How To Retire Early Without Paying Penalty Fees Roth Conversion Ladder

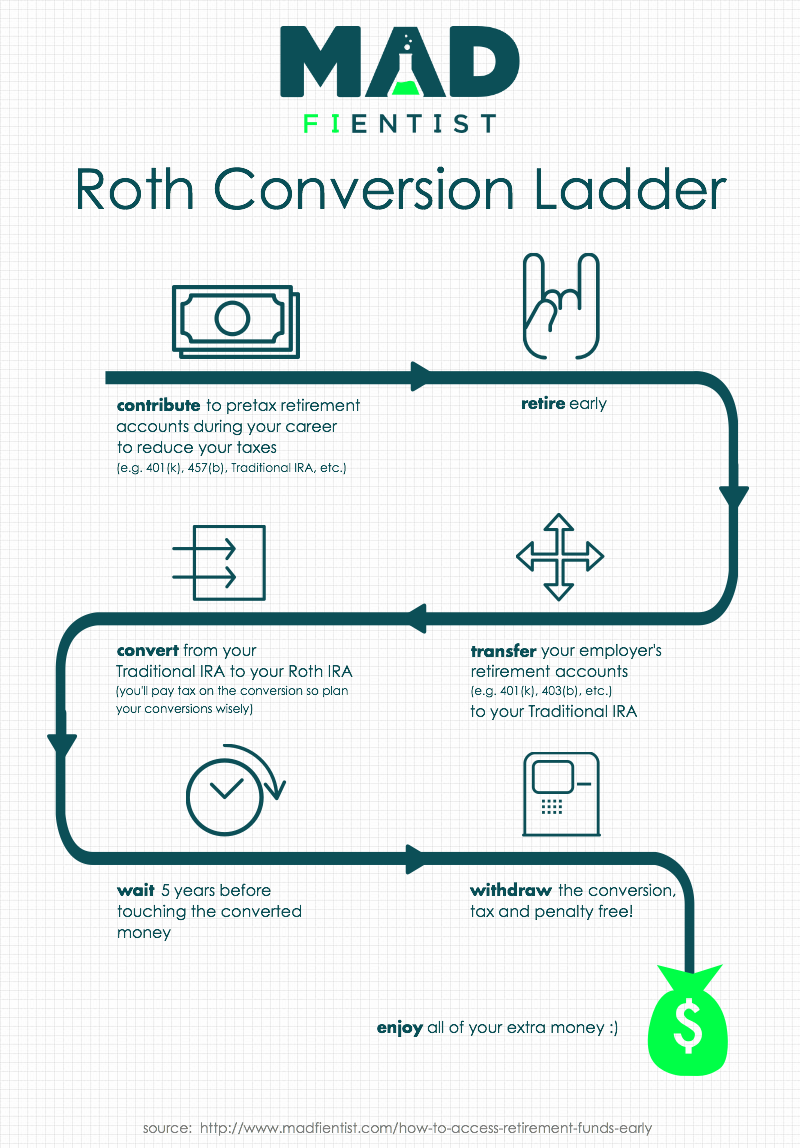

How To Retire Early Without Paying Penalty Fees Roth Conversion Ladder A roth ira conversion ladder could help you tap your tax sheltered retirement accounts before age 59½—without the usual 10% penalty. with a roth conversion ladder, you shift money from a tax. A roth conversion ladder is a multi year transfer of retirement funds from pretax accounts to post tax accounts. it’s a process that lets you access tax advantaged savings early, side stepping early withdraw penalties and minimizing tax liability. since it’s a multi year plan, a conversion ladder requires attention to detail and thorough.

How To Access Retirement Funds Early The roth ira five year rule. the roth ira has two “five year rules” that dictate when you can pull out your earnings and conversions without penalty. the five year rule for earnings (aka accrued interest) states that you can’t withdraw earnings penalty free until: you reach age 59 ½, and. your roth ira is at least five years old. A roth conversion ladder allows you to sidestep the hefty early withdrawal fees that come with 401 (k)s and other retirement accounts. your 401 (k) distributions incur a 10% penalty if you. The method used is important because it impacts the amount converted, cash flow, overall tax situation, and any penalties and fees. understanding the different conversion tax payment methods will help you determine the best way to avoid or reduce any conversion underpayment fees and penalties. at conversion. while not required at conversion. The roth conversion ladder not only helps to avoid the 10% early withdrawal penalty but also optimizes retirement savings for long term benefit. the basics of a roth conversion ladder. establishing a roth conversion ladder requires initiating the process a minimum of five years prior to your intended early retirement.

How To Retire Early With A Roth Ira Conversion Ladder Artofit The method used is important because it impacts the amount converted, cash flow, overall tax situation, and any penalties and fees. understanding the different conversion tax payment methods will help you determine the best way to avoid or reduce any conversion underpayment fees and penalties. at conversion. while not required at conversion. The roth conversion ladder not only helps to avoid the 10% early withdrawal penalty but also optimizes retirement savings for long term benefit. the basics of a roth conversion ladder. establishing a roth conversion ladder requires initiating the process a minimum of five years prior to your intended early retirement. Five years after the conversion the money becomes eligible for tax free withdrawals after age 59 ½. the main disadvantage to a roth ira conversion is that you have to pay income tax— but not the 10% early withdrawal penalty—on the amount converted. for example, if you were to convert $50,000 from a traditional ira to a roth ira, and you. Roth ira conversion ladder. today i want to talk about something called a roth ira conversion ladder, because it’s the magic tax loophole that enables you to use your traditional 401(k) before age 59.5 without the 10% penalty that normally applies. here’s what to do: roll over your entire traditional 401(k) to a traditional ira. this is a.

Roth Conversion Ladder The Ultimate Key To Early Retirement Five years after the conversion the money becomes eligible for tax free withdrawals after age 59 ½. the main disadvantage to a roth ira conversion is that you have to pay income tax— but not the 10% early withdrawal penalty—on the amount converted. for example, if you were to convert $50,000 from a traditional ira to a roth ira, and you. Roth ira conversion ladder. today i want to talk about something called a roth ira conversion ladder, because it’s the magic tax loophole that enables you to use your traditional 401(k) before age 59.5 without the 10% penalty that normally applies. here’s what to do: roll over your entire traditional 401(k) to a traditional ira. this is a.

Comments are closed.