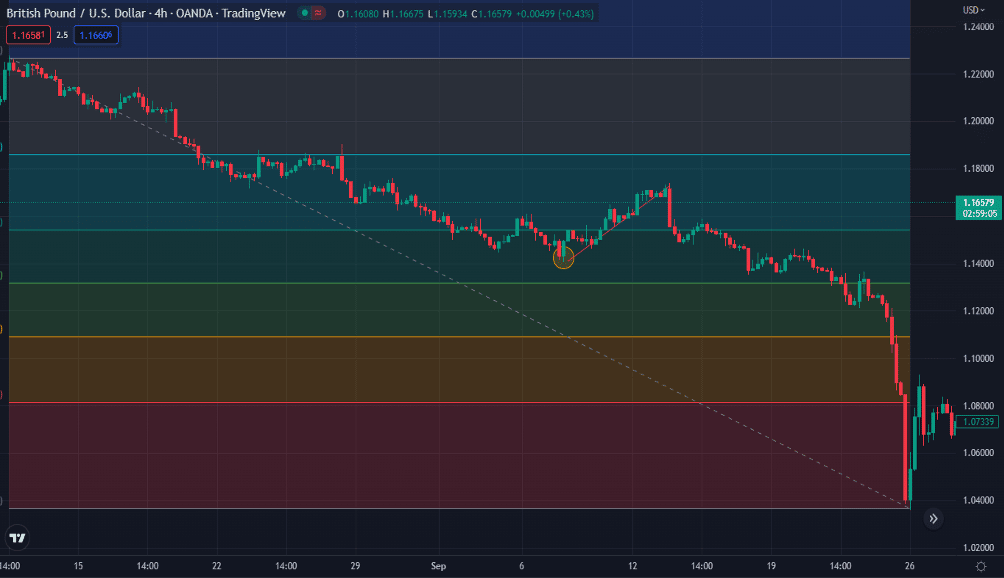

How To Use The Fibonacci Retracement Tool Video Included This video is about the fibonacci numbers and how to use the fibonacci retracement tool.download the 6 month blueprint here: stokestrades bluepri. Welcome to our latest video! have you ever heard of fibonacci retracements but felt unsure of how to use them in the live market? well, you're in luc. The charting software automagically calculates and shows you the retracement levels. as you can see from the chart, the fibonacci retracement levels were .7955 (23.6%), .7764 (38.2%), .7609 (50.0%*), .7454 (61.8%), and .7263 (76.4%). now, the expectation is that if aud usd retraces from the recent high, it will find support at one of those. To plot the retracements, draw a trendline from the low to the high (also known as the swing low to the swing high), or vice versa, high to low, within a continuous price movement trend – fibonacci retracement levels should be placed at 61.80%, 38.20%, and 23.60% of the height of the line for you by the tool itself.

Trading Tip 6 How To Use The Fibonacci Retracement Tool Youtube The charting software automagically calculates and shows you the retracement levels. as you can see from the chart, the fibonacci retracement levels were .7955 (23.6%), .7764 (38.2%), .7609 (50.0%*), .7454 (61.8%), and .7263 (76.4%). now, the expectation is that if aud usd retraces from the recent high, it will find support at one of those. To plot the retracements, draw a trendline from the low to the high (also known as the swing low to the swing high), or vice versa, high to low, within a continuous price movement trend – fibonacci retracement levels should be placed at 61.80%, 38.20%, and 23.60% of the height of the line for you by the tool itself. The fib retracement tool includes the ability to set 24 different fibonacci levels (including the 0% and the 100% levels that are defined by the two extremes of the trend line that is originally drawn). values between 0 and 1 are internal retracement levels. values greater than 1 are external retracement levels, while values less than 0 are. Here are some best practices for using the fibonacci trading strategy: spot the trend: first, figure out if the market is moving up or down. tools like moving averages can help confirm the direction. plot fibonacci levels: use the fibonacci retracement tool to connect swing highs and lows.

How To Use The Fibonacci Retracement Tool Video Included The fib retracement tool includes the ability to set 24 different fibonacci levels (including the 0% and the 100% levels that are defined by the two extremes of the trend line that is originally drawn). values between 0 and 1 are internal retracement levels. values greater than 1 are external retracement levels, while values less than 0 are. Here are some best practices for using the fibonacci trading strategy: spot the trend: first, figure out if the market is moving up or down. tools like moving averages can help confirm the direction. plot fibonacci levels: use the fibonacci retracement tool to connect swing highs and lows.

How To Use The Fibonacci Retracement Tool Video Included

Comments are closed.