How To Unfreeze Credit With All Three Major Credit Bureaus Credit

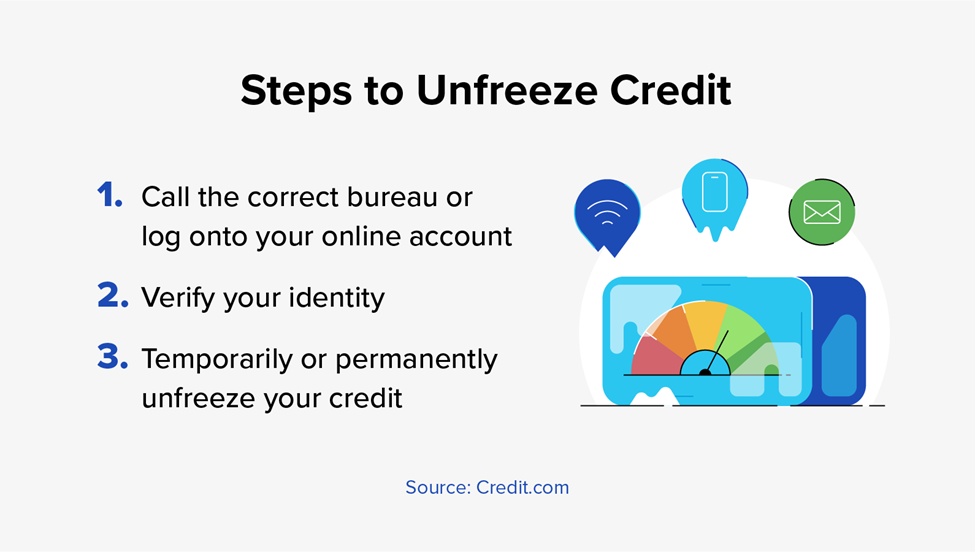

How To Lift A Credit Freeze From All 3 Bureaus Chime To unfreeze your equifax credit file, visit the equifax consumer services center and log in to or create a myequifax account. alternatives include calling 888 298 0045 and verifying your identity to lift a freeze or sending the appropriate forms and documentation to equifax information services llc, p.o. box 105788, atlanta, ga 30348 5788. Place or lift a credit freeze. freeze or lift the freeze on your credit report for free by contacting each of the three major credit reporting agencies: equifax. experian. transunion. you can submit your request online, by phone, or by mail.

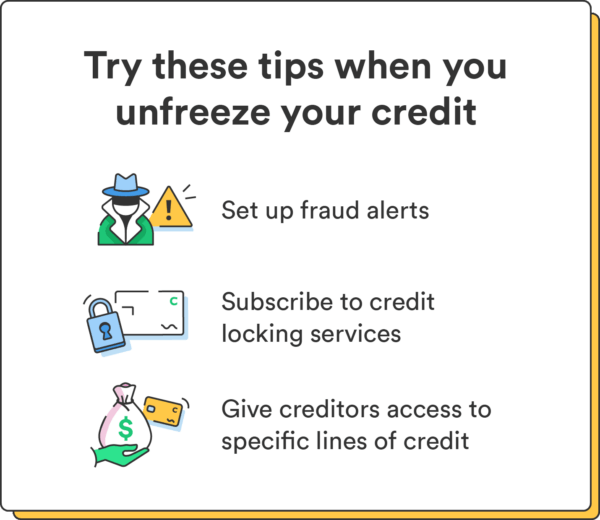

How To Lift A Credit Freeze From All 3 Bureaus Chime A credit freeze can be added, temporarily lifted or permanently removed by creating an account on myequifax. this account is a one stop shop to monitor the status of your credit report. here’s how to contact equifax. phone: 1 888 298 0045. mail: equifax information services llc, p.o. box 105788 atlanta, ga 30348 5788. 1. you place a credit freeze on your equifax credit report. 2. your security freeze restricts access to your equifax credit report for the purposes of extending credit in your name. 3. when you want to apply for credit, you can temporarily lift or permanently remove your security freeze. A fraud alert will not prevent a lender from accessing your credit, but requests the lender to verify your identity before granting you credit. when a fraud alert is requested, the other two credit bureaus (equifax and transunion) are notified and fraud alerts are added to your credit reports with the 3 major credit reporting bureaus. Online: make a transunion service center account, then choose “freeze credit report” under the “services” tab. mail: ship your written request, proof of identity, and a six digit pin number to the following address: transunion, p.o. box 160, woodlyn, pa 19094. phone: call 800 916 8800, then prepare to provide your six digit pin number.

How To Lift A Credit Freeze From All 3 Bureaus Chime A fraud alert will not prevent a lender from accessing your credit, but requests the lender to verify your identity before granting you credit. when a fraud alert is requested, the other two credit bureaus (equifax and transunion) are notified and fraud alerts are added to your credit reports with the 3 major credit reporting bureaus. Online: make a transunion service center account, then choose “freeze credit report” under the “services” tab. mail: ship your written request, proof of identity, and a six digit pin number to the following address: transunion, p.o. box 160, woodlyn, pa 19094. phone: call 800 916 8800, then prepare to provide your six digit pin number. When you place a fraud alert on your credit report, you can get a free copy of your credit report from each of the three credit bureaus. duration: a fraud alert lasts one year. after a year, you can renew it. cost: free. how to place: contact any one of the three credit bureaus — equifax, experian, and transunion. The easiest way to remove a transunion credit freeze is through the transunion service center. you can also remove a freeze by contacting transunion by phone or by mail and providing all the information requested. transunion contact information: phone number: (800) 916 8800.

How To Unfreeze Credit With All Three Major Credit Bureaus Credit When you place a fraud alert on your credit report, you can get a free copy of your credit report from each of the three credit bureaus. duration: a fraud alert lasts one year. after a year, you can renew it. cost: free. how to place: contact any one of the three credit bureaus — equifax, experian, and transunion. The easiest way to remove a transunion credit freeze is through the transunion service center. you can also remove a freeze by contacting transunion by phone or by mail and providing all the information requested. transunion contact information: phone number: (800) 916 8800.

How Do You Unfreeze Transunion And Equifax Leia Aqui How Do You

Comments are closed.