How To Use Form Ss 4 To Apply For An Ein For Your Llc

How To Use Form Ss 4 To Apply For An Ein For Your Llc Complete form ss 4 at least 4 to 5 weeks before you will need an ein. sign and date the application and mail it to the appropriate address listed in where to file or fax, later. you will receive your ein in the mail in approximately 4 weeks. also, see third party designee, later. Taxpayers can fax the completed form ss 4 pdf application to the appropriate fax number (see where to file your taxes (for form ss 4)), after ensuring that the form ss 4 contains all of the required information. if it is determined that the entity needs a new ein, one will be assigned using the appropriate procedures for the entity type.

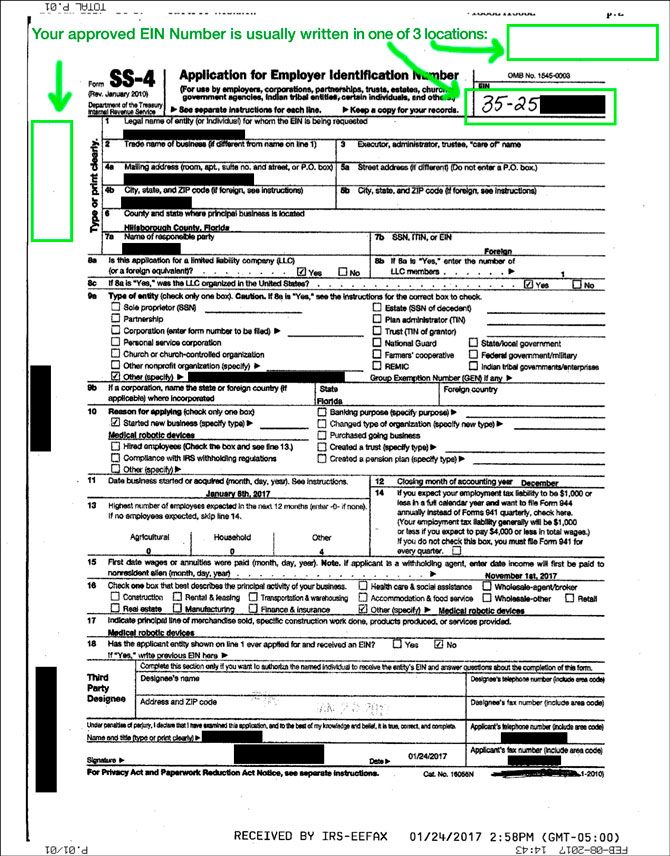

Applying For Ein Without Ssn Or Itin For An Llc Llc University Step 1: determine your eligibility. you may apply for an ein online if your principal business is located in the united states or u.s. territories. the person applying online must have a valid taxpayer identification number (ssn, itin, ein). you are limited to one ein per responsible party per day. Form ss 4 is used when applying for an employer identification number (ein). an ein is a nine digit number the internal revenue service (irs) assigns to employers, sole proprietors, corporations. Irs form ss 4 is used to obtain an employer identification number (ein) for your business or other entity such as a trust or estate. the ss 4 form requires detailed information about the business, including the legal name, business type, and reason for applying. you can apply for an ein directly through the irs website or by mailing or faxing. Make a copy of form ss 4 before sending to the irs. we recommend making a copy (or two) of form ss 4 before sending to the irs. just keep the copies with your llc’s business records. methods of filing. you can send form ss 4 to the irs in one of two ways: 1. by mail 2. by fax. if mailing form ss 4 to the irs, the approval time is slower (4 8.

Learn How To Fill The Form Ss 4 Application For Ein Youtube Irs form ss 4 is used to obtain an employer identification number (ein) for your business or other entity such as a trust or estate. the ss 4 form requires detailed information about the business, including the legal name, business type, and reason for applying. you can apply for an ein directly through the irs website or by mailing or faxing. Make a copy of form ss 4 before sending to the irs. we recommend making a copy (or two) of form ss 4 before sending to the irs. just keep the copies with your llc’s business records. methods of filing. you can send form ss 4 to the irs in one of two ways: 1. by mail 2. by fax. if mailing form ss 4 to the irs, the approval time is slower (4 8. How to complete form ss 4 to apply for an ein. if you are registered as an llc, check yes on line 8a, enter the number of owners on line 8b, and check whether the llc was organized in the u.s. Español. use form ss 4 to apply for an employer identification number (ein). an ein is a 9 digit number (for example, 12 3456789) assigned to employers, sole proprietors, corporations, partnerships, estates, trusts, certain individuals, and other entities for tax filing and reporting purposes. note: keep the form ss 4 information current.

Comments are closed.